Analyst Gus Richard from Northland has increased his price target for Ambarella (AMBA, Financial) from $70 to $75 while maintaining an Outperform rating on the stock. The decision follows Ambarella's report of a robust quarterly performance and a forecast for second-quarter results that exceed general market expectations. The company now anticipates its fiscal year 2026 revenues to rise between 19% and 25%, an upgrade from their previous prediction of a mid to high-teens percentage increase. These developments reflect growing optimism about Ambarella's future growth prospects.

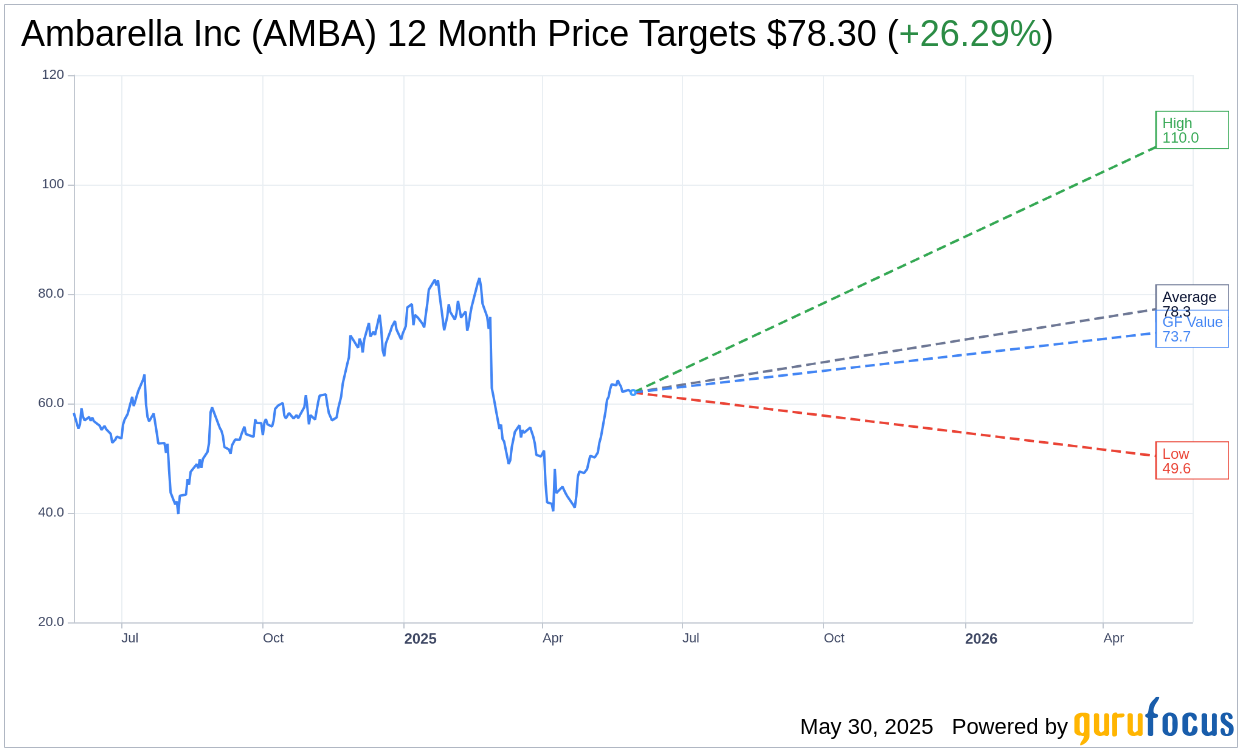

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Ambarella Inc (AMBA, Financial) is $78.30 with a high estimate of $110.00 and a low estimate of $49.60. The average target implies an upside of 26.29% from the current price of $62.00. More detailed estimate data can be found on the Ambarella Inc (AMBA) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Ambarella Inc's (AMBA, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ambarella Inc (AMBA, Financial) in one year is $73.66, suggesting a upside of 18.81% from the current price of $62. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ambarella Inc (AMBA) Summary page.

AMBA Key Business Developments

Release Date: May 29, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ambarella Inc (AMBA, Financial) reported first-quarter revenue of $85.9 million, exceeding the midpoint of their guidance range.

- AI revenue accounted for more than 75% of Q1 revenue, marking the fourth consecutive quarter of record AI revenue.

- The company increased its fiscal 2026 revenue growth estimate to a range of 19% to 25%, reflecting strong market demand.

- Ambarella Inc (AMBA) is expanding its market reach with new edge infrastructure products, leveraging their third-generation AI accelerator.

- The company has a strong cash position with $259.4 million in cash and marketable securities, up $56 million from the previous year.

Negative Points

- Geopolitical uncertainties remain a concern, potentially impacting future revenue and growth projections.

- Gross margin is expected to decline in the next quarter due to changes in customer and product mix.

- There is uncertainty regarding the seasonality of revenue due to geopolitical factors, which could affect the second half of the fiscal year.

- The company faces competition in the low-end market from Chinese and Taiwanese suppliers, which could impact market share.

- Ambarella Inc (AMBA) is cautious about potential indirect impacts from tariffs, which could affect financial performance.