Key Takeaways:

- NetApp (NTAP, Financial) maintains a steady dividend payout with an attractive yield.

- Analyst forecasts suggest a potential upside, but GF Value indicates a possible downside.

- Consensus recommendation leans towards holding the stock.

NetApp Inc. (NASDAQ: NTAP) recently declared a quarterly dividend of $0.52 per share, consistent with its previous distributions, illustrating stability for income-focused investors. This results in a forward yield of 2.1%. The company has scheduled the next dividend payment for July 23, with shareholders required to be on record by July 3. Despite this steady payout, the company's stock performance was recently hampered by less-than-expected Q1 guidance.

Insights from Wall Street Analysts

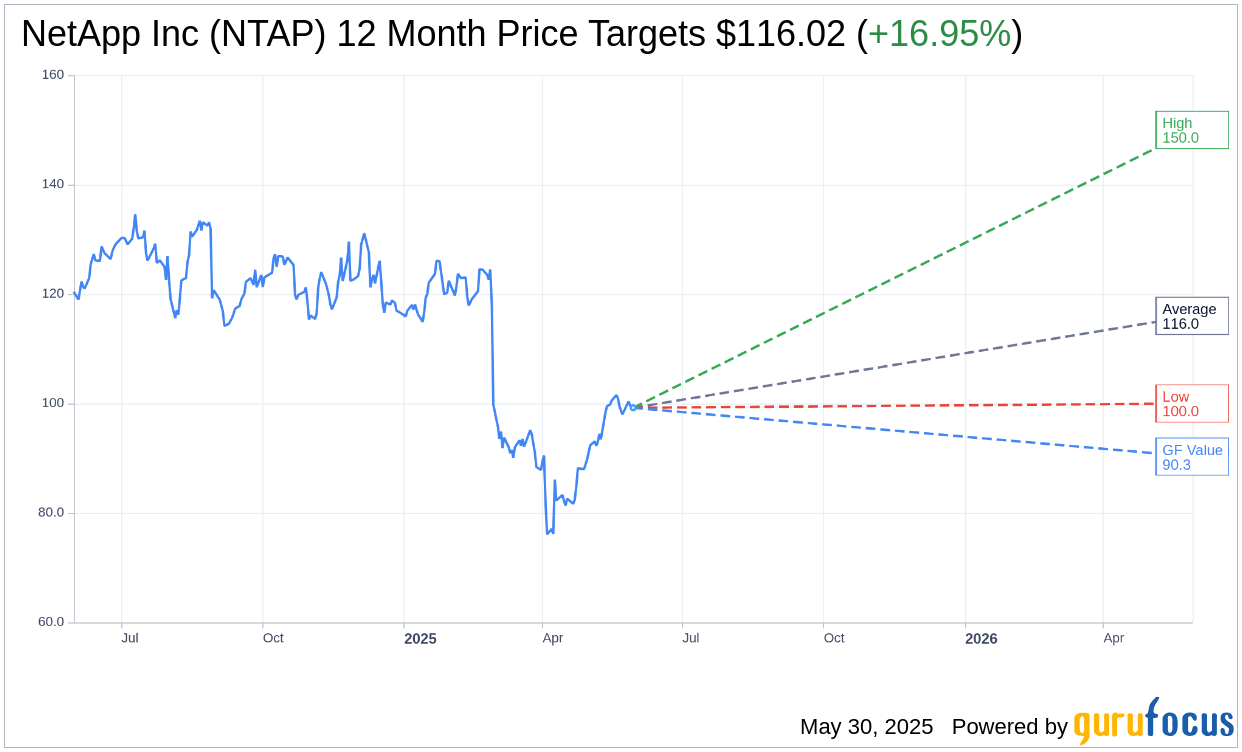

Examining the forecasts from 15 analysts, the consensus one-year price target for NetApp Inc. (NTAP, Financial) is pegged at $116.02. This includes a high estimate of $150.00 and a low estimate of $100.00, reflecting a potential upside of 16.95% from the current share price of $99.21. For a deeper dive into these projections, visit the NetApp Inc (NTAP) Forecast page.

Considering the consensus from 22 brokerage firms, NetApp Inc.'s average brokerage recommendation currently holds at 2.6, which suggests a "Hold" status within the rating scale of 1 to 5, where 1 indicates a Strong Buy and 5 suggests a Sell.

Evaluating the GF Value

According to GuruFocus estimates, the estimated GF Value for NetApp Inc. (NTAP, Financial) is projected to be $90.30 in one year, implying a downside of 8.98% from the current price of $99.21. The GF Value is a calculated metric that reflects the fair value of a stock based on its historical trading multiples, past business growth, and future performance forecasts. For further analysis, investors can explore the NetApp Inc (NTAP) Summary page.