Key Takeaways:

- Bitdeer Technologies (BTDR, Financial) initiates a strategic $40 million share buyback program.

- Analysts see significant upside potential with an average price target of $21.03.

- The company is rated "Outperform" by the consensus of brokerage firms.

Bitdeer Technologies Announces New Share Repurchase Program

In a strategic move to bolster shareholder value, Bitdeer Technologies (NASDAQ: BTDR) has announced a substantial new share repurchase program valued at up to $40 million. According to a recent SEC filing, this initiative allows Bitdeer to repurchase its class A shares through May 2026, providing a strong vote of confidence in the company's future. Notably, this comes on the heels of a successfully completed $20 million buyback plan. Despite these positive developments, shares dropped 3.21% to $13.85 earlier today, offering an intriguing entry point for potential investors.

Wall Street Analysts Set Upbeat Price Targets

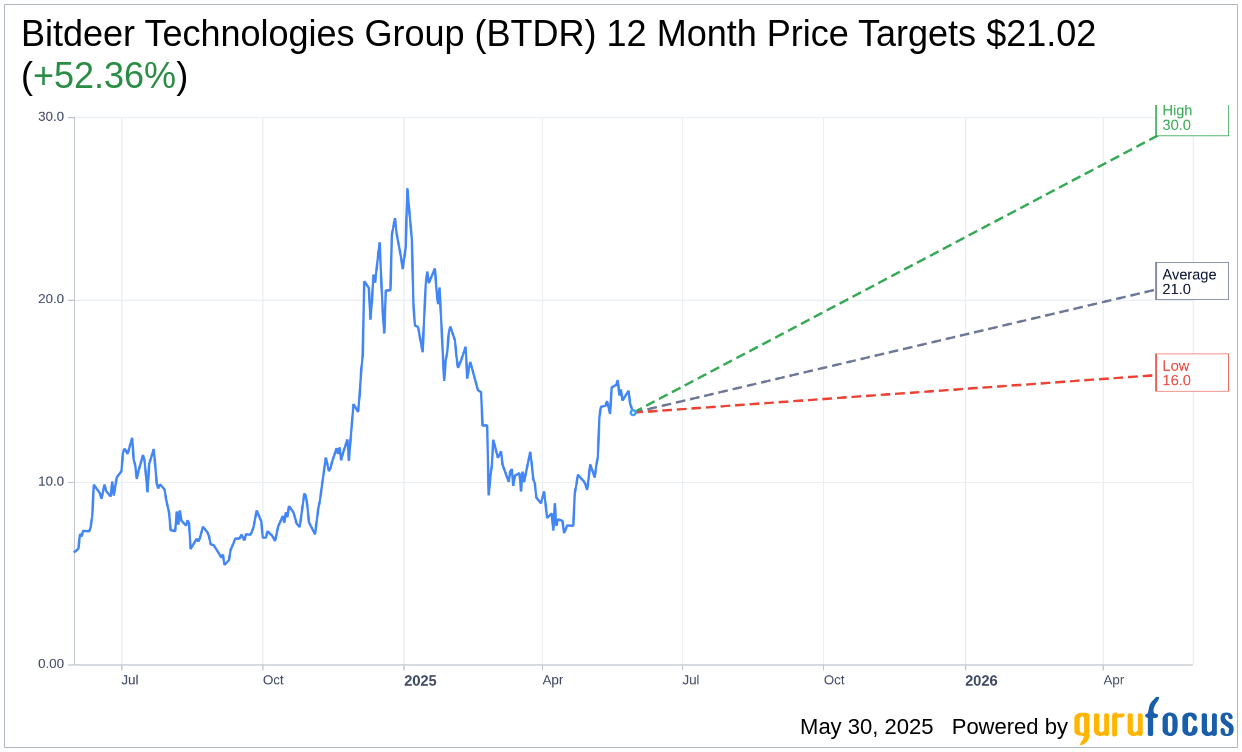

Market optimism surrounds Bitdeer Technologies Group (BTDR, Financial) as analysts have set an average 12-month price target of $21.03. This reflects a notable 52.36% upside from the current trading price of $13.80. Individual estimates are bullish, with projections ranging from a low of $16.00 to a high of $30.00. Investors can explore deeper insights and detailed estimates on the Bitdeer Technologies Group (BTDR) Forecast page.

Analyst Consensus Signals Outperformance

The current consensus among 12 brokerage firms suggests a positive outlook for Bitdeer Technologies Group (BTDR, Financial), with an average recommendation rating of 1.9. This places the stock in the "Outperform" category, indicating that it is expected to deliver returns superior to its peers. The recommendation scale runs from 1, representing a Strong Buy, to 5, indicating a Sell, positioning BTDR favorably among market analysts.