Petrobras (PBR, Financial) has seen a notable increase in bullish activity, with 5,990 call options being traded, which is 1.5 times the usual volume. The company's implied volatility has risen by nearly 3 points, reaching 29.74%. Among the options, the Jun-25 12 calls and Jan-26 11 calls stand out with combined trading activity close to 4,300 contracts. The Put/Call Ratio currently sits at 0.67, suggesting a favorable sentiment towards call options. Investors are looking forward to Petrobras's earnings report anticipated on August 7th.

Wall Street Analysts Forecast

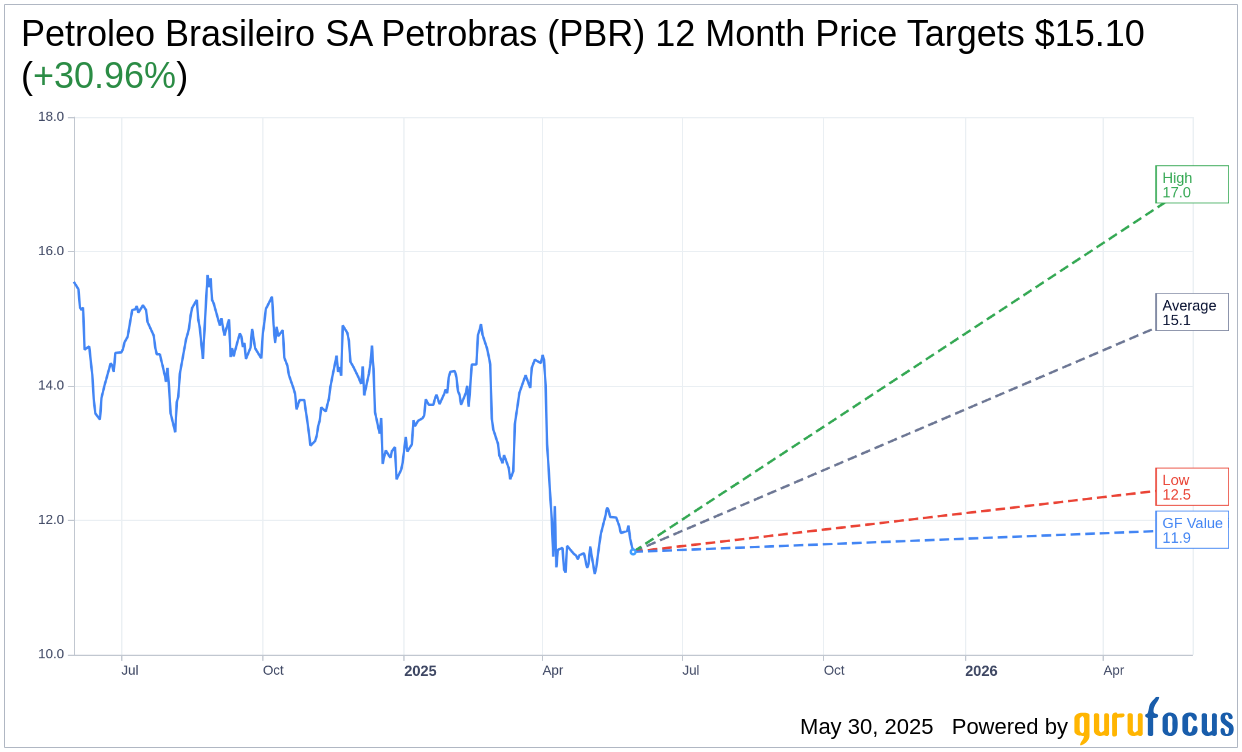

Based on the one-year price targets offered by 11 analysts, the average target price for Petroleo Brasileiro SA Petrobras (PBR, Financial) is $15.10 with a high estimate of $17.00 and a low estimate of $12.50. The average target implies an upside of 30.96% from the current price of $11.53. More detailed estimate data can be found on the Petroleo Brasileiro SA Petrobras (PBR) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Petroleo Brasileiro SA Petrobras's (PBR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Petroleo Brasileiro SA Petrobras (PBR, Financial) in one year is $11.86, suggesting a upside of 2.86% from the current price of $11.53. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Petroleo Brasileiro SA Petrobras (PBR) Summary page.

PBR Key Business Developments

Release Date: May 13, 2025

- Average Oil Price: $75 per barrel in Q1 2025, down from $84 per barrel in Q1 2024.

- Production Increase: 5.4% increase in oil production compared to the previous quarter.

- Cash Generation: $8.5 billion generated in cash from operations.

- Net Income: $6 billion, with a note that without foreign exchange effects, it would have been $4 billion.

- Adjusted EBITDA: $10 billion, 8% increase from the previous quarter.

- Operational Cash Flow: $8.5 billion, a 4% increase from the previous quarter.

- Investments: $4.1 billion in Q1 2025, a 29% decrease from Q4 2024, but a 34% increase from Q1 2024.

- Gross Debt: Increase due to the entry of FPSO Almirante Tamandare, but within the $75 billion debt ceiling.

- Dividends: BRL11.7 billion approved for Q1 2025, equivalent to BRL0.91 per share.

- Taxes Paid: BRL65.7 billion in taxes to various government levels.

- Exploration Success: New discoveries in the pre-salt layer and other regions, contributing to reserve expansion.

- Refinery Capacity Increase: RNEST Train 1 capacity increased from 80,000 to 130,000 barrels per day.

- Natural Gas Processing: Boaventura Complex to reach 21 million cubic meters per day capacity.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Petroleo Brasileiro SA Petrobras (PBR, Financial) reported a strong financial performance in Q1 2025, with a net income of USD 6 billion and an adjusted EBITDA of USD 10 billion, reflecting an 8% increase from the previous quarter.

- The company achieved a 5.4% increase in oil production compared to the previous quarter, contributing significantly to its financial results.

- Petroleo Brasileiro SA Petrobras (PBR) successfully expanded its reserves, particularly in the pre-salt layer, with new discoveries in the Aram block and the Campos Basin.

- The company is committed to capital discipline and cost reduction, focusing on simplified projects and optimizing spending to maintain profitability in a challenging oil price environment.

- Petroleo Brasileiro SA Petrobras (PBR) is actively pursuing energy transition initiatives, including the production of low-carbon products and reforestation projects to capture carbon credits.

Negative Points

- The company faces a challenging scenario with declining oil prices, which have dropped from $84 per barrel in Q1 2024 to $65 per barrel in Q2 2025, impacting revenue potential.

- Petroleo Brasileiro SA Petrobras (PBR) is experiencing increased lifting costs, prompting the need for cost-cutting measures to maintain profitability.

- The company's gross debt increased due to the entry of new FPSO units, raising concerns about leverage and financial sustainability.

- Petroleo Brasileiro SA Petrobras (PBR) is dealing with external market volatility, particularly in diesel and gasoline prices, which affects its pricing strategy and market stability.

- The company must navigate regulatory challenges and environmental licensing processes, particularly in the Equatorial Margin, which could impact exploration and production timelines.