Key Highlights:

- Taiwan Semiconductor Manufacturing Co. (TSM, Financial) is planning a new chip plant in the UAE, aligning with its global expansion strategy.

- Analysts project a potential upside of nearly 12% from TSM's current stock price.

- TSM's consensus rating by brokerage firms remains an "Outperform," reflecting strong future prospects.

Taiwan Semiconductor Manufacturing Co. (TSM) is making strategic moves to broaden its geographical footprint by considering the establishment of a high-tech chip fabrication plant in the United Arab Emirates (UAE). This ambitious endeavor is part of TSM's global expansion plans and hinges on securing the necessary green light from Washington. Such an initiative would not only bolster TSM's operational capacity but also resonate with the UAE's vision for technological advancement.

Analyst Predictions and Market Performance

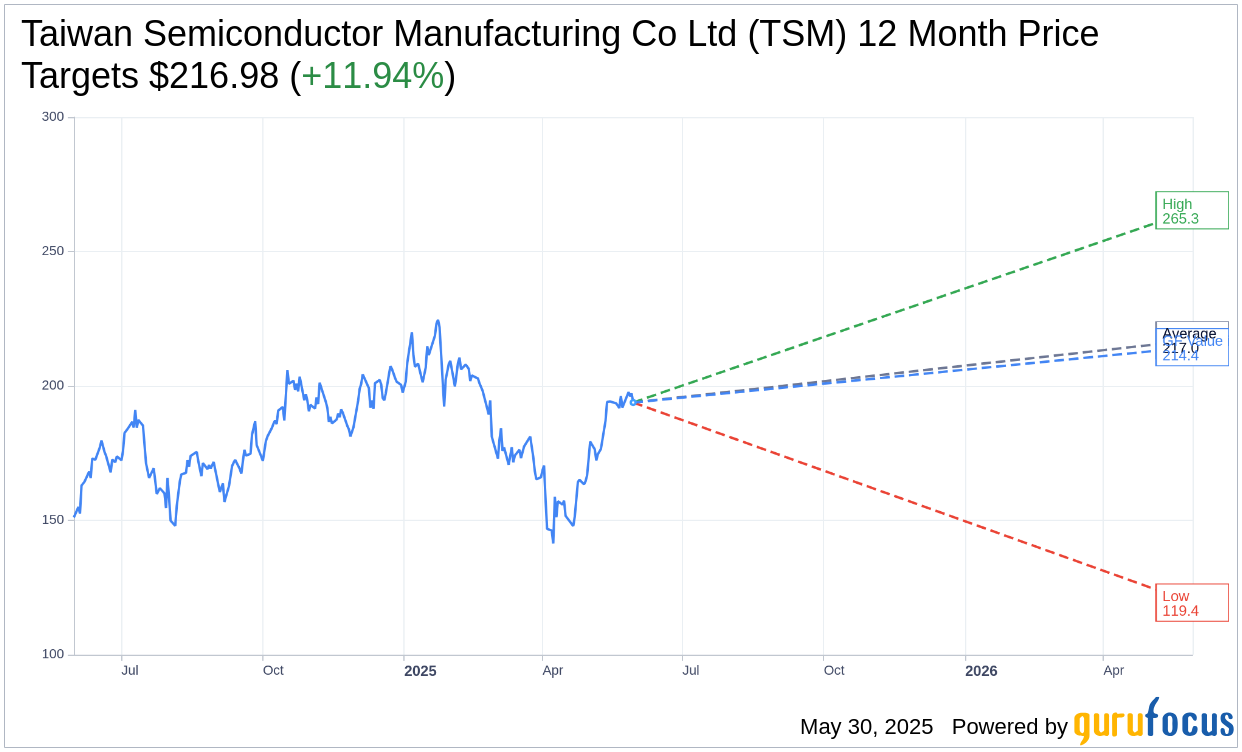

According to the latest one-year price targets from 17 industry analysts, Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) has an average target price set at $216.98. The projections reveal a high estimate of $265.34 and a low of $119.37. The average target indicates a potential upside of 11.94% compared to the current trading price of $193.83. For more detailed projections, visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

Brokerage Recommendations

In terms of brokerage assessments, TSM's outlook remains robust. Analyzing data from 19 brokerage firms, the average recommendation for Taiwan Semiconductor Manufacturing Co Ltd is currently 1.6, which is categorized as "Outperform." This scale spans from 1, representing a Strong Buy, to 5, indicating a Sell. This favorable positioning underscores the market's confidence in TSM's future growth trajectory.

GF Value Estimation

GuruFocus estimates that the GF Value for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) will reach $214.41 in one year. This implies a potential upside of 10.62% relative to the current trading price of $193.83. GF Value is a metric devised to reflect the stock's fair trading value, derived from historical trading multiples, along with past and forecasted business growth metrics. For an in-depth analysis, investors can refer to the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Summary page.