The Real Brokerage (REAX, Financial) has revealed a newly approved share buyback plan set by its Board of Directors. This initiative permits the repurchase of up to $150 million worth of shares or a maximum of 35 million shares, depending on which is reached first. This move underscores the company's strategic focus on enhancing shareholder value through tactical use of available resources.

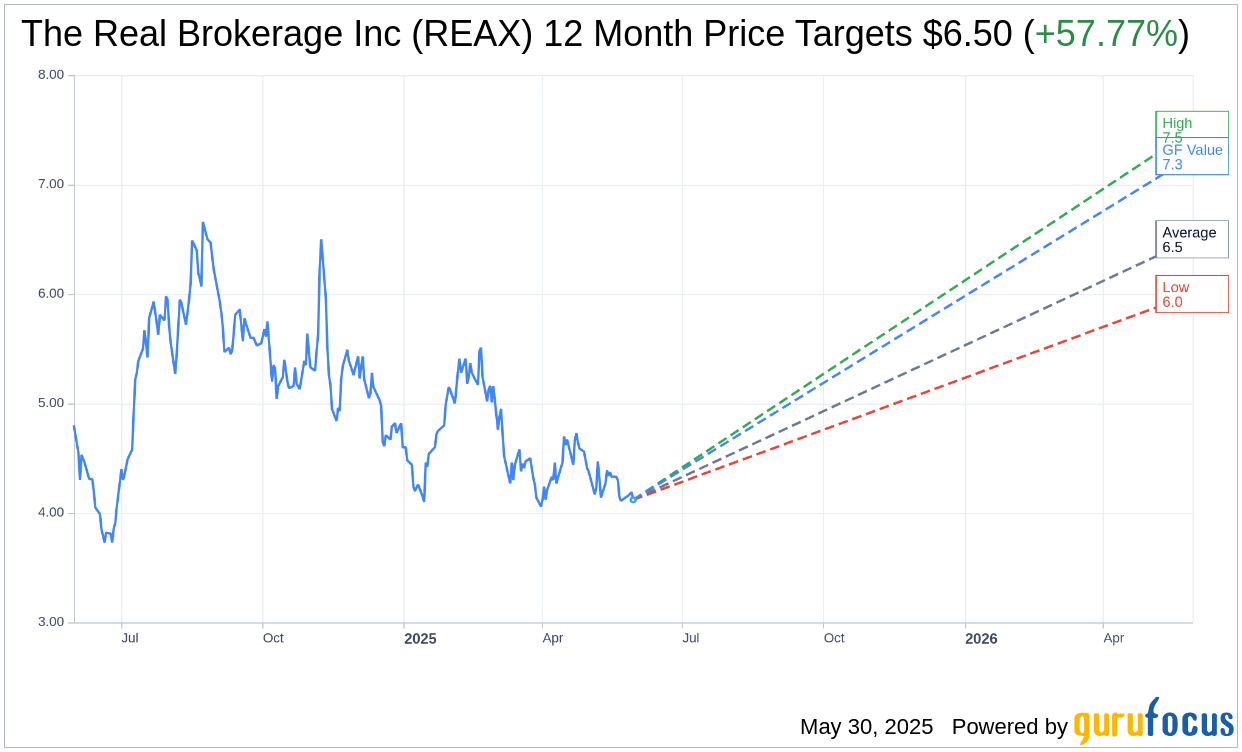

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for The Real Brokerage Inc (REAX, Financial) is $6.50 with a high estimate of $7.50 and a low estimate of $6.00. The average target implies an upside of 57.77% from the current price of $4.12. More detailed estimate data can be found on the The Real Brokerage Inc (REAX) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, The Real Brokerage Inc's (REAX, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Real Brokerage Inc (REAX, Financial) in one year is $7.26, suggesting a upside of 76.21% from the current price of $4.12. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Real Brokerage Inc (REAX) Summary page.

REAX Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Real Brokerage Inc (REAX, Financial) reported record first quarter results with revenue of $354 million, a 76% increase compared to the prior year.

- The company saw a 77% increase in the number of transactions closed, reaching 33,600, despite a 2% decline in the existing home sale industry.

- Agent count increased by 61% year-over-year, with over 27,700 agents as of the call date.

- The company's technology platform and high-margin ancillary businesses, including mortgage, title, and RealWallet, grew by a combined 50% versus the prior year.

- RealWallet generated $126,000 in revenue in its first full quarter, with an annualized run rate revenue exceeding $700,000, highlighting strong adoption and growth potential.

Negative Points

- The company reported a net loss of $5.1 million, although this was an improvement from a $16.1 million loss in the prior year.

- Gross margin declined to 9.6% from 10.3% in the prior year, due to a higher mix of production from agents who have reached their annual commission cap.

- Operating expenses increased by approximately $12 million year-over-year, driven by higher revenue share, agent equity-based compensation, and corporate investments.

- The company faces ongoing challenges in the housing market, with existing home sales down about 2% year-over-year due to affordability pressures.

- The shift in revenue mix towards more productive capped agents may continue to impact gross margins in the short term, despite efforts to offset this with fee changes and ancillary services.