- Nvidia (NVDA, Financial) shares soar by 3% following the release of impressive first-quarter earnings.

- Analysts predict a promising upside potential for Nvidia, with an average price target significantly higher than its current price.

- GuruFocus estimates suggest a substantial potential gain for investors in Nvidia stocks over the next year.

Nvidia (NVDA) continues to demonstrate its strong foothold in the tech sector, with shares climbing 3% after the company exceeded first-quarter earnings and guidance expectations. This performance is commendable, especially as Nvidia faces export control challenges with China. The company's ability to navigate these hurdles underscores its resilience and strength in the market.

Wall Street Analysts Forecast

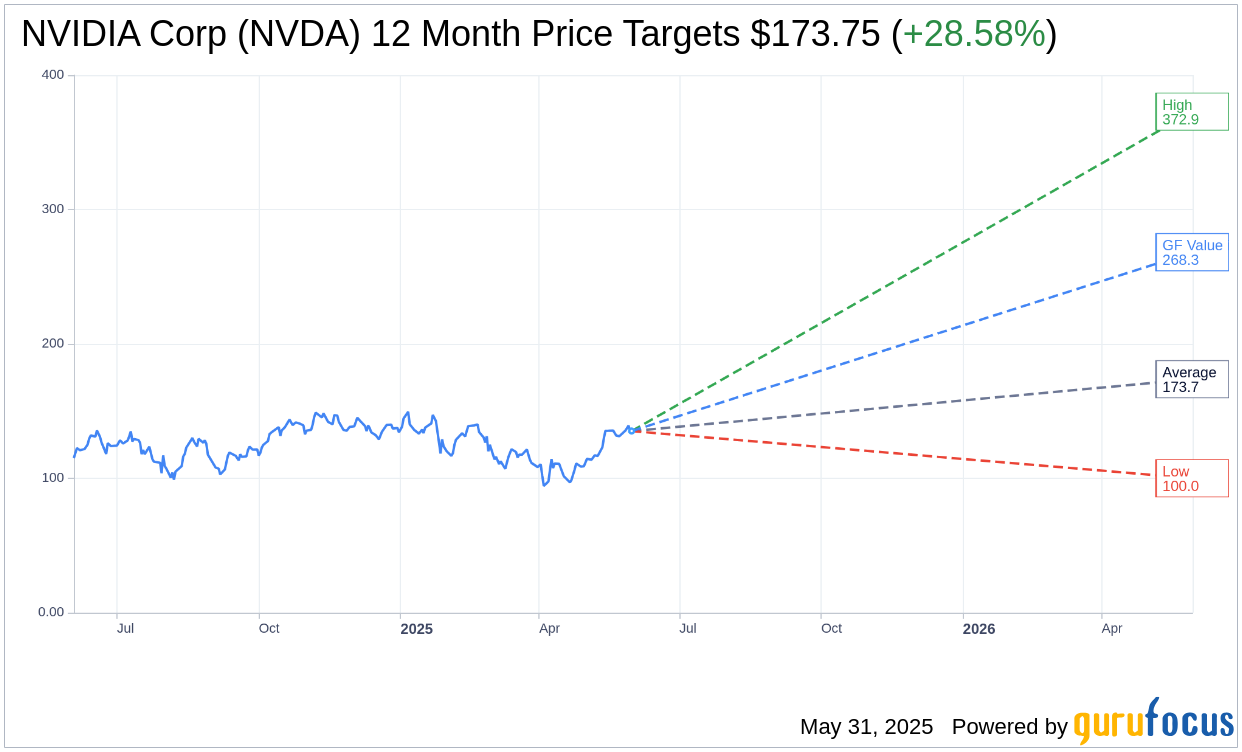

Wall Street's confidence in Nvidia Corp (NVDA, Financial) is evident in the one-year price targets set by 50 analysts. The average target price is $173.75, with projections ranging from a high of $372.87 to a low of $100.00. This average target reflects a potential upside of 28.58% from Nvidia's current trading price of $135.13. For more comprehensive estimate data, visit Nvidia's Forecast page.

Investor sentiment remains positive, with 64 brokerage firms offering a consensus recommendation of 1.8 for Nvidia Corp (NVDA, Financial), which falls under the "Outperform" category. This rating scale runs from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

GuruFocus Valuation Estimates

In terms of valuation, GuruFocus provides an estimated GF Value for Nvidia Corp (NVDA, Financial) of $268.27 over the next year. This suggests a remarkable potential upside of 98.53% from its current price of $135.13. The GF Value is a critical metric, calculated by considering Nvidia's historical trading multiples, past growth, and future business performance estimates. For more in-depth details, refer to the Nvidia Corp (NVDA) Summary page.

Overall, Nvidia's recent performance and positive outlook from analysts indicate a robust investment opportunity for those looking at the tech sector. As always, investors are encouraged to perform their due diligence and consider their financial objectives before making investment decisions.