Spotify started out with a bold mission: make all the world's music instantly accessible. Fast forward to 2025, and it's done that, and a lot more. With 678 million monthly active users and dominance across music, podcasts, and now audiobooks, Spotify Technology SA (NYSE: SPOT) is the largest audio streaming platform on the planet.

But here's the real question: Can Spotify turn that massive audience into consistent, long-term profits, or is the company still stuck in an arms race of content costs and competitive threats?

Spotify's Q1 2025 results show it's finally unlocking meaningful profitability through scale, pricing power, and product expansion, but looming competition and licensing costs still present structural hurdles. The next phase for investors is deciding whether this shift is durable or temporary.

Financial Performance: Spotify Finally Turns Up the Volume on Profit

Spotify's performance in the first quarter of 2025 marked a shift — not just in numbers, but in tone. Total revenue climbed to €4.19 billion, up 15% from the same quarter last year, with the Premium segment doing most of the heavy lifting. That part of the business now contributes about 90% of total revenue. What's more encouraging is how those revenues are translating into stronger margins.

Gross profit came in at €1.33 billion, a 32% increase, nudging gross margins up to 32% from 28% a year ago. A few things helped: pricing changes, amortization improvements, and the decision to pull back on some high-cost podcast deals. The result? Operating income jumped to €509 million, nearly triple what it was a year earlier. Net income landed at €225 million, while free cash flow more than doubled to €534 million — a sign that Spotify's investments may finally be hitting their stride.

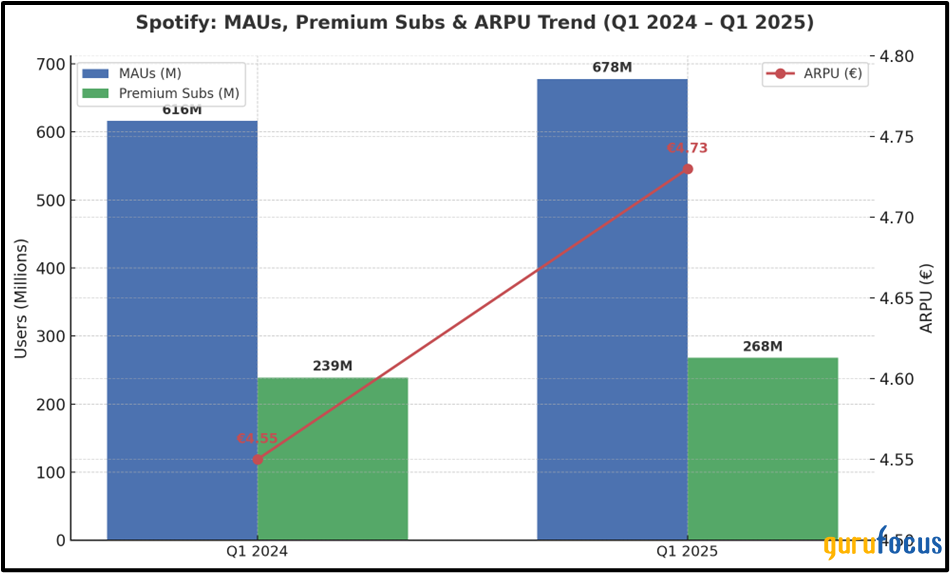

Subscriber growth wasn't explosive, but it was steady: Monthly active users climbed to 678 million (up 10%), and Premium subscribers reached 268 million (up 12%). Average revenue per Premium user (ARPU) ticked up to €4.73, largely due to price adjustments across several key markets.

The ad-supported segment also showed some lift — nothing dramatic, but enough to suggest Spotify's ongoing efforts to diversify monetization are gaining ground. With content costs better managed and free cash flow improving, the company's financial profile is looking more stable than it has in recent memory.

Spotify ended the quarter with 678 MAUs and 268 million Premium subscribers — reflecting 10% and 12% year-over-year growth, respectively. Average revenue per Premium user also ticked up 4% on a global basis. But what's more telling is how the company managed to expand its paying base while easing up on expensive exclusive content. That suggests users are sticking around for the overall experience — not just star-driven deals — and that could be key to improving profitability moving forward.

Who Owns Spotify? A Strategic Web of Founders and Financial Giants

Although Spotify is based in Europe, its ownership is predominantly global and institutional. Recent SEC filings show that more than 65% of the company's shares are held by institutional investors. Baillie Gifford (Trades, Portfolio) & Co. tops the list with roughly 11.1% ownership, followed by Morgan Stanley at 7.1% and T. Rowe Price at 4.6%. Co-founder and CEO Daniel Ek still holds substantial influence over corporate decisions, despite owning a smaller portion of the equity — a result of Spotify's dual-class share structure.

This setup gives Spotify a mix of founder-led direction and institutional oversight. While that approach can drive long-term strategy and innovation, it also depends heavily on execution. The presence of major investors suggests continued confidence in the company's path forward.

Valuation Metrics: How Does Spotify Stack Up?

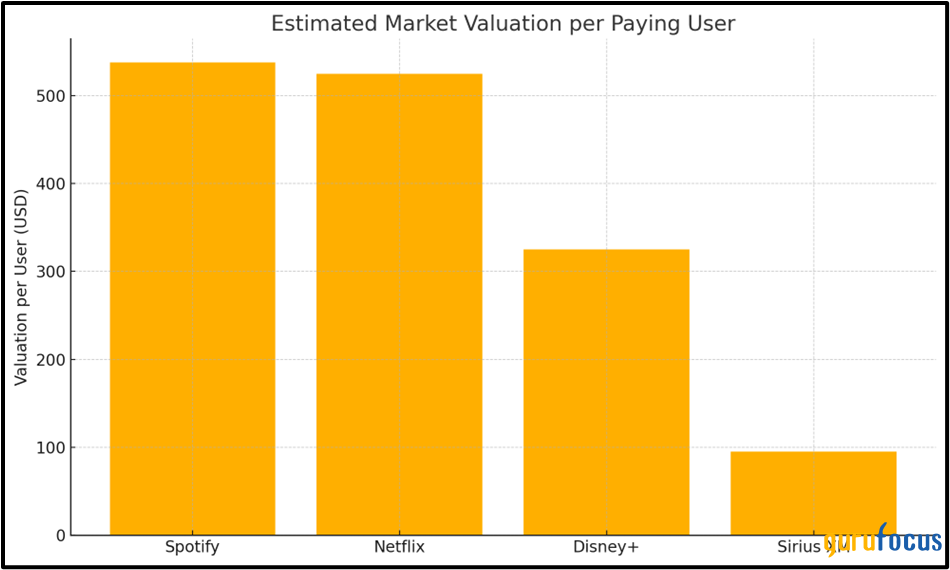

With Spotify valued around $140 billion and a Premium subscriber base of roughly 260 million, the implied price tag per paying user is about $538. On the surface, that might seem steep — especially since each subscriber brings in only about $50 in annual revenue today. But investors aren't just buying into current income; they're also factoring in the long-term value of a loyal user base and the potential to expand what each subscriber contributes over time.

Compare that to other media platforms: Netflix, for example, is valued at roughly $500–$550 per subscriber with a higher ARPU but also steeper content costs. Disney+ sits closer to $300–$350 per user depending on the quarter, while Sirius XM trades at less than $100 per listener, reflecting lower growth and older demographics. Spotify sits in the middle — priced above legacy platforms like Sirius, but slightly below streaming's gold standard, Netflix.

What increases the value of Spotify's users are the way they use the application. There is very little churn in music services, especially for paying subscribers, and the platform enjoys a lot of interaction from its users every day. Compared to video streaming that makes people bored and change their subscriptions often, Spotify stands out because its product is tailored to each user and hard to imitate. The way it suggests music, creates playlists, and has a large creator group helps defend its user base.

When viewed through this lens, Spotify's valuation becomes less about revenue multiples and more about user economics: acquisition cost, lifetime value, monetization rate, and retention. The company's improving ARPU, growing ad business, and margin expansion make a stronger case that each of those $538 users could be worth significantly more over time — if the current trajectory holds.

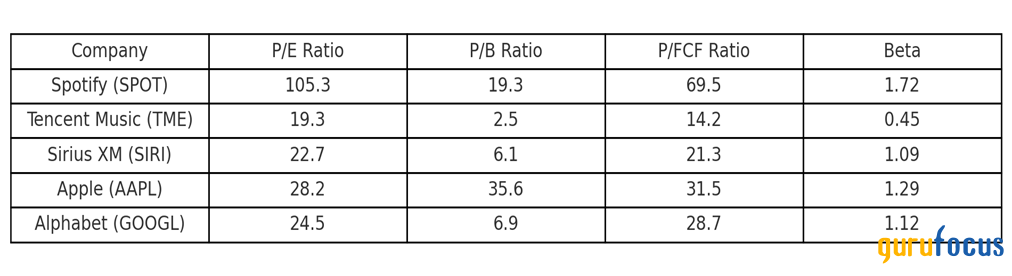

Against this backdrop, Spotify's EV/EBITDA ratio of 23.4x still places it in a middle lane — more expensive than Tencent Music (11.2x) or Sirius XM (9.7x), but cheaper than diversified tech giants like Apple (28.5x) and Alphabet (25.8x). Forward P/E stands at 31.7x — rich compared to SIRI or TME, but again, Spotify is arguably pricing in higher user quality and engagement.

The takeaway: Spotify's valuation may seem aggressive at face value, but it becomes far more defensible when you consider the stickiness, monetization potential, and strategic optionality embedded in its user base. It's not just buying a music library — it's buying a relationship with 260 million loyal, paying users

Competitive Landscape: Titans at the Gates

Spotify faces stiff competition from platform giants like Apple and Alphabet. Apple Music comes pre-installed on every iPhone and syncs effortlessly with Apple's wider ecosystem — Siri, Apple Pay, the Apple Watch, and more. YouTube Music benefits from Alphabet's deep reach through its search dominance and the massive pull of YouTube, which draws billions of viewers each month.

These companies don't need their music services to turn a profit — they can use them to deepen customer loyalty across their ecosystems. Spotify, by contrast, relies on making each subscription pay for itself. That puts pressure on pricing and profitability. Even so, Spotify has built a solid base of returning users who are deeply engaged with the platform.

What keeps listeners coming back isn't bundling or hardware — it's the listening experience. From personalized playlists and year-end Wrapped summaries to algorithmic recommendations that genuinely land, Spotify connects with users in a more personal way. It's often the app people use daily — whether they're commuting, working, or relaxing — and that kind of relationship is harder to replace.

In China, Tencent Music leads with over 800 million users, but its karaoke-heavy, tipping-centric model hasn't translated well globally. It's profitable, but largely confined to the domestic market, and now faces increased regulatory scrutiny. Sirius XM, on the other hand, still has a hold on U.S. car entertainment. But its listener base is aging, and newer drivers are moving toward more flexible, app-based listening options — which doesn't favor satellite radio in the long run.

Spotify doesn't dominate through hardware or bundled deals. Its edge lies in becoming part of people's routines. That kind of familiarity is tough for even tech giants to displace.

Risks and Challenges: Navigating the Roadblocks Ahead

Even after a solid quarter, Spotify faces structural headwinds that could disrupt its trajectory. Chief among them is the rising cost of content. The company has committed over €4.3 billion in licensing guarantees — a heavy obligation. If revenue growth slows, that burden becomes harder to absorb and puts pressure on profitability.

There's also legal turbulence on the horizon. Spotify remains locked in a royalty dispute with the Mechanical Licensing Collective, with potential liabilities that could exceed €200 million. And as governments around the world start defining rules for AI-generated media, new compliance demands are almost certain — meaning more costs and more complexity.

Growth, too, has become uneven. While emerging markets bring in new users, they also dilute average revenue per subscriber. In saturated regions, it's getting harder to attract fresh listeners without significant incentives. At the same time, Spotify's efforts to branch into audiobooks and video podcasts are still in the investment phase. The upside is promising, but monetization isn't guaranteed.

Then there's the threat from Big Tech. Apple, Google, and Amazon continue to treat streaming as an ecosystem benefit, not a standalone business. If they choose to drop prices, bundle aggressively, or hoard exclusive content, it could corner Spotify into defending share at the expense of margins.

Spotify's current momentum is real — but the runway ahead still has friction. How well it navigates these risks will define whether recent profitability becomes a trend or just a moment.

Conclusion:

Spotify's Q1 2025 wasn't just financially impressive — it marked a turning point. After years of prioritizing growth, the company is now proving it can convert its massive audience into consistent profit. With €225 million in net income, a 32% rise in gross profit, and €534 million in free cash flow, Spotify is no longer chasing scale for its own sake — it's making scale work.

But what truly sets Spotify apart isn't just revenue — it's the loyalty and value of its global user base. With 678 MMUs and 260 million paying subscribers, the platform commands not just attention, but habit. Users engage daily, interact deeply, and rarely churn. That kind of stickiness is rare — even among Big Tech peers.

Viewed through this lens, Spotify looks less like a music company and more like a recurring revenue machine built on behaviour, not bundles. Every user isn't just a stream of income — they're a long-term asset with growing value.

As competition intensifies and margins evolve, the company's future will depend on how well it continues to deepen engagement and expand monetization. But for now, Spotify isn't just playing music — it's playing for keeps.