Goldman Sachs has revised its stance on Union Pacific (UNP, Financial), downgrading the stock to a Neutral rating from a previous Buy position while maintaining their price target at $263. This change reflects a strategic pivot in favor of the trucking industry, impacting their perspective on the rail sector and related segments. The firm highlights continued fundamental risks, such as tariffs and their effects on consumer demand and global freight dynamics. Despite these challenges, Goldman Sachs suggests that increasing investments in transportation stocks early could be advantageous as they might benefit from the next earnings upgrade cycle. The strategy emphasizes investing when fundamental conditions are under pressure, with the belief that current prices, especially within the trucking industry, present robust potential returns relative to the associated risks.

Wall Street Analysts Forecast

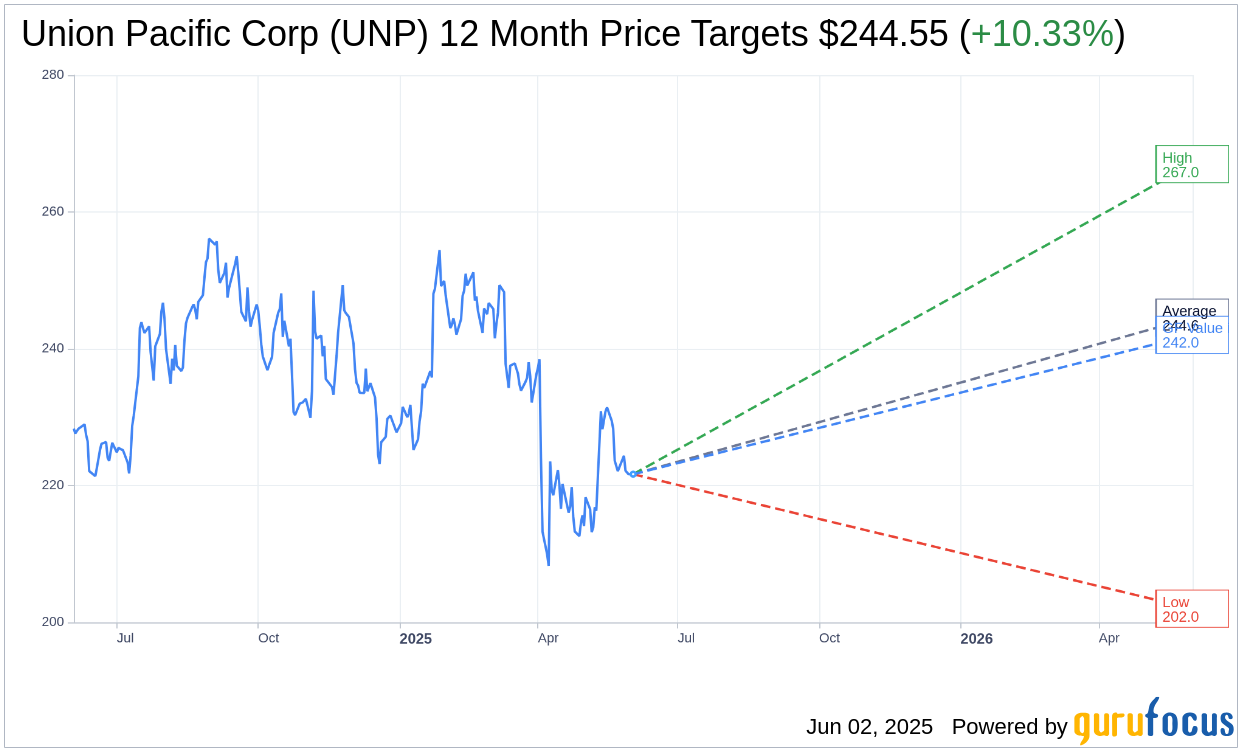

Based on the one-year price targets offered by 26 analysts, the average target price for Union Pacific Corp (UNP, Financial) is $244.55 with a high estimate of $267.00 and a low estimate of $202.00. The average target implies an upside of 10.33% from the current price of $221.66. More detailed estimate data can be found on the Union Pacific Corp (UNP) Forecast page.

Based on the consensus recommendation from 30 brokerage firms, Union Pacific Corp's (UNP, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Union Pacific Corp (UNP, Financial) in one year is $242.04, suggesting a upside of 9.19% from the current price of $221.66. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Union Pacific Corp (UNP) Summary page.