Goldman Sachs has elevated its rating on Schneider National (SNDR, Financial) from Neutral to Buy, while boosting the price target from $24 to $32. This shift highlights a renewed focus on the trucking sector, as the firm takes a more cautious stance toward the rail and rail-adjacent industries. Despite lingering concerns regarding tariffs and their effects on consumer demand and global freight flows, Goldman Sachs advocates for early investment in transportation stocks poised for an upcoming earnings upgrade cycle. The firm's strategy emphasizes purchasing stocks when market fundamentals are under significant pressure, believing that the current underperformance of trucking stocks, alongside a potential freight recovery, presents a compelling opportunity for returns.

Wall Street Analysts Forecast

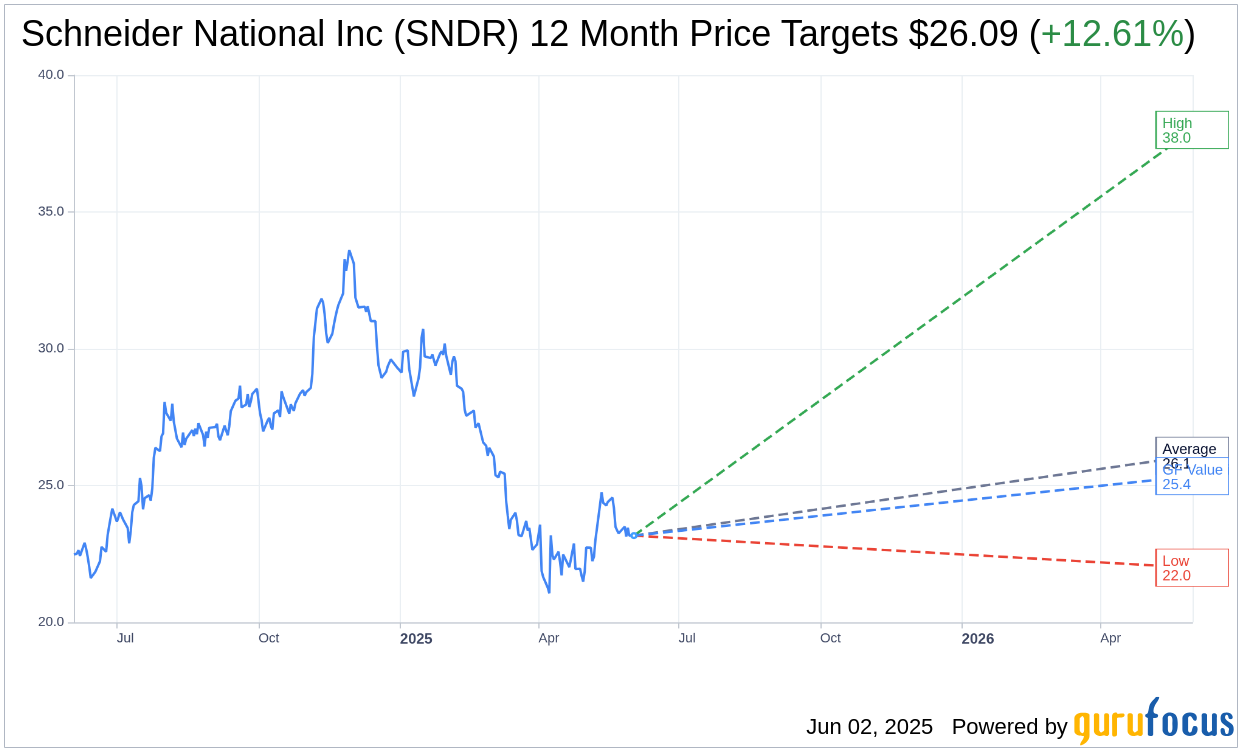

Based on the one-year price targets offered by 13 analysts, the average target price for Schneider National Inc (SNDR, Financial) is $26.09 with a high estimate of $38.00 and a low estimate of $22.00. The average target implies an upside of 12.61% from the current price of $23.17. More detailed estimate data can be found on the Schneider National Inc (SNDR) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Schneider National Inc's (SNDR, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Schneider National Inc (SNDR, Financial) in one year is $25.35, suggesting a upside of 9.41% from the current price of $23.17. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Schneider National Inc (SNDR) Summary page.

SNDR Key Business Developments

Release Date: May 01, 2025

- Enterprise Revenue (excluding fuel surcharge): $1.26 billion, up 8% year over year.

- Adjusted Income from Operations: $44 million, a 47% increase year over year.

- Adjusted Operating Ratio: Improved by 90 basis points compared to Q1 2024.

- Adjusted Diluted Earnings Per Share: $0.16, compared to $0.11 last year.

- Truckload Revenue (excluding fuel surcharge): $614 million, 14% increase year over year.

- Truckload Operating Income: $25 million, up nearly 70% year over year.

- Truckload Operating Ratio: 95.9%, improved by 130 basis points compared to Q1 2024.

- Intermodal Revenue (excluding fuel surcharge): $260 million, 5% increase year over year.

- Intermodal Operating Income: $14 million, a 97% increase year over year.

- Intermodal Operating Ratio: 94.7%, improved by 250 basis points compared to Q1 2024.

- Logistics Revenue (excluding fuel surcharge): $332 million, 2% increase year over year.

- Logistics Operating Income: $8 million, a 50% increase year over year.

- Logistics Operating Ratio: 97.6%, improved by 70 basis points compared to Q1 2024.

- Total Debt and Finance Lease Obligations: $577 million.

- Cash and Cash Equivalents: $106 million.

- Net Debt Leverage: 0.8 times at the end of the quarter.

- Net Capital Expenditures: $97 million, compared to $112 million last year.

- Free Cash Flow: Increased by approximately $9 million compared to Q1 2024.

- Full Year 2025 EPS Guidance: $0.75 to $1.

- Full Year 2025 Net CapEx Guidance: $325 million to $375 million, down from $400 million to $450 million previously.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Schneider National Inc (SNDR, Financial) reported an 8% increase in enterprise revenues excluding fuel surcharge, reaching $1.26 billion compared to the previous year.

- The acquisition of Cowan Systems has been immediately accretive, contributing to a 14% increase in Truckload revenues and a 70% improvement in Truckload operating income year over year.

- Intermodal segment nearly doubled its earnings compared to the previous year, driven by a 4% order growth and increased shipping activity in the west of Mexico.

- Logistics segment improved earnings by 50% year over year, supported by effective net revenue management and the strength of the Power Only offering.

- The company has established a target of more than $40 million in additional cost reductions across the enterprise, focusing on AI-based digital assistant technologies and digital employee models to enhance productivity.

Negative Points

- Schneider National Inc (SNDR) faces elevated churn in the second and third quarters due to select dedicated operations moving to network-based solutions and a more competitive landscape.

- The company anticipates lower net truck growth than originally expected due to asset efficiency actions and competitive pressures.

- Intermodal rates remained largely flat year over year, indicating challenges in achieving significant pricing improvements.

- The company is experiencing a more competitive environment in the dedicated segment, particularly in standard equipment, which may impact fleet growth.

- Schneider National Inc (SNDR) has lowered its expectations for fleet growth and pricing improvements for the remainder of the year due to moderating economic conditions and trade policy uncertainties.