Goldman Sachs analysts have decided to take Belden (BDC, Financial) off their US Conviction List as part of their routine monthly review. This move indicates a reevaluation of the company's position within the investment bank's top picks. The reasons for such adjustments typically involve changes in market dynamics or company performance. As Belden (BDC) navigates through these updates, investors may need to reassess its potential within their portfolios.

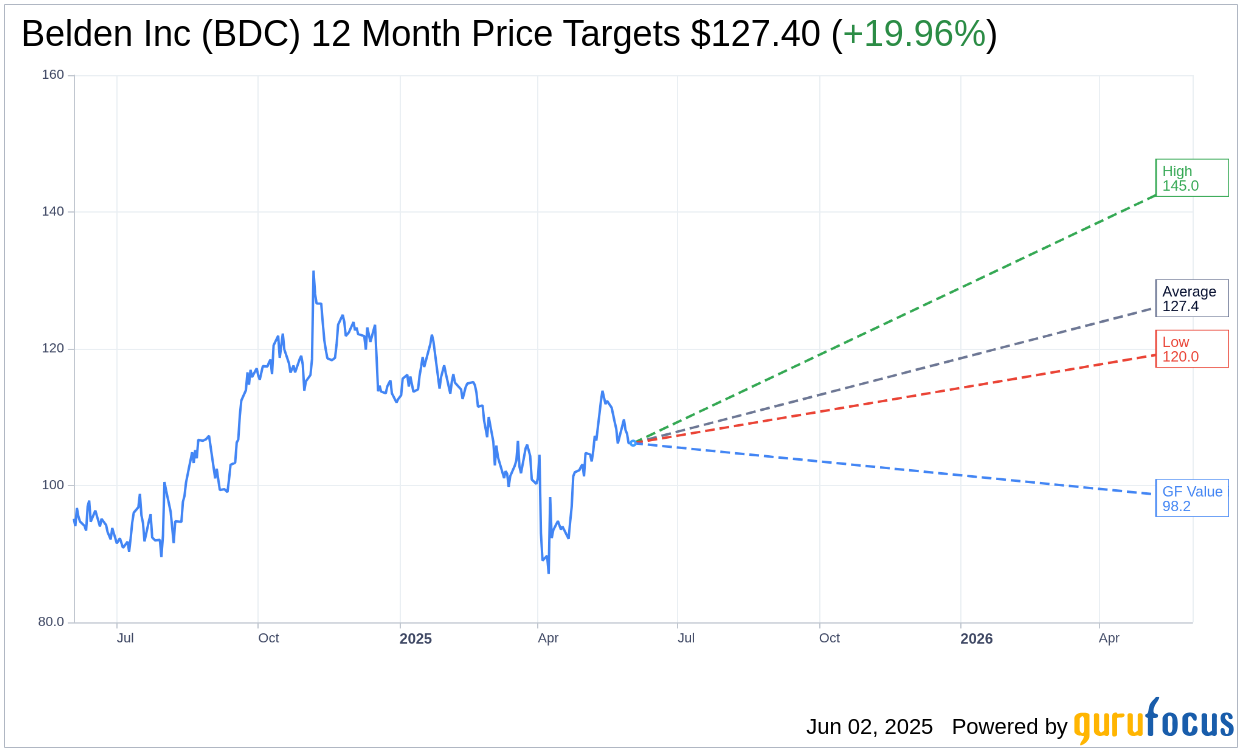

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Belden Inc (BDC, Financial) is $127.40 with a high estimate of $145.00 and a low estimate of $120.00. The average target implies an upside of 19.96% from the current price of $106.20. More detailed estimate data can be found on the Belden Inc (BDC) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Belden Inc's (BDC, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Belden Inc (BDC, Financial) in one year is $98.18, suggesting a downside of 7.55% from the current price of $106.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Belden Inc (BDC) Summary page.

BDC Key Business Developments

Release Date: May 01, 2025

- Revenue: $625 million, up 17% year over year.

- Earnings Per Share (EPS): $1.60, up 29% year over year.

- Gross Margin: 39.8%, up 140 basis points year over year.

- Adjusted EBITDA Margin: 16.6%, up 80 basis points year over year.

- Organic Growth: 11% for the quarter.

- Orders Growth: 18% year over year.

- Book-to-Bill Ratio: 1.05, compared to 1.03 in the prior year period.

- Free Cash Flow: $220 million for the trailing twelve months.

- Share Repurchases: $100 million deployed to repurchase 1 million shares.

- Automation Solutions Revenue Growth: 16% year over year.

- Smart Infrastructure Solutions Revenue Growth: 17% year over year.

- Cash and Cash Equivalents: $259 million at the end of the first quarter.

- Net Income: $65 million, up from $51 million in the prior year quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Belden Inc (BDC, Financial) reported a strong first quarter with revenue of $625 million, up 17% year-over-year, exceeding the high end of their guidance.

- Earnings per share increased by 29% to $1.60, surpassing expectations.

- Gross margins reached 39.8%, the highest since the company's strategic solutions transformation in 2020.

- The company achieved organic growth of 11%, with significant strength in the Americas, which saw 14% organic growth.

- Belden Inc (BDC) generated strong free cash flow of $220 million over the trailing twelve months, allowing for continued investment in high-return opportunities and share repurchases.

Negative Points

- Despite strong performance, there is ongoing uncertainty in the market due to policy changes and trade tensions, which could impact future demand.

- The Smart Infrastructure Solutions segment experienced a book-to-bill ratio below parity, indicating potential challenges in order intake.

- The company's cash and cash equivalents decreased from $370 million in Q4 2024 to $259 million in Q1 2025, reflecting typical seasonality and share repurchases.

- There is some short-term uncertainty and friction in decision-making among customers, particularly regarding reshoring and investment in IT/OT converged backbones.

- The Smart Infrastructure segment experienced a sequential step down in margins due to lower revenue leverage and ongoing targeted investments.