Truist has started coverage on Global Payments (GPN, Financial), assigning it a Hold rating and setting a price target of $79. According to their analysis, while the stock appears undervalued and efforts are being made to streamline the business, predicting organic revenue growth beyond 4%-5% remains challenging. Consequently, they anticipate the stock price to stay within a certain range until the completion of the asset swap between Tsys and Worldpay. Truist also notes that there may be more attractive opportunities available among other large-cap stocks within their coverage.

Wall Street Analysts Forecast

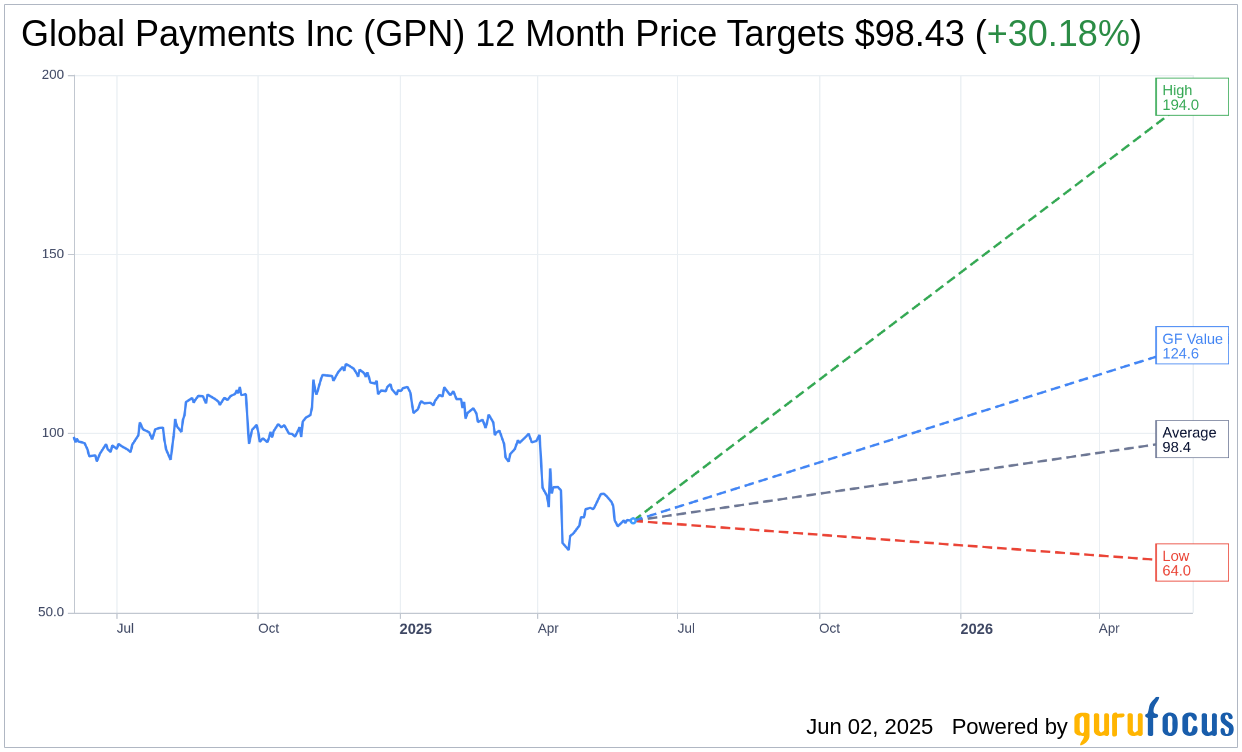

Based on the one-year price targets offered by 24 analysts, the average target price for Global Payments Inc (GPN, Financial) is $98.43 with a high estimate of $194.00 and a low estimate of $64.00. The average target implies an upside of 30.18% from the current price of $75.61. More detailed estimate data can be found on the Global Payments Inc (GPN) Forecast page.

Based on the consensus recommendation from 34 brokerage firms, Global Payments Inc's (GPN, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Global Payments Inc (GPN, Financial) in one year is $124.62, suggesting a upside of 64.82% from the current price of $75.61. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Global Payments Inc (GPN) Summary page.

GPN Key Business Developments

Release Date: May 06, 2025

- Adjusted Net Revenue: $2.2 billion, reflecting 5% constant currency growth, excluding dispositions.

- Adjusted Operating Margin: Increased by 70 basis points.

- Adjusted Earnings Per Share (EPS): $2.69, an increase of 11% on a constant currency basis.

- Merchant Solutions Revenue: $1.69 billion, 6% growth on a constant currency basis, excluding dispositions.

- Issuer Solutions Revenue: $529 million, 3% growth on a constant currency basis.

- Adjusted Free Cash Flow: Approximately $512 million, with a 77% conversion rate of adjusted net income.

- Capital Expenditures: $128 million for the quarter.

- Net Leverage Position: Under 3.2x at the end of the first quarter.

- Share Repurchases: Approximately $450 million executed in the quarter.

- Available Liquidity: Approximately $3.8 billion at the end of the period.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Global Payments Inc (GPN, Financial) reported over 5% constant currency adjusted net revenue growth, excluding dispositions, and an 11% constant currency adjusted earnings per share growth compared to the same period in 2024.

- The company is aggressively executing its transformation agenda, including simplifying its organizational structure and increasing its benefit target by 20% to $600 million.

- The acquisition of Worldpay is expected to enhance GPN's global scale and position it as a leading pure-play commerce solutions provider for merchants worldwide.

- GPN expects to achieve at least $600 million in cost synergies and $200 million in revenue synergies from the Worldpay acquisition.

- The company plans to return roughly $7 billion in capital to shareholders from 2025 to 2027, maintaining a strong focus on shareholder returns.

Negative Points

- The divestiture of the Issuer Solutions business and acquisition of Worldpay may present integration challenges, especially given past unsuccessful integrations.

- There is potential risk associated with the timing and execution of the Worldpay transaction and its alignment with GPN's transformation agenda.

- The company faces macroeconomic uncertainties, including ongoing tariff negotiations, which could impact global economic conditions and consumer spending.

- GPN's adjusted net revenue growth is impacted by dispositions and unfavorable foreign currency exchange rates, which were headwinds in the first quarter.

- The company has yet to complete its target of $500 million to $600 million in revenue dispositions, indicating ongoing restructuring efforts.