Mizuho has updated its price target for Veeva Systems (VEEV, Financial), raising it from $280 to $295, while maintaining an Outperform rating on the stock. This adjustment follows Veeva's impressive performance in the first fiscal quarter. The firm's upward revision in estimates is driven by notable sales growth in both its Commercial Cloud and Development Cloud segments.

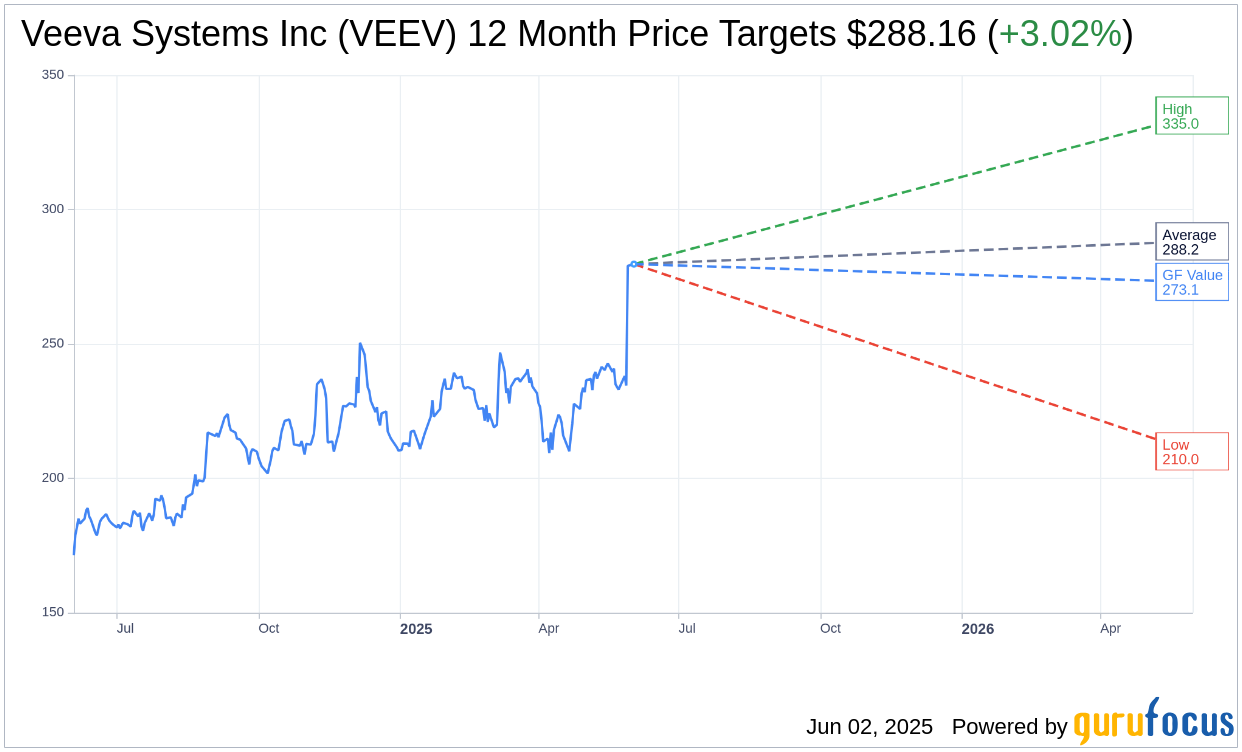

Wall Street Analysts Forecast

Based on the one-year price targets offered by 28 analysts, the average target price for Veeva Systems Inc (VEEV, Financial) is $288.16 with a high estimate of $335.00 and a low estimate of $210.00. The average target implies an upside of 3.02% from the current price of $279.70. More detailed estimate data can be found on the Veeva Systems Inc (VEEV) Forecast page.

Based on the consensus recommendation from 32 brokerage firms, Veeva Systems Inc's (VEEV, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Veeva Systems Inc (VEEV, Financial) in one year is $273.09, suggesting a downside of 2.36% from the current price of $279.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Veeva Systems Inc (VEEV) Summary page.

VEEV Key Business Developments

Release Date: May 28, 2025

- Total Revenue: $759 million for the quarter.

- Non-GAAP Operating Margin: 46%.

- Revenue Run Rate Goal: Achieved $3 billion for calendar 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Veeva Systems Inc (VEEV, Financial) reported total revenue of $759 million, surpassing their guidance.

- The company achieved a non-GAAP operating margin of 46%, indicating strong operational efficiency.

- Veeva AI is a major initiative that is off to a good start, with potential positive impacts on the life sciences industry.

- The company has successfully onboarded over 80 customers to Vault CRM, with plans to reach 200 customers within a year.

- Crossix, a part of Veeva's commercial segment, outperformed expectations and is growing at more than 30% year-over-year.

Negative Points

- The macroeconomic environment is uncertain, largely due to dynamics in the US administration, which could impact future performance.

- Some customers prefer custom projects, which may lead to decisions against migrating to Veeva's solutions.

- The company acknowledges potential funding issues in the small biopharma market due to macroeconomic uncertainties.

- Veeva's horizontal CRM initiative is still in the early stages, with many details yet to be determined.

- There is a risk of conservatism in large pharma due to macroeconomic uncertainties, which could delay projects.