- Campbell Soup Company (CPB, Financial) exceeds quarterly expectations, boosting stock in premarket trading.

- Analyst predictions suggest substantial potential upside for CPB stock based on average price targets.

- GuruFocus estimates indicate significant undervaluation, providing an attractive investment opportunity.

Campbell Soup Company (CPB) experienced a notable 1.4% rise in premarket trading after surpassing its fiscal third-quarter projections. The company achieved a 4% increase in sales, reaching $2.48 billion. Impressively, the adjusted EPS of $0.73 outperformed the consensus estimate of $0.66. Campbell's has confidently reaffirmed its full-year guidance, projecting sales growth between 6% and 8%.

Wall Street Analysts' Forecast

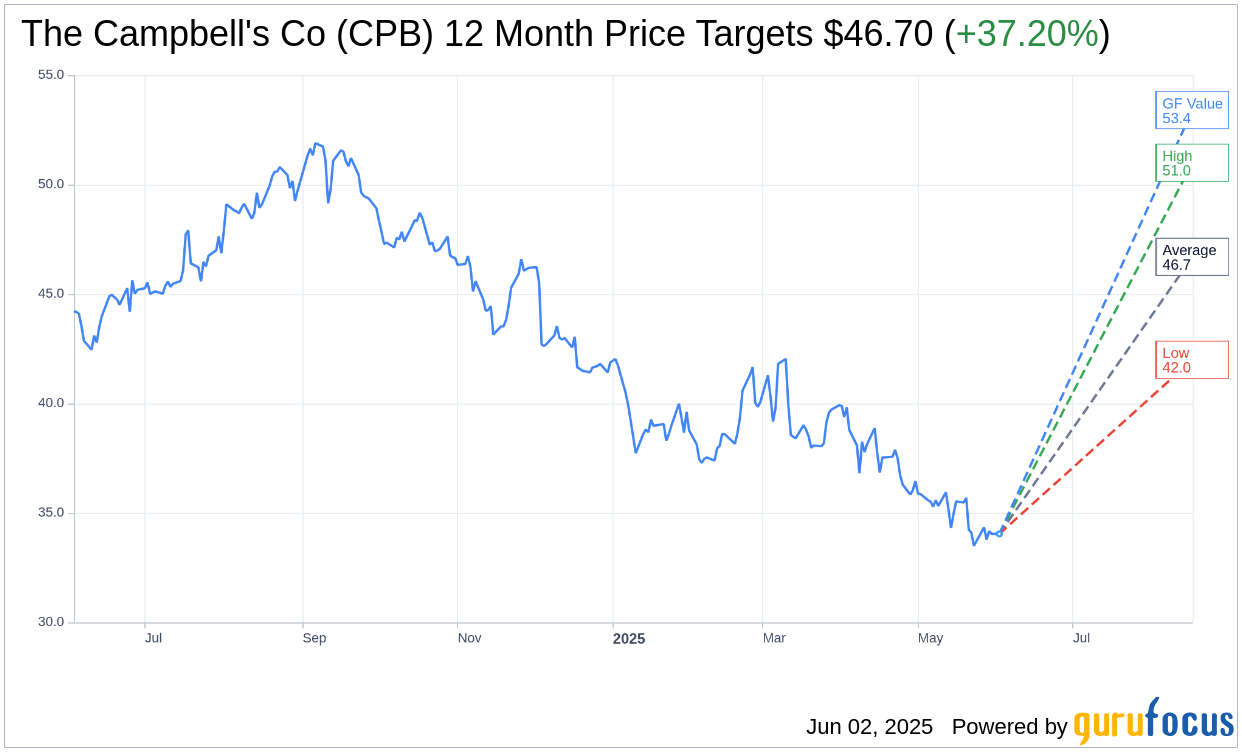

According to the insights provided by 18 analysts, The Campbell's Co (CPB, Financial) has an average one-year price target of $46.70. The high estimate is $51.00, and the low is $42.00, suggesting a significant potential upside of 37.20% from the current price of $34.04. For more comprehensive estimate data, visit the The Campbell's Co (CPB) Forecast page.

Moreover, the consensus from 21 brokerage firms rates The Campbell's Co (CPB, Financial) with an average recommendation of 3.0, indicating a "Hold" stance. This rating system spans from 1 to 5, where 1 represents a Strong Buy and 5 denotes a Sell.

GuruFocus Valuation Estimate

GuruFocus estimates place the GF Value for The Campbell's Co (CPB, Financial) at $53.41 over the next year. This figure suggests an impressive upside of 56.9% from the current market price of $34.04. The GF Value reflects GuruFocus’s fair value estimation based on historical trading multiples, previous business growth, and future performance predictions. For more detailed insights, visit the The Campbell's Co (CPB) Summary page.