UBS has revised its price target for Bancolombia (CIB, Financial), increasing it from $35 to $38. Despite this adjustment, the firm maintains its Neutral stance on the stock. This change reflects a slightly more optimistic outlook on Bancolombia's potential market performance.

Wall Street Analysts Forecast

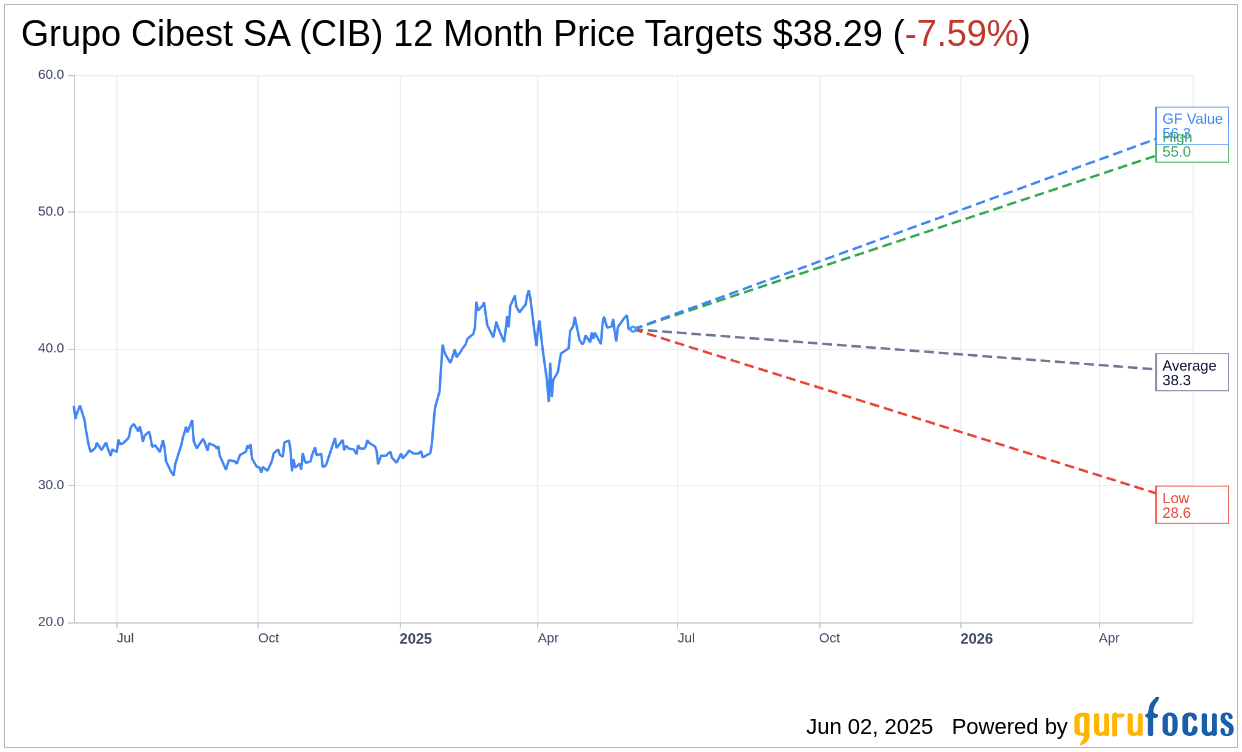

Based on the one-year price targets offered by 8 analysts, the average target price for Grupo Cibest SA (CIB, Financial) is $38.29 with a high estimate of $55.00 and a low estimate of $28.60. The average target implies an downside of 7.59% from the current price of $41.43. More detailed estimate data can be found on the Grupo Cibest SA (CIB) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Grupo Cibest SA's (CIB, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Grupo Cibest SA (CIB, Financial) in one year is $56.31, suggesting a upside of 35.92% from the current price of $41.43. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Grupo Cibest SA (CIB) Summary page.

CIB Key Business Developments

Release Date: May 06, 2025

- Net Income: COP1.7 trillion, reflecting a 4.5% growth both quarterly and annually.

- Net Interest Margin (NIM): Over 6.4%.

- Return on Equity (ROE): 16.3%.

- Loan Portfolio: Decreased slightly this quarter, but grew 7% annually.

- Deposits: Fell by 1% in the quarter, increased almost 13% annually.

- Cost of Risk: 1.6% for the period.

- Total Solvency Ratio: Nearly 13%.

- Core Equity Tier 1 Ratio: 11%.

- Dividend Payout: COP69 million total for the year, including an extraordinary dividend of COP624 per share.

- Operating Expenses: Decreased 7.7% compared to the previous quarter.

- Efficiency Ratio: Fell to 49.6%.

- Shareholders' Equity: Fell 6.7% quarter over quarter, grew 11.4% year over year.

- Loan Growth Guidance for 2025: Approximately 5%.

- Net Interest Margin Guidance for 2025: Around 6.2%.

- Cost of Risk Guidance for 2025: Decreasing to a range of 1.8% to 2%.

- Return on Equity Guidance for 2025: Between 14.5% and 15%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- BanColombia SA (CIB, Financial) reported a quarterly net income of COP1.7 trillion, reflecting a 4.5% growth both quarterly and annually.

- The company achieved a robust Net Interest Margin (NIM) of over 6.4%, contributing to a strong Return on Equity (ROE) of 16.3%.

- Asset quality improved with a cost of risk at 1.6%, supported by lower delinquency rates and effective credit risk models.

- BanColombia SA (CIB) maintained a strong capital position with a total solvency ratio of nearly 13% and a core equity Tier 1 ratio of 11%.

- The merger of Bancolombia La Mano with NECI is expected to enhance operational efficiencies and profitability, with NECI projected to reach breakeven by the first quarter of 2026.

Negative Points

- The loan portfolio slightly decreased in the quarter, although it grew 7% annually, indicating potential challenges in sustaining growth.

- Deposits fell by 1% in the quarter, despite a 13% annual increase, highlighting potential issues in maintaining funding levels.

- The fiscal situation in Colombia remains a significant challenge, with a high fiscal deficit and recent suspension of the IMF Flexible Credit Line.

- Interest income fell by almost 3% in the quarter due to lower-yielding loans and securities, despite a drop in interest expenses.

- Operating expenses increased by 9.8% annually, driven by IT-related costs and annual wage increases, impacting the efficiency ratio.