- Strategic Expansion Boost: Applied Digital (APLD, Financial) secures $7 billion in revenue through 15-year leases with CoreWeave, sparking a 40% stock surge.

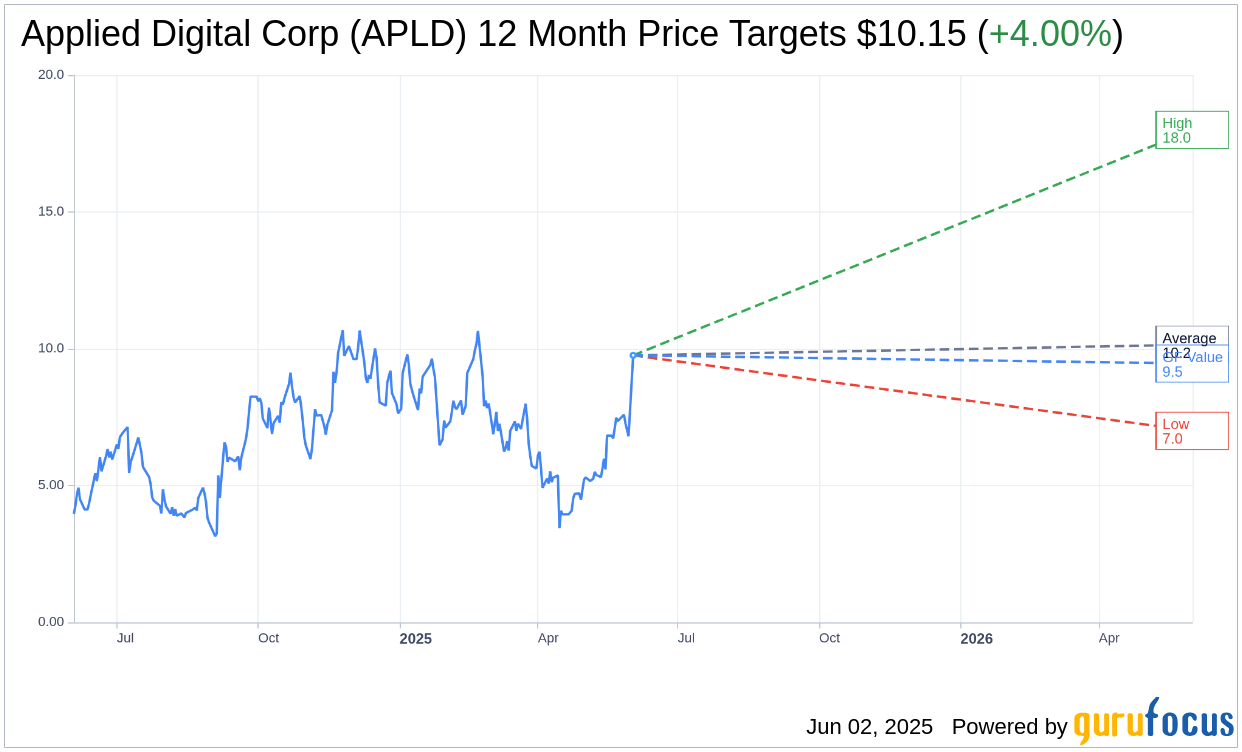

- Analyst Insights: Wall Street sets an average price target of $10.15, suggesting a modest upside from current levels.

- Value Assessment: GuruFocus projects a GF Value downside of 3.07%, indicating potential overvaluation at current prices.

Applied Digital Corp (APLD) has recently made headlines by securing two significant lease agreements with CoreWeave, projected to generate substantial revenue over the next 15 years. Under this agreement, the delivery of 250 megawatts of critical IT load at a new North Dakota data center is anticipated, boosting investor confidence and driving the stock price up by 40%.

Analyst Perspectives

According to projections from 10 Wall Street analysts, Applied Digital's stock has an average target price set at $10.15. The forecasts span a high estimate of $18.00 and a low of $7.00, indicating a potential upside of 4.00% from its current valuation of $9.76. Investors can explore detailed estimates and further projections on the GuruFocus platform.

Brokerage Recommendations

Market analysts from 10 brokerage firms have provided an average recommendation of 1.9 for Applied Digital Corp, which translates to an "Outperform" status. This rating scale, extending from 1 (Strong Buy) to 5 (Sell), reflects optimism about the company's future.

Value Evaluation

GuruFocus' proprietary metrics suggest a one-year GF Value for Applied Digital at $9.46, pointing to a 3.07% downside from its current share price of $9.76. This fair value estimate is based on the stock's historical trading multiples, past growth metrics, and future business performance forecasts. Additional insights and analyses are readily available on the Applied Digital Corp Summary page for interested investors.