- Microsoft announces a substantial $400 million investment in Switzerland to boost its AI and cloud computing capabilities.

- Analysts foresee a potential 9.98% upside for Microsoft's stock, despite a slight dip in premarket trading.

- MSFT holds an "Outperform" status with an average brokerage recommendation of 1.8.

Microsoft Corp (MSFT, Financial) is making headlines with a strategic investment of $400 million aimed at enhancing its artificial intelligence and cloud computing operations in Switzerland. This investment involves the expansion of data centers near Zurich and Geneva, alongside initiatives to support local startups and promote AI skill development among the Swiss population. Despite this promising move, MSFT shares experienced a 0.4% decline in premarket trading.

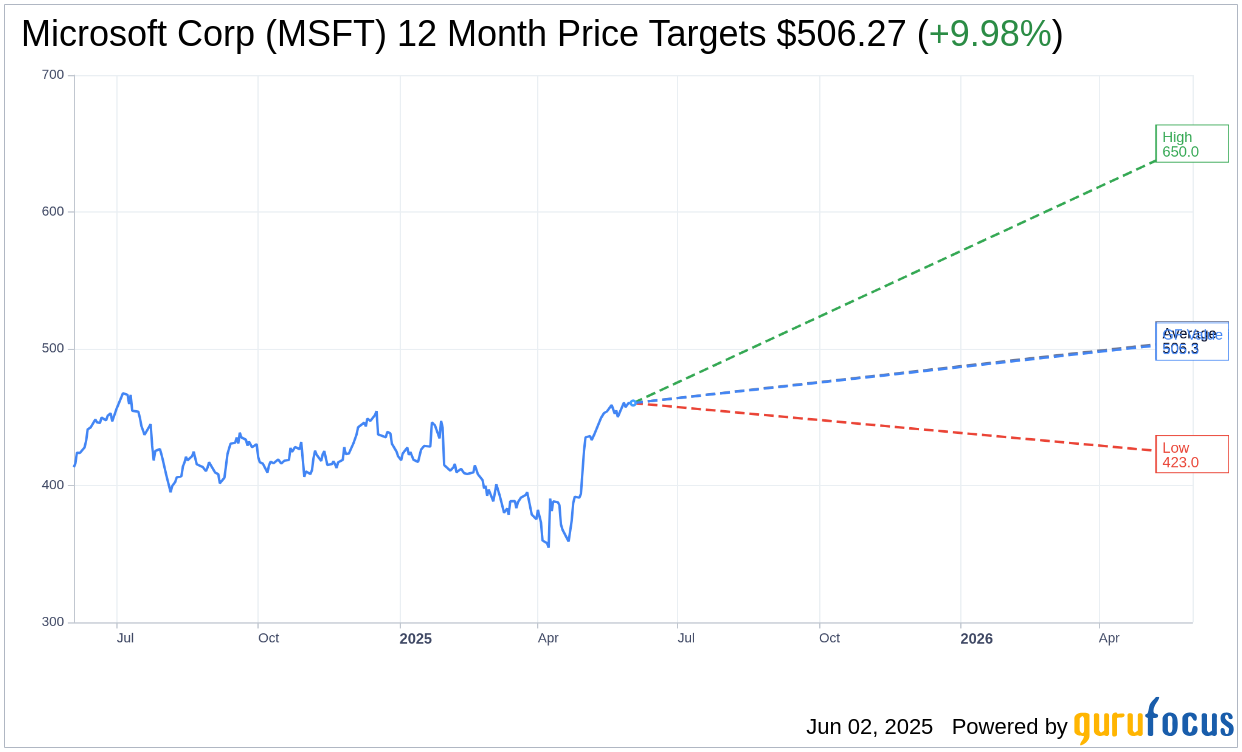

Wall Street Analysts Forecast

In the realm of Wall Street projections, the consensus among 49 analysts sets the average one-year price target for Microsoft Corp (MSFT, Financial) at $506.27. This estimate reflects a potential high of $650.00 and a low of $423.00, suggesting an expected upside of 9.98% from the current trading price of $460.35. For more detailed insights into Microsoft's potential trajectory, visit the Microsoft Corp (MSFT) Forecast page.

Furthermore, Microsoft's stock enjoys a favorable outlook from 63 brokerage firms, earning an average brokerage recommendation of 1.8. This rating indicates an "Outperform" status, positioned on a scale where 1 represents a Strong Buy and 5 indicates a Sell.

According to GuruFocus estimates, the estimated GF Value for Microsoft Corp (MSFT, Financial) in one year is $505.29. This projection suggests a potential upside of 9.76% from the current price point of $460.35. The GF Value is determined by assessing historical trading multiples, the company's business growth trajectory, and future performance estimates. Further details on Microsoft's valuation can be accessed on the Microsoft Corp (MSFT) Summary page.