Teck Resources (TECK, Financial) is facing a minor challenge with its stock potentially experiencing a slight downturn due to operational interruptions. The company announced that a copper grinding mill at the Andacollo mine and a shiploader at the QB2 facility are temporarily out of action for repairs. These events are independent of each other but are anticipated to last approximately one month.

Despite these setbacks, the impact of the shiploader's downtime is expected to be minimal. The company can bypass the issues at the QB2 port by utilizing alternative ports or transporting the concentrate via trucks. RBC Capital maintains its optimistic outlook on Teck Resources with an Outperform rating and a price target of C$82. The firm anticipates that the company's strategic responses will mitigate any significant impact on operations.

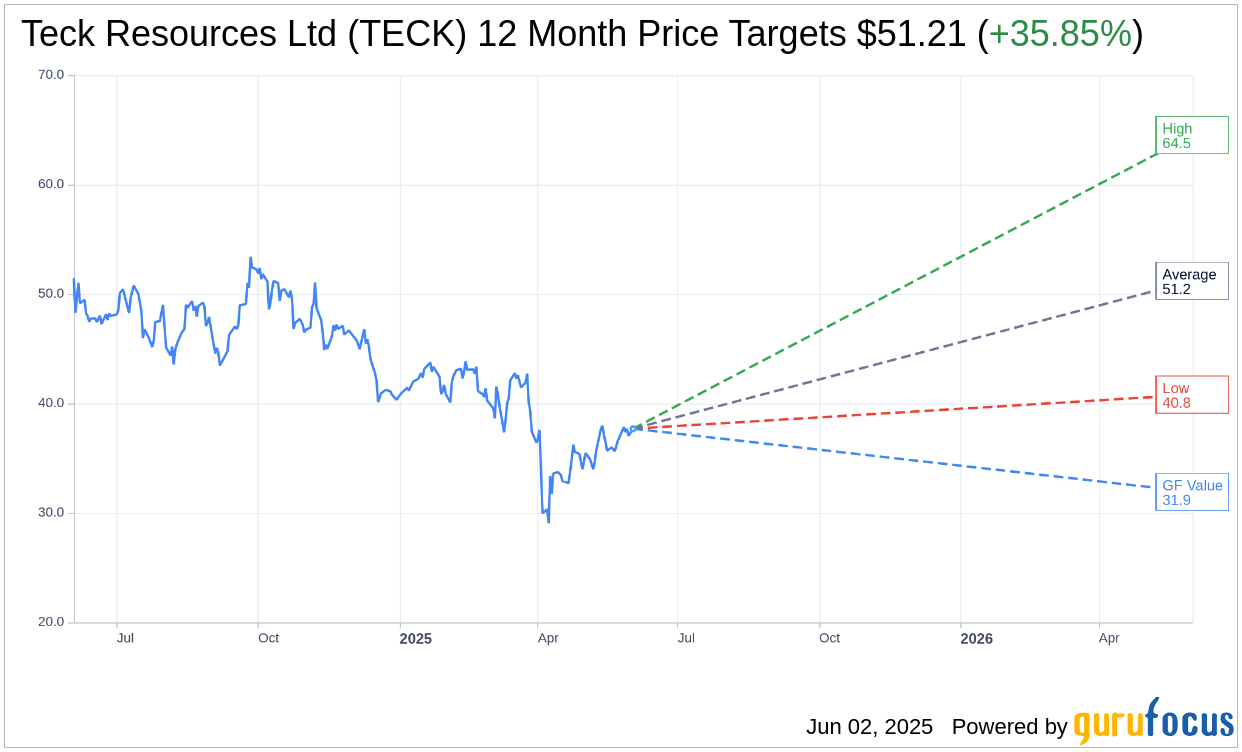

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Teck Resources Ltd (TECK, Financial) is $51.21 with a high estimate of $64.52 and a low estimate of $40.81. The average target implies an upside of 35.85% from the current price of $37.70. More detailed estimate data can be found on the Teck Resources Ltd (TECK) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Teck Resources Ltd's (TECK, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teck Resources Ltd (TECK, Financial) in one year is $31.92, suggesting a downside of 15.33% from the current price of $37.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teck Resources Ltd (TECK) Summary page.