- Signet Jewelers (SIG, Financial) is expected to announce Q1 earnings on June 3rd, with an anticipated EPS decline.

- Analysts predict a modest revenue growth, enhancing investor expectations.

- Stock forecasts show significant potential upside, according to GuruFocus proprietary metrics.

Signet Jewelers (SIG) is poised to release its Q1 earnings report on June 3rd. Analysts are forecasting an earnings per share (EPS) of $1.04, marking a 6.3% decline compared to last year. However, the company is expected to see a revenue uptick, projecting a 1.3% increase with revenues poised at $1.52 billion. Impressively, Signet Jewelers has a strong track record in surpassing EPS estimates, having done so 88% of the time over the past two years.

Wall Street Analysts Forecast

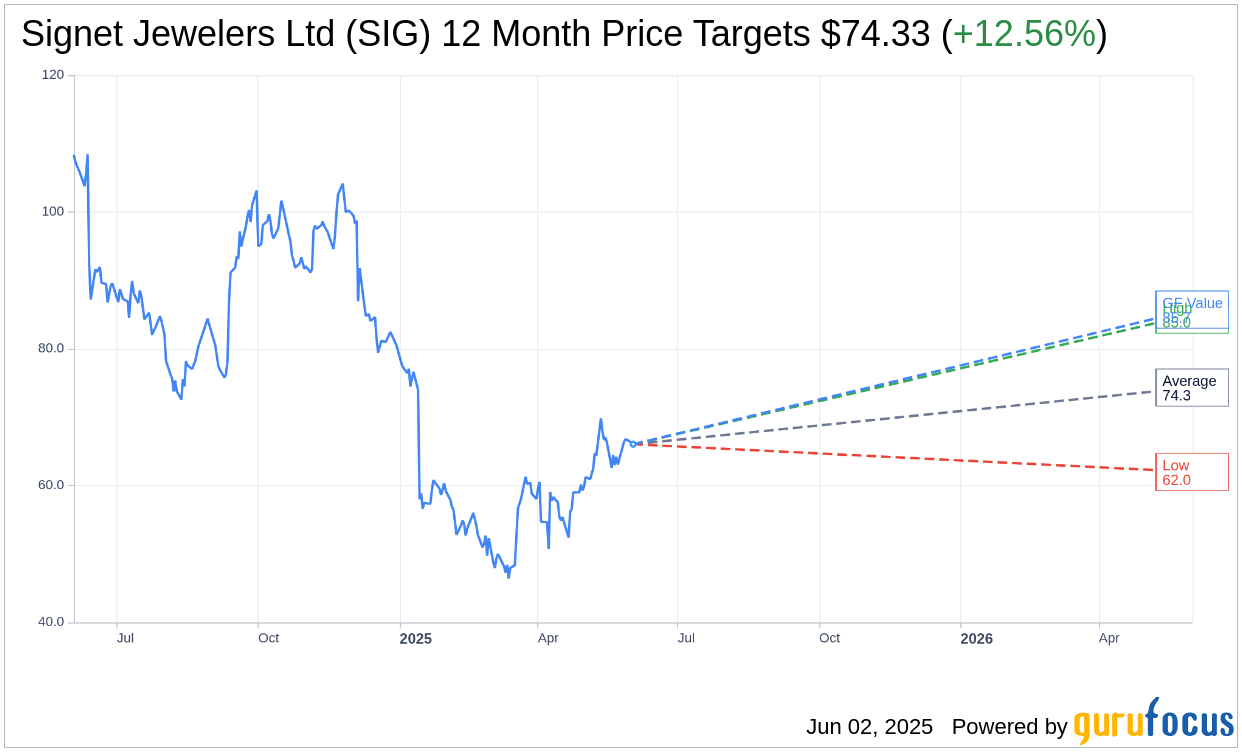

When examining the insights from six industry analysts, the average one-year price target for Signet Jewelers Ltd (SIG, Financial) stands at $74.33. Projections vary, with a high estimate at $85.00 and a low at $62.00. This average target suggests a potential upside of 12.56% from the current stock price of $66.04. For those interested in more detailed estimates, additional data is available on the Signet Jewelers Ltd (SIG) Forecast page.

With insights from eight brokerage firms, the consensus recommendation for Signet Jewelers Ltd (SIG, Financial) is an "Outperform," reflected in the average brokerage recommendation of 2.4. This rating, based on a scale from 1 to 5, aligns closer to "Strong Buy," with 1 being a Strong Buy and 5 indicating a Sell.

According to GuruFocus, the estimated GF Value for Signet Jewelers Ltd (SIG, Financial) in a year is projected to be $85.73, indicating a 29.82% upside from the current price of $66.04. The GF Value represents GuruFocus' assessment of the stock's fair trading value, derived from analyzing historical multiples and forecasting future business performance. Interested investors can access further detailed insights on the Signet Jewelers Ltd (SIG) Summary page.