Key Highlights:

- Analysts have upgraded Costco (COST, Financial) from 'hold' to 'buy', recognizing its strong business model.

- Current commodity price trends reduce concerns over margin impacts from tariffs.

- The stock shows an average price target suggesting a modest upside potential.

Costco Wholesale Corp (COST) has gained attention in the investment community with a recent upgrade from 'hold' to 'buy' by the analysts at Hunting Alpha. This positive shift reflects confidence in Costco's robust business framework, which consistently yields significant returns for shareholders. Despite some looming concerns about tariffs, favorable commodity price movements suggest a limited impact on Costco's profit margins.

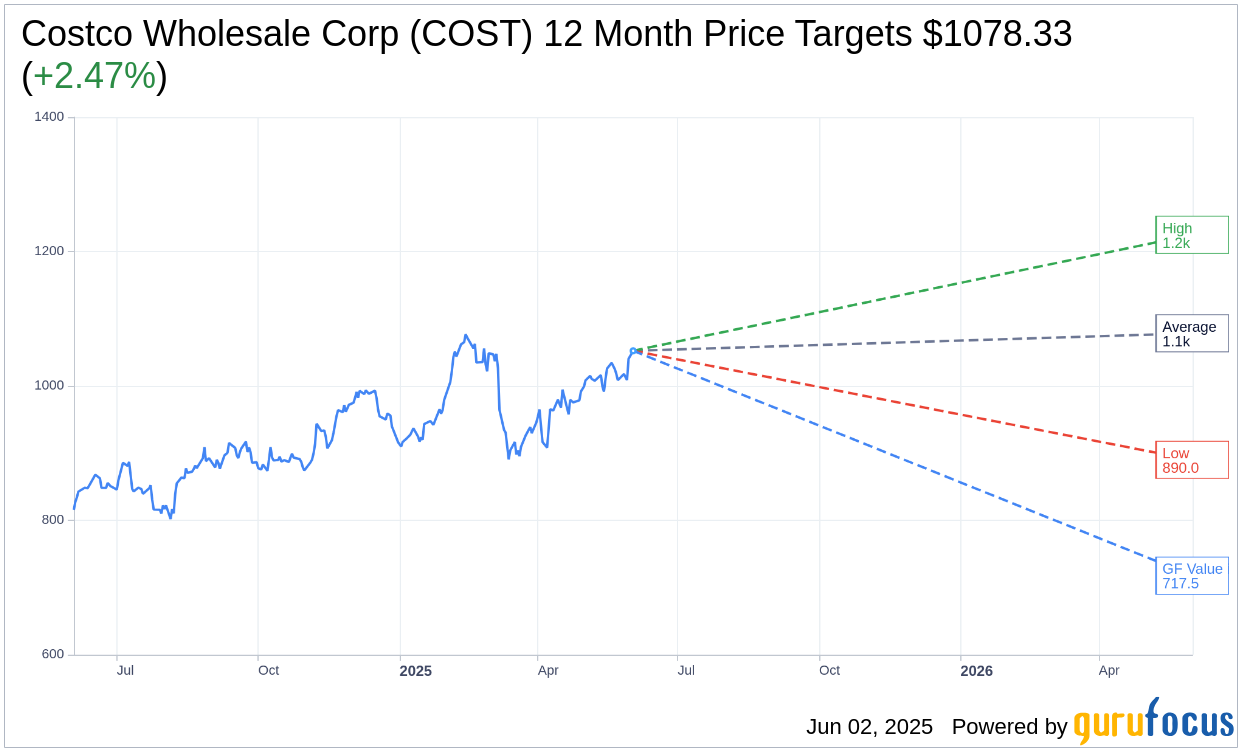

Wall Street Analysts Forecast

According to projections from 31 analysts over the next year, the average target price for Costco stands at $1,078.33. Estimates range from a high of $1,225.00 to a low of $890.00, offering an average potential upside of 2.47% from the current share price of $1,052.32. Interested investors can explore more detailed predictions on the Costco Wholesale Corp (COST, Financial) Forecast page.

Brokerage Recommendations

Collectively, 39 brokerage firms have contributed to an average rating of 2.2 for Costco, indicating an "Outperform" recommendation. On a scale where 1 represents a Strong Buy and 5 signals a Sell, this rating underscores positive sentiment among analysts regarding Costco's market performance.

GuruFocus Valuation Estimates

According to GuruFocus's valuation model, the estimated GF Value for Costco in the coming year is $717.53. This estimation implies a potential downside of 31.81% from its current stock price of $1,052.32. The GF Value integrates historical trading multiples, the company's previous growth patterns, and future business performance forecasts. Investors can find a comprehensive analysis on the Costco Wholesale Corp (COST, Financial) Summary page.