- BP partners with TPAO and SOCAR to expand the Shafag-Asiman gas field.

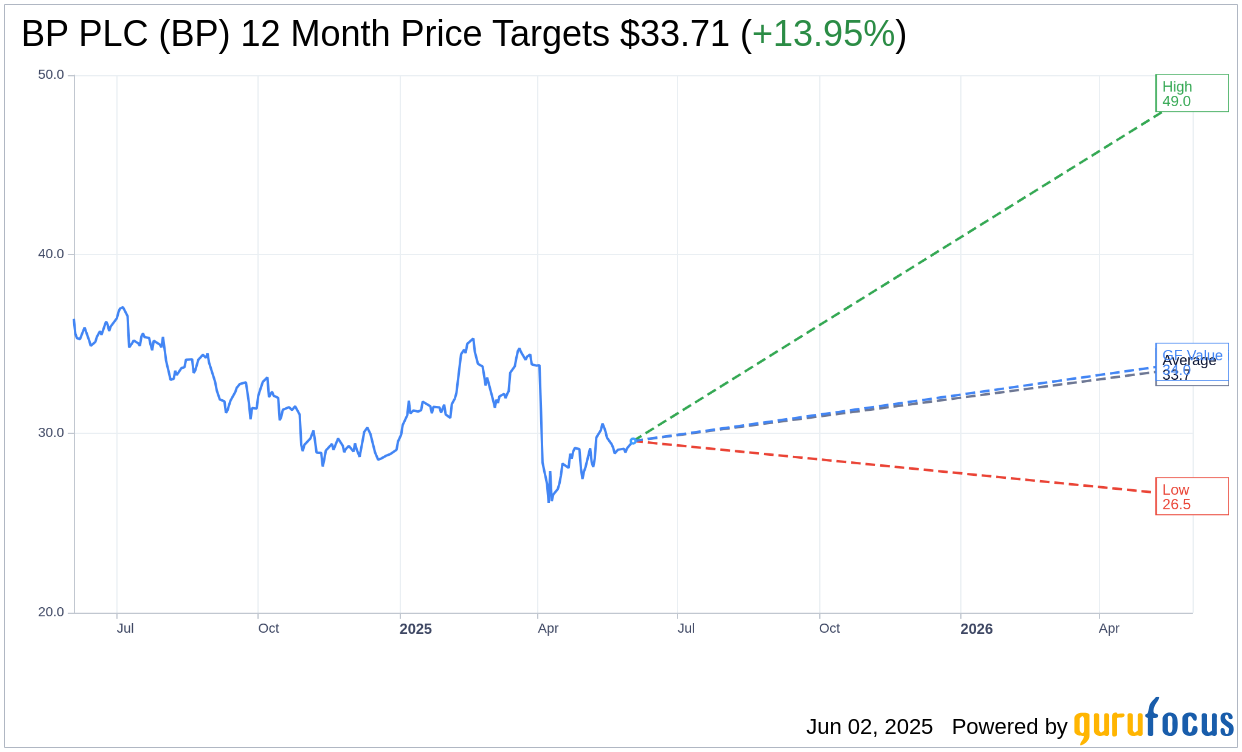

- Analysts predict a potential 13.95% upside with an average target price of $33.71.

- GuruFocus estimates suggest a GF Value growth of 14.94% for BP.

BP (BP, Financial) is embarking on a strategic collaboration with Turkey's TPAO and Azerbaijan's SOCAR to drive forward the development of the Shafag-Asiman gas field located in the Caspian Sea. This strategic partnership will see TPAO acquiring a 30% stake, while BP and SOCAR continue their equal partnership, a collaboration that has been in place since 2020.

Wall Street Analysts Forecast

Wall Street analysts have provided their one-year price targets for BP PLC (BP, Financial) with significant insights for potential investors. The average target price is projected at $33.71, marked by a high estimate of $49.00 and a low of $26.50. This average target suggests a potential upside of 13.95% from the current market price of $29.58. For further insights and a detailed breakdown, visit our BP PLC (BP) Forecast page.

Moreover, the consensus from 18 brokerage firms places BP PLC (BP, Financial) at an average recommendation of 2.7, indicating a "Hold" status. This rating operates on a scale from 1 to 5, where 1 is a Strong Buy and 5 is a Sell. This consensus reflects a cautious but optimistic approach as analysts await further developments.

GuruFocus GF Value Estimate

According to GuruFocus estimates, BP PLC (BP, Financial) could reach a GF Value of $34.00 in the next year, implying an appealing upside of 14.94% from its current stock price of $29.58. The GF Value is a metric developed by GuruFocus to assess the fair value of a stock, drawing from historical trading multiples, historical growth rates, and future performance estimates. Investors can explore these insights in more detail on the BP PLC (BP) Summary page.