In the latest development for Cantaloupe (CTLP, Financial), the payment solutions provider has attracted final takeover offers, with several interested parties joining the bidding process. Reports indicate that these bids have surpassed $10 per share. As a result, the company's stock saw a rise of 57 cents, translating to a 7% increase, bringing the share price to $8.94 during afternoon trading. Earlier this year, Cantaloupe was reported to be exploring various strategic options, including a possible sale or transition to a private entity. Such developments are closely watched by investors interested in the company's future direction and market position.

Wall Street Analysts Forecast

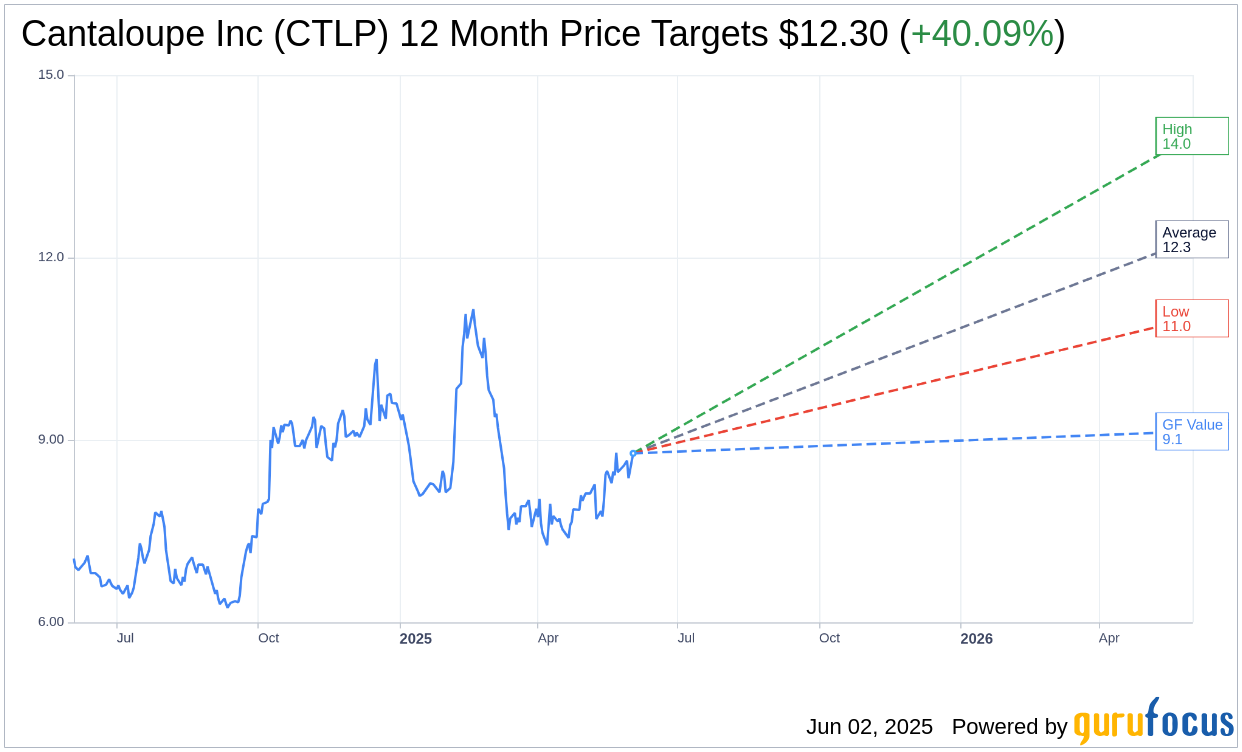

Based on the one-year price targets offered by 5 analysts, the average target price for Cantaloupe Inc (CTLP, Financial) is $12.30 with a high estimate of $14.00 and a low estimate of $11.00. The average target implies an upside of 40.09% from the current price of $8.78. More detailed estimate data can be found on the Cantaloupe Inc (CTLP) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Cantaloupe Inc's (CTLP, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cantaloupe Inc (CTLP, Financial) in one year is $9.14, suggesting a upside of 4.1% from the current price of $8.78. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cantaloupe Inc (CTLP) Summary page.

CTLP Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cantaloupe Inc (CTLP, Financial) reported an 11% year-over-year increase in total revenue for Q3 2025, reaching $75.4 million.

- The company achieved a 37% increase in adjusted EBITDA, amounting to $13.9 million, reflecting successful margin expansion and operating leverage.

- Cantaloupe Inc (CTLP) experienced strong cash generation, with $22.4 million in cash from operating activities during the quarter.

- The company saw significant growth in its smart store product, with over $2 million in shipments, indicating strong demand in new verticals.

- Cantaloupe Inc (CTLP) released a $42.2 million valuation allowance on deferred tax assets, contributing to a net income of $48.9 million for the quarter.

Negative Points

- Revenue was lower than anticipated due to one-time weather events impacting transaction revenue and delays in equipment purchases.

- Transaction revenue was materially impacted by adverse weather events, leading to abnormally low traffic in customer locations.

- There was a pullback in large equipment purchases due to economic uncertainty, affecting sales in the quarter.

- The company faced supply constraints for its smart store product, limiting its ability to meet demand.

- International revenue remains a small portion of total revenue, expected to be only 3-4% by the end of fiscal year 2025.