Medical Properties Trust, identified by the ticker MPW, has submitted a filing for an automatic mixed securities shelf. This strategic move allows the company to offer various types of securities in the future, providing flexibility in their financial and operational strategies. By establishing this shelf, Medical Properties Trust aims to strengthen its financial standing and maintain agility in capital markets. Investors and stakeholders are closely watching these developments, given their potential impact on the company's growth trajectory and market performance.

Wall Street Analysts Forecast

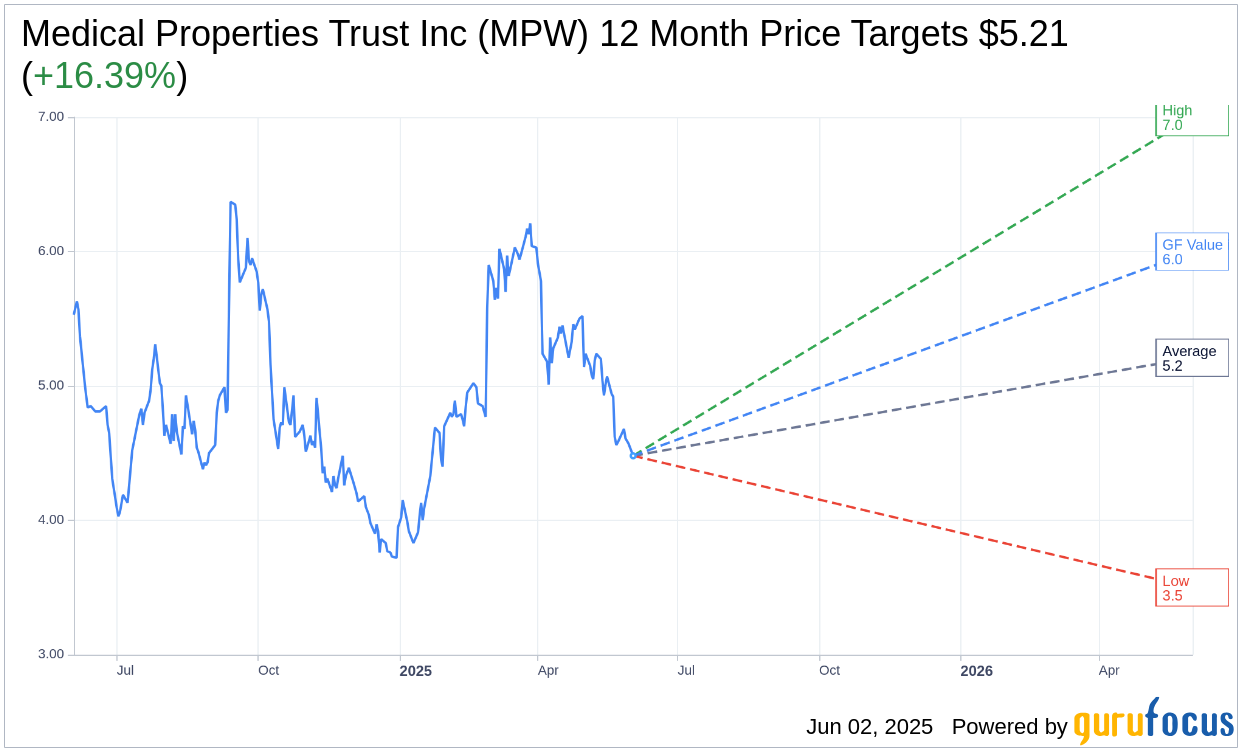

Based on the one-year price targets offered by 7 analysts, the average target price for Medical Properties Trust Inc (MPW, Financial) is $5.21 with a high estimate of $7.00 and a low estimate of $3.50. The average target implies an upside of 16.39% from the current price of $4.48. More detailed estimate data can be found on the Medical Properties Trust Inc (MPW) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Medical Properties Trust Inc's (MPW, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Medical Properties Trust Inc (MPW, Financial) in one year is $6.00, suggesting a upside of 33.93% from the current price of $4.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Medical Properties Trust Inc (MPW) Summary page.

MPW Key Business Developments

Release Date: May 01, 2025

- GAAP Net Loss: $0.20 per share for Q1 2025.

- Normalized FFO: $0.14 per share for Q1 2025.

- Debt Issuance: Over $2.5 billion of seven-year secured bonds at a blended coupon rate of approximately 7.8%.

- Impairments and Adjustments: Approximately $73 million in impairments and fair market value adjustments, including $11 million impairment on mortgage investments in Colombia.

- Cash Rent from Former Steward Facilities: Scheduled to increase from $4 million in Q1 to more than $23 million in Q4 2025.

- Ernest Health EBITDARM Coverage: 2.1 times.

- LifePoint Health Admissions Growth: 17% year-over-year increase at Conemaugh Memorial.

- Swiss Medical EBITDAR Growth: High single-digit growth driven by cost optimization and top-line growth.

- Circle Health Performance: Strong performance driven by increasing surgical volumes and patient acuity.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Medical Properties Trust Inc (MPW, Financial) issued over $2.5 billion in seven-year secured bonds at a blended coupon rate of approximately 7.8%, strengthening their balance sheet and providing liquidity to cover all debt maturities through 2026.

- The company reported strong growth in admissions and rate improvements across its portfolio, with an uptick in year-over-year EBITDARM coverage driven by improved volumes and strategic expense management.

- New operators in the transitional portfolio are ramping up operations, with cash rents expected to increase significantly by the fourth quarter of 2026.

- In the UK, three operators in MPW's portfolio were nominated for Health Investors Private Hospital Group of the Year, indicating strong performance and market recognition.

- MPW's stabilized portfolio continues to produce steady or improving performance, with expectations of reaching total annualized cash rent of more than $1 billion once new tenants are fully ramped.

Negative Points

- MPW reported a GAAP net loss of $0.20 per share for the first quarter of 2025, affected by debt refinancing transactions and higher stock compensation expenses.

- The company recorded approximately $73 million in impairments and fair market value adjustments to investments in Prospect, real estate in Connecticut, and PHP, which could impact future financial performance.

- There are ongoing disputes in the Steward bankruptcy process, with new operators facing challenges in collecting payments owed to them, potentially affecting their financial stability.

- MPW impaired its mortgage investments in Colombia by approximately $11 million due to government limitations on hospital reimbursements, indicating geopolitical risks.

- The company expects second-quarter normalized FFO to be reduced by approximately $0.02 per share due to the full quarterly impact of higher interest expenses from recent transactions.