aTyr Pharma (ATYR, Financial) is set to participate in an important event in New York on June 4, hosted by Piper Sandler. This meeting could provide valuable insights into the company's performance and future prospects. Investors interested in understanding the nuances of aTyr Pharma's market position may find this event particularly enlightening as it offers an opportunity to engage with management and gain strategic insights.

Wall Street Analysts Forecast

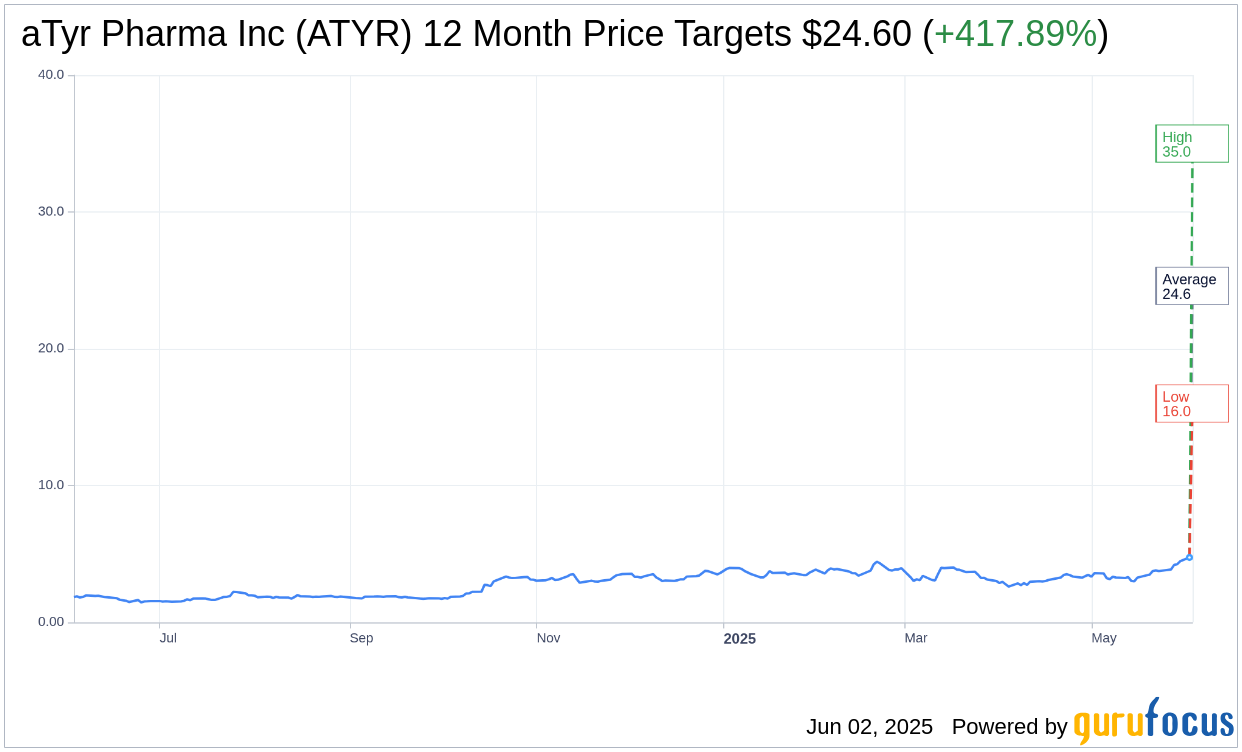

Based on the one-year price targets offered by 5 analysts, the average target price for aTyr Pharma Inc (ATYR, Financial) is $24.60 with a high estimate of $35.00 and a low estimate of $16.00. The average target implies an upside of 417.89% from the current price of $4.75. More detailed estimate data can be found on the aTyr Pharma Inc (ATYR) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, aTyr Pharma Inc's (ATYR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

ATYR Key Business Developments

Release Date: March 13, 2025

- Cash and Investments: $75.1 million at the end of 2024.

- ATM Offering Proceeds: Approximately $18.8 million raised subsequent to Q4 2024.

- Collaboration and License Revenue: $0.2 million for 2024 from the Kurin Agreement.

- Total Revenue from Kurin Agreement: Over $20 million received to date, with potential for up to $155 million in additional milestone payments.

- Research and Development Expenses: $54.4 million for the year ended 2024.

- General and Administrative Expenses: $13.8 million for the year ended 2024.

- Cash Runway: Expected to fund operations through one year following the phase 3 FSOfi readout.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- aTyr Pharma Inc (ATYR, Financial) completed enrollment in their global pivotal phase three Esofi study for pulmonary sarcoidosis, marking it as the largest interventional study conducted in this indication.

- The company reported four positive Data and Safety Monitoring Board (DSMB) reviews for the Esofi study, with no safety concerns identified, reinforcing the favorable safety profile of their lead candidate, epsofitamo.

- aTyr Pharma Inc (ATYR) has published a manuscript in Science Translational Medicine, validating the mechanism of action of epsofitamo and reinforcing its potential application in chronic inflammatory conditions.

- The company has a strong cash position, ending 2024 with $75.1 million and raising an additional $18.8 million through an ATM offering, ensuring a cash runway sufficient to fund operations through a year following the phase 3 readout.

- aTyr Pharma Inc (ATYR) has identified a potentially larger market opportunity for epsofitamo in sarcoidosis, with updated research supporting a significant portion of the estimated $2 to $5 billion global market opportunity for ILD.

Negative Points

- The company faces challenges in enrolling patients in the Expanded Access Program (EAP) due to varying local regulatory requirements across different countries.

- There is uncertainty regarding the percentage of trial patients transitioning to the EAP, as not all regions can participate, complicating the assessment of patient interest and drug efficacy.

- The company has not yet analyzed the phase 1/2 trial data using the new endpoint definition, leaving some uncertainty about the potential impact of the statistical analysis plan change.

- aTyr Pharma Inc (ATYR) is competing in a market with large pharmaceutical players, which could pose challenges in terms of market penetration and competition.

- The company is still in the process of exploring the potential of their pipeline candidates, AIR 0101 and AIR 0750, which are in pre-clinical stages, indicating a longer timeline before these candidates can contribute to revenue.