Amicus Therapeutics (FOLD, Financial) has unveiled a publication detailing a post-hoc analysis from the PROPEL study, focusing on adults with late-onset Pompe disease. This analysis, published in "Muscle and Nerve," evaluates the effects of transitioning from alglucosidase alfa to a combination therapy of cipaglucosidase alfa-atga with miglustat. Of the participants, 77% were previously on enzyme replacement therapy (ERT) with alglucosidase alfa for an average of 7.4 years before entering the study.

The findings highlight that patients who made the switch to cipaglucosidase alfa-atga and miglustat, referred to as cipa+mig, experienced improvements or maintained stability in key health metrics. These metrics included 6-minute walk distance, upper and lower muscle strength, overall manual muscle testing, fatigue levels, and biomarker levels. There were no significant deteriorations observed in any of these categories for those on cipa+mig. In contrast, patients who continued with alglucosidase alfa and a placebo exhibited either stability or worsening across various health outcomes, notably experiencing declines in several lung function metrics, though they did see improvements in dyspnea.

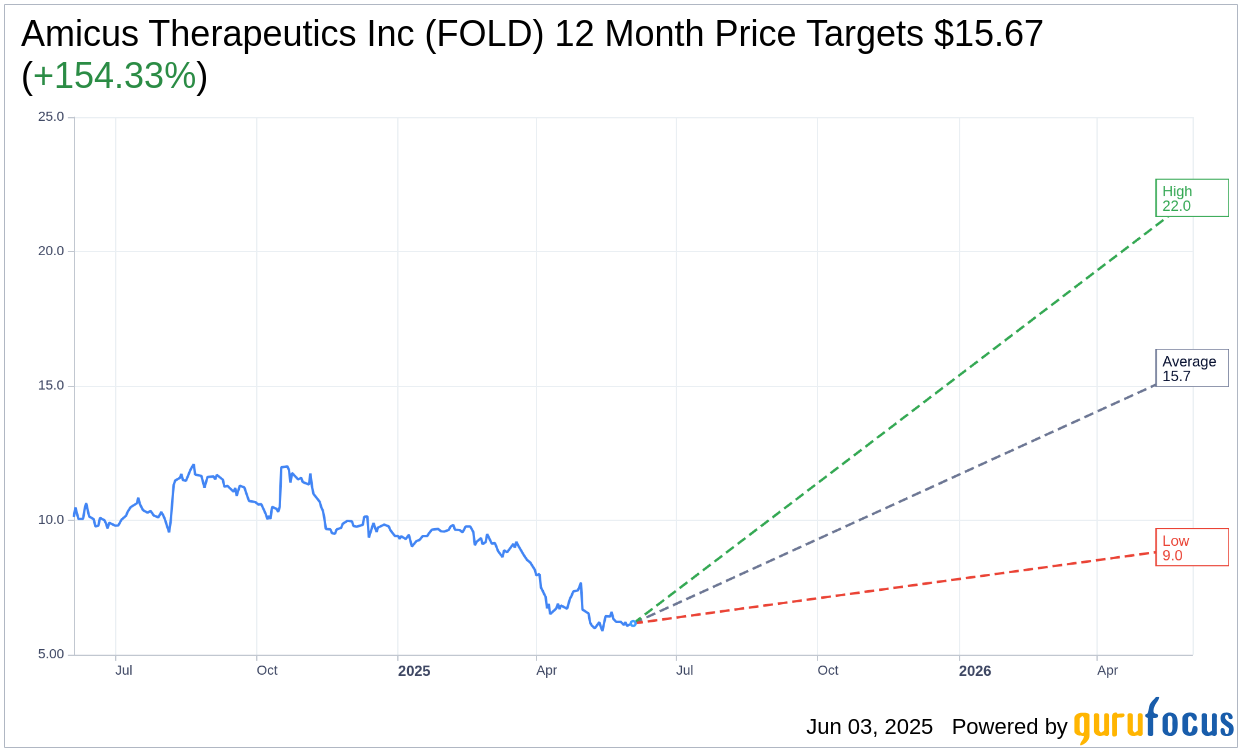

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Amicus Therapeutics Inc (FOLD, Financial) is $15.67 with a high estimate of $22.00 and a low estimate of $9.00. The average target implies an upside of 154.33% from the current price of $6.16. More detailed estimate data can be found on the Amicus Therapeutics Inc (FOLD) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Amicus Therapeutics Inc's (FOLD, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Amicus Therapeutics Inc (FOLD, Financial) in one year is $20.40, suggesting a upside of 231.17% from the current price of $6.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Amicus Therapeutics Inc (FOLD) Summary page.