Ollie's Bargain Outlet Holdings, Inc. (OLLI, Financial) reported first-quarter revenue of $576.767 million, exceeding the market consensus of $565.95 million. The company's CEO, Eric van der Valk, noted the quarter's success was marked by increased store growth along with higher-than-anticipated sales and profits. As consumers prioritize value, OLLI is poised to thrive amidst challenging conditions affecting retailers and suppliers. Their flexible business model provides a competitive edge, enhancing resilience in the current retail landscape.

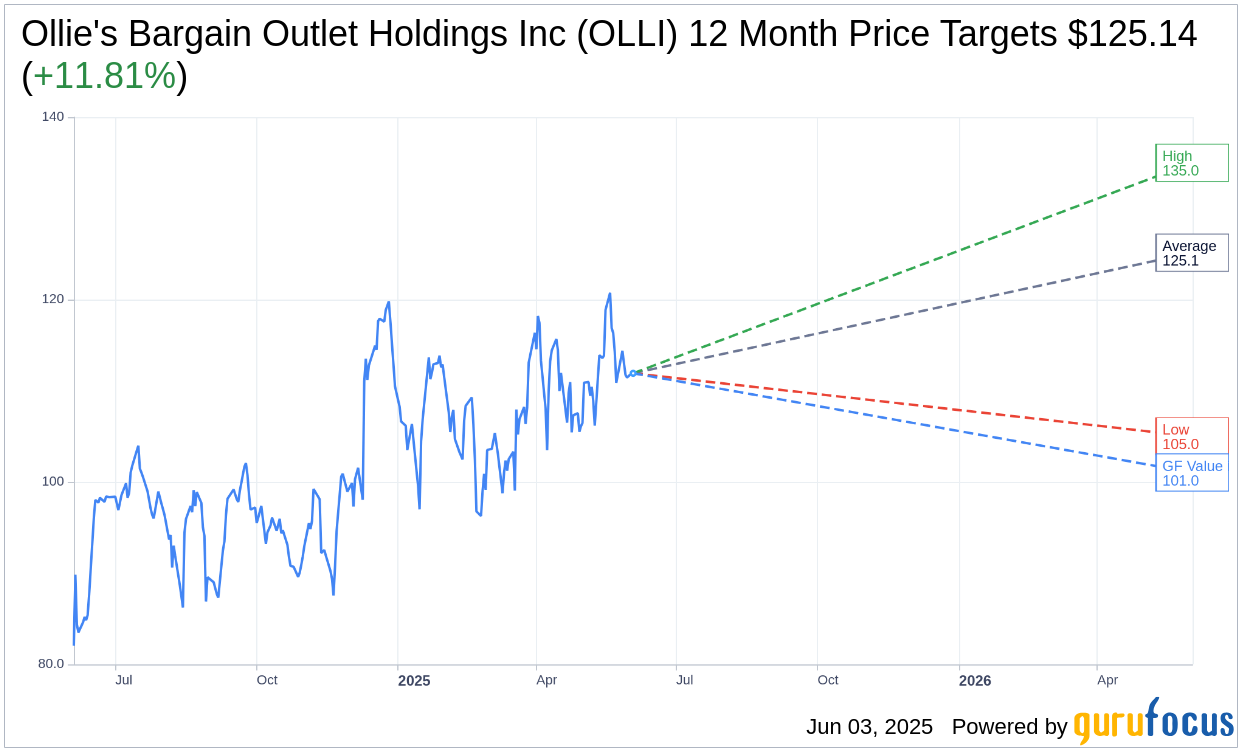

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Ollie's Bargain Outlet Holdings Inc (OLLI, Financial) is $125.14 with a high estimate of $135.00 and a low estimate of $105.00. The average target implies an upside of 11.81% from the current price of $111.92. More detailed estimate data can be found on the Ollie's Bargain Outlet Holdings Inc (OLLI) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Ollie's Bargain Outlet Holdings Inc's (OLLI, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ollie's Bargain Outlet Holdings Inc (OLLI, Financial) in one year is $101.04, suggesting a downside of 9.72% from the current price of $111.92. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ollie's Bargain Outlet Holdings Inc (OLLI) Summary page.

OLLI Key Business Developments

Release Date: March 19, 2025

- Net Sales: Increased 3% to $667 million.

- Comparable Store Sales Growth: Increased 2.8%.

- Gross Margin: Increased 20 basis points to 40.7%.

- Adjusted Net Income: $73 million.

- Adjusted Earnings Per Share: $1.19.

- Adjusted EBITDA: $109 million with a margin of 16.4%.

- Cash and Short Term Investments: $429 million.

- Store Count: Ended the quarter with 559 stores, a 9% increase year-over-year.

- New Store Openings: 13 new stores in the quarter, 50 for the fiscal year.

- Ollie's Army Members: Increased over 8% to over 15.1 million members.

- Capital Expenditures: $24 million for the quarter.

- Inventory Increase: 9% year-over-year.

- SG&A Expenses: $170 million, including a one-time expense of $5.5 million.

- Pre-Opening Expenses: $5 million in the quarter.

- Fiscal 2025 Guidance: 75 new store openings, net sales of $2.564 billion to $2.586 billion, comparable store sales growth of 1% to 2%, and adjusted net income per diluted share of $3.65 to $3.75.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ollie's Bargain Outlet Holdings Inc (OLLI, Financial) reported a 2.8% increase in comparable store sales for the fourth quarter, aligning with expectations.

- The company successfully acquired 40 additional store leases from former Big Lots locations, which are expected to generate long-term profitability due to below-market rents and long-term leases.

- Ollie's army membership grew by over 8% to 15.1 million members, with sales to members representing over 80% of total sales.

- The company ended the quarter with a strong balance sheet, holding $429 million in cash and short-term investments, and no outstanding borrowings.

- Ollie's announced a new $300 million share buyback program, demonstrating a commitment to returning capital to investors while pursuing growth opportunities.

Negative Points

- The company faced some pressure from unfavorable weather and the liquidation of Big Lots stores, impacting near-term earnings growth.

- There were transitory expenses related to bankruptcy-acquired stores and accelerated growth, which put pressure on near-term earnings.

- The first quarter of fiscal 2025 got off to a sluggish start, with challenges such as weather, Big Lots store closures, and delayed tax refunds.

- Big ticket items have been softer, and there is ongoing pressure from tariffs creating uncertainty across the retail landscape.

- The company anticipates higher pre-opening expenses due to the acquisition of Big Lots locations, which will impact earnings in the short term.