Truist has increased its price target for DigitalBridge (DBRG, Financial) from $13 to $15 while maintaining a Buy rating for the stock. This adjustment comes as part of a broader evaluation of real estate investment trusts (REITs). The firm's analysts have revised their model in light of DigitalBridge's first-quarter performance, incorporating updated projections for revenue growth and expense expectations. These changes reflect the analyst's confidence in DigitalBridge's financial outlook.

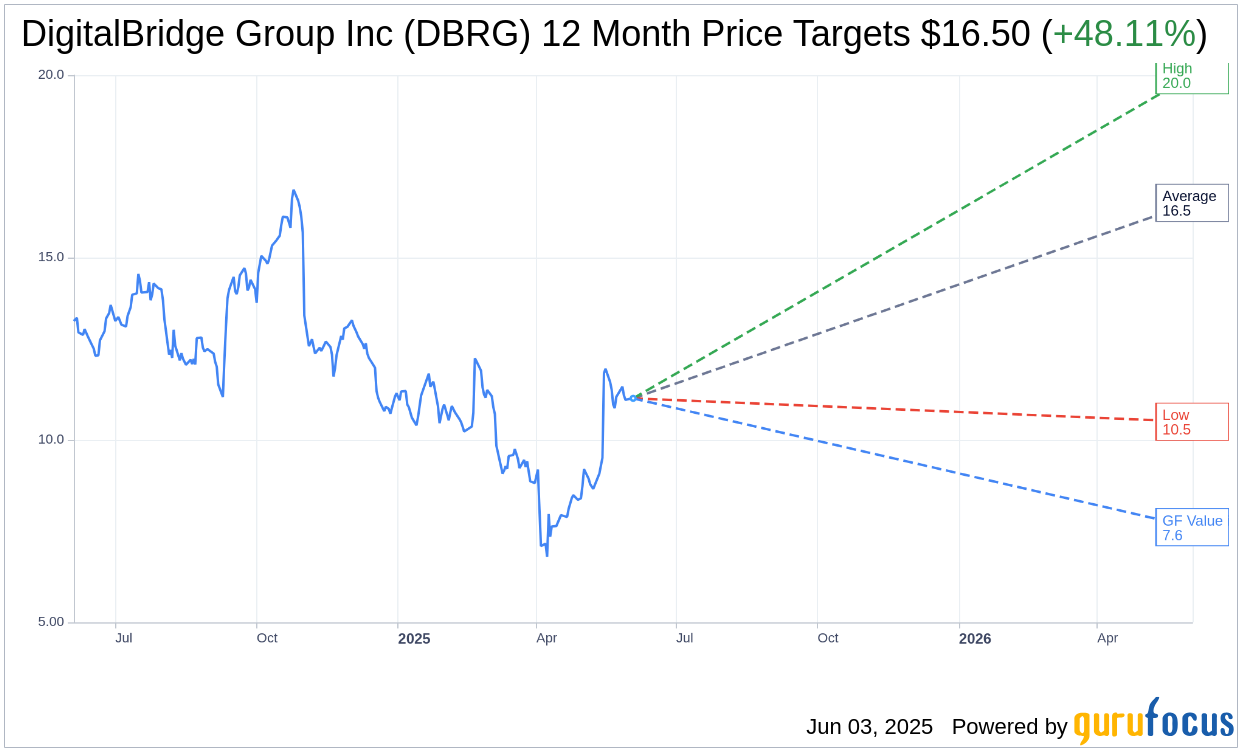

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for DigitalBridge Group Inc (DBRG, Financial) is $16.50 with a high estimate of $20.00 and a low estimate of $10.50. The average target implies an upside of 48.11% from the current price of $11.14. More detailed estimate data can be found on the DigitalBridge Group Inc (DBRG) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, DigitalBridge Group Inc's (DBRG, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for DigitalBridge Group Inc (DBRG, Financial) in one year is $7.61, suggesting a downside of 31.69% from the current price of $11.14. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the DigitalBridge Group Inc (DBRG) Summary page.

DBRG Key Business Developments

Release Date: May 01, 2025

- Fee Revenue: $90 million, a 24% increase over Q1 2024.

- FRE (Fee-Related Earnings): $35 million, up almost 80% year over year.

- Distributable Earnings: $55 million, including a $34 million gain from partial realization of Databank investment.

- Available Corporate Cash: $201 million.

- Fee Earning Equity Under Management (FEEUM): $37.3 billion as of March 31, 2025, a 15% increase from last year.

- Fundraising: $1.2 billion raised in Q1, with $6.3 billion in the third flagship fund as of March 31st.

- FRE Margin: 39% in Q1, benefiting from catch-up fees.

- Principal Investment Income: $5 million.

- Corporate Assets: Approximately $1.5 billion.

- Debt Facility Transaction: $500 million debt facility at Aloe Fiber.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- DigitalBridge Group Inc (DBRG, Financial) delivered strong financial performance with solid revenue and earnings growth in the first quarter, including fee revenues of $90 million and FRE of $35 million, up almost 80% year over year.

- The company successfully raised $1.2 billion in the quarter, primarily through commitments to its flagship DigitalBridge partner strategy.

- DigitalBridge Group Inc (DBRG) supported ZAO's $4.5 billion acquisition of Crown Castle's fiber business, an accretive transaction that lowers the effective entry multiple and positions the company for improved returns.

- The company has a robust pipeline of $13 billion in new loan origination opportunities, indicating strong future growth potential in its private credit business.

- DigitalBridge Group Inc (DBRG) maintains a strong balance sheet with approximately $1.5 billion of corporate assets and no debt maturities within the next 12 months, providing material liquidity and flexibility.

Negative Points

- Some final fundraising decisions are being delayed by LPs due to uncertain market conditions, which could impact the timing of capital deployment.

- The company experienced a $5 million reversal of carried interest during the quarter due to net increases in the fair value of portfolio assets coming in slightly below the preferred return hurdle.

- Market volatility and trade tariff policies are impacting the business environment, potentially affecting new business and incremental CapEx at the portfolio company level.

- There is a significant amount of committed capital that has not yet commenced generating management fees, which could delay revenue recognition.

- DigitalBridge Group Inc (DBRG) trades at a significant discount to its peer group, indicating a potential disconnect between market perception and company performance.