Cognition Therapeutics (CGTX, Financial) has announced that it has received a significant anonymous donation aimed at supporting an expanded access program for individuals suffering from dementia with Lewy bodies (DLB). The contribution comes from a family whose member participated in the Phase 2 SHIMMER study using the drug zervimesine. This program will make it possible for participants to take 100 mg of oral zervimesine daily over the course of approximately one year.

The initiative is set to begin at the Banner Sun Health Research Institute located in Arizona, where David Shprecher, DO Msci, will lead as the primary investigator. This site is the first of eight planned locations for the rollout.

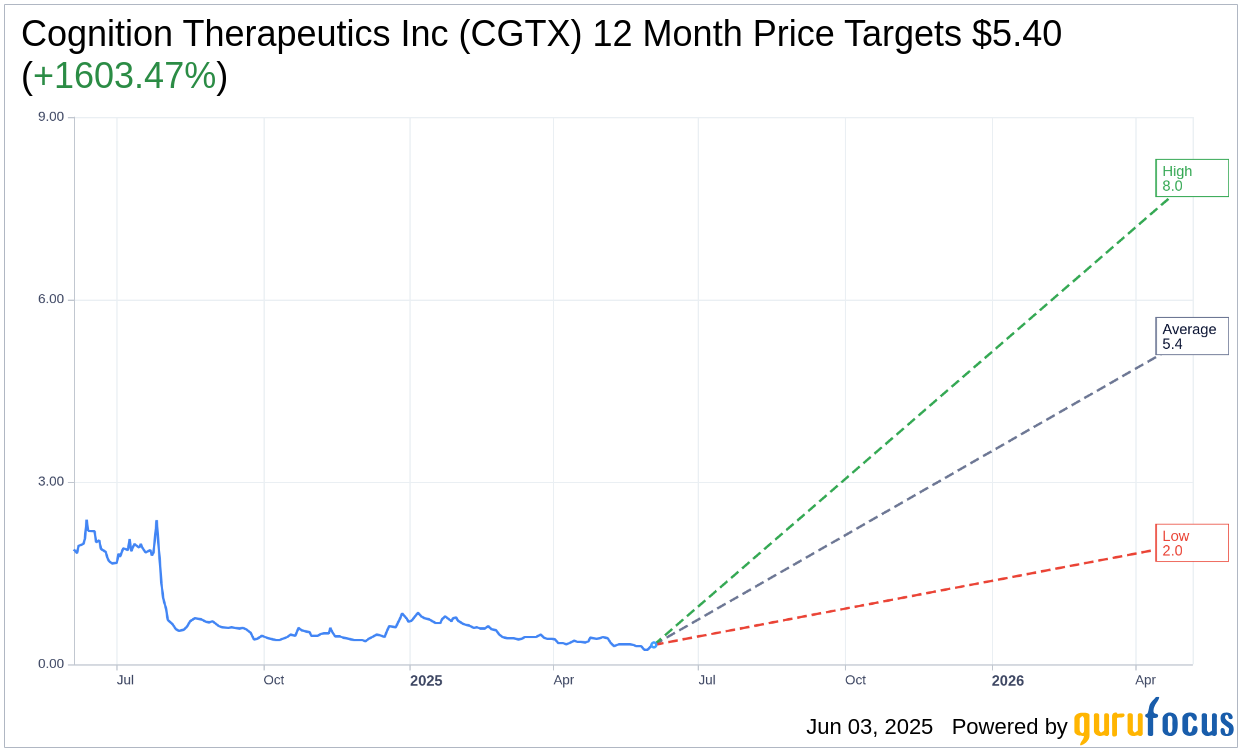

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Cognition Therapeutics Inc (CGTX, Financial) is $5.40 with a high estimate of $8.00 and a low estimate of $2.00. The average target implies an upside of 1,603.47% from the current price of $0.32. More detailed estimate data can be found on the Cognition Therapeutics Inc (CGTX) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Cognition Therapeutics Inc's (CGTX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

CGTX Key Business Developments

Release Date: March 20, 2025

- Cash and Cash Equivalents: Approximately $25 million as of December 31, 2024.

- Total Obligated Grant Funds: $50 million remaining from the NIA.

- Research and Development Expenses: $41.7 million for the year ended December 31, 2024, up from $37.2 million in 2023.

- General and Administrative Expenses: $12.3 million for the year ended December 31, 2024, down from $13.5 million in 2023.

- Net Loss: $34 million or $0.86 per basic and diluted share for the year ending December 31, 2024, compared to a net loss of $25.8 million or $0.86 per share in 2023.

- ATM Facility Proceeds: Sold almost 20 million shares for gross proceeds of approximately $12.8 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cognition Therapeutics Inc (CGTX, Financial) reported strong efficacy signals from studies on zervimesine for Alzheimer's and dementia with Lewy bodies (DLB), indicating potential value for patients and investors.

- The company has strategically prioritized its resources by concluding the dry AMD study, allowing full focus on Alzheimer's and DLB programs.

- Cognition Therapeutics Inc (CGTX) has developed a novel chemical process for manufacturing zervimesine, with provisional patent applications filed, supporting future clinical and commercial needs.

- The company has an active business development program and is exploring partnerships to secure non-dilutive funding for its clinical development efforts.

- Cognition Therapeutics Inc (CGTX) has sufficient cash to fund operations into the fourth quarter of 2025, supported by a $50 million balance in obligated grant funds from the NIA.

Negative Points

- Cognition Therapeutics Inc (CGTX) faces significant capital requirements to fund its Alzheimer's and DLB studies, with no guaranteed partnerships or funding deals confirmed yet.

- The company reported a net loss of $34 million for 2024, an increase from the previous year's loss of $25.8 million.

- Cognition Therapeutics Inc (CGTX) needs to regain compliance with Nasdaq's minimum bid requirement by September 8, 2025, to avoid delisting.

- The decision to conclude the dry AMD study, despite passing a futility analysis, may raise concerns about the company's ability to manage multiple programs simultaneously.

- There is uncertainty around the exact dosing strategy for pivotal studies, as the company has not yet finalized the dose for zervimesine in Alzheimer's and DLB trials.