Wells Fargo has increased its price target for Pennant Group (PNTG, Financial) from $30 to $31 while maintaining an Equal Weight rating for the stock. This adjustment reflects a robust first-quarter performance across various sectors, with notable success in the Home Health & Hospice division. The firm has revised its estimates upwards, influenced by the optimistic guidance commentary and positive updates on the integration of Signature. Wells Fargo's decision highlights their confidence in Pennant Group's ongoing business strategies and execution.

Wall Street Analysts Forecast

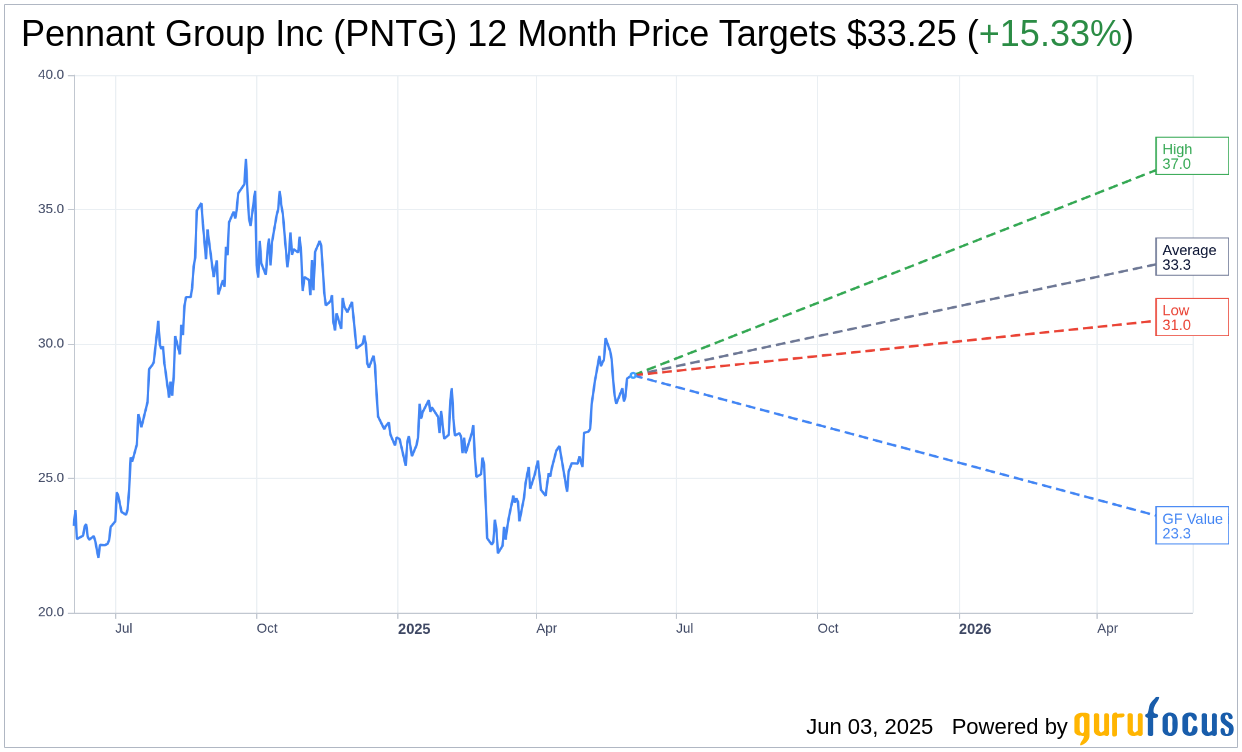

Based on the one-year price targets offered by 4 analysts, the average target price for Pennant Group Inc (PNTG, Financial) is $33.25 with a high estimate of $37.00 and a low estimate of $31.00. The average target implies an upside of 15.33% from the current price of $28.83. More detailed estimate data can be found on the Pennant Group Inc (PNTG) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Pennant Group Inc's (PNTG, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Pennant Group Inc (PNTG, Financial) in one year is $23.25, suggesting a downside of 19.35% from the current price of $28.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Pennant Group Inc (PNTG) Summary page.

PNTG Key Business Developments

Release Date: May 07, 2025

- Revenue: $209.8 million, an increase of $52.9 million or 33.7% over the prior year quarter.

- Consolidated Adjusted EBITDA: $16.4 million, an increase of $5.1 million or 45.9% over the prior year quarter.

- Adjusted Diluted Earnings Per Share: $0.27, an increase of $0.07 or 35% over the prior year quarter.

- Home Health and Hospice Segment Revenue: $159.9 million, up $43.4 million or 37.2% over the prior year quarter.

- Home Health and Hospice Adjusted EBITDA: $25.1 million, an increase of $7.3 million or 40.6% over the prior year quarter.

- Adjusted EBITDA Margin: 15.8%, a 10 basis point improvement.

- Hospice Admissions: 3,783, an increase of 22.8% over the prior year quarter.

- Average Daily Census: 3,794, up 28.1% over the prior year quarter.

- Home Health Total Admissions: 18,878, an increase of 4,229 or 28.9% over the prior year quarter.

- Medicare Admissions: Increased by 19.7% over the prior year quarter.

- Medicare Revenue Per Episode: Increased by 9.3% over the prior year quarter.

- Senior Living Segment Revenue: $50 million, an increase of $9.5 million or 23.6% over the prior year quarter.

- Senior Living Adjusted EBITDA: $4.9 million, an increase of $1.4 million or 40.8% over the prior year quarter.

- Senior Living Segment Adjusted EBITDA Margin: 9.9%, a 120 basis point improvement over the prior year quarter.

- Revenue Per Occupied Room: Increased by 11.3% over the prior year quarter.

- Cash Flow Used in Operations: $21.2 million, a decrease of $21.8 million compared to the prior year quarter.

- Net Debt to Adjusted EBITDA: 0.83 times.

- Cash on Hand: $5.2 million at quarter end.

- Available Funds on Revolver: $193.3 million.

- 2025 Guidance: Revenue of $800 million to $865 million, adjusted EBITDA of $63.1 million to $68.2 million, and adjusted EPS of $1.03 to $1.11.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Pennant Group Inc (PNTG, Financial) reported a record-breaking quarter with revenue of $209.8 million, a 33.7% increase over the prior year.

- Consolidated adjusted EBITDA increased by 45.9% to $16.4 million, showcasing strong financial performance.

- The Home Health and Hospice segment delivered a record-setting quarter with a 37.2% increase in revenue and a 40.6% rise in adjusted EBITDA.

- The company successfully integrated 36 new operations since January 2024, with many acquisitions performing above initial expectations.

- Pennant Group Inc (PNTG) is trending towards the upper end of its 2025 guidance, indicating strong business momentum and confidence in future performance.

Negative Points

- Operating cash flow decreased by $21.8 million compared to the prior year quarter due to significant acquisitions and transition-related payment reconciliation processes.

- The company experienced elevated labor cost inflation, particularly in the senior living segment, with labor inflation just under 5%.

- First quarter operating cash flows were impacted by annual incentive payouts and payroll accrual timing, affecting cash flow expectations.

- Despite strong revenue growth, occupancy in the senior living segment remained flat, indicating potential challenges in increasing occupancy rates.

- Economic uncertainties and macroeconomic conditions could impact future performance, particularly in the senior living business where residents are often on fixed incomes.