Enlight Renewable Energy (ENLT, Financial) has finalized financing deals amounting to around $310 million to enhance the Gecama Project in Spain. This project involves integrating a solar array and a large-scale energy storage system with the existing operations at the Gecama facility, which is Spain's largest wind farm boasting 329 MW capacity. The new hybrid facility will have a total capacity of 554 MW and 220 MWh, offering round-the-clock clean energy at a cost-effective rate, thus promising high returns.

By combining diverse technology profiles and utilizing an advanced battery system, the project optimizes energy resource use. Once finished, it is poised to become Spain’s largest renewable energy complex and significantly boost energy storage capabilities, aligning with national objectives to tackle climate change and enhance energy reliability. Following power outages in April, such advancements are crucial. The hybrid project is set to become operational by late 2026, with expected revenue increases of $38-40 million and EBITDA of $31-33 million in its first year.

The financing includes two tranches at a fixed ~5.1% interest rate, covering wind project refinancing and hybrid construction, fully amortizing by 2045 and 2046. Over $150 million of secured debt will fund hybrid project construction, estimated at $195-205 million, with the rest covered by equity.

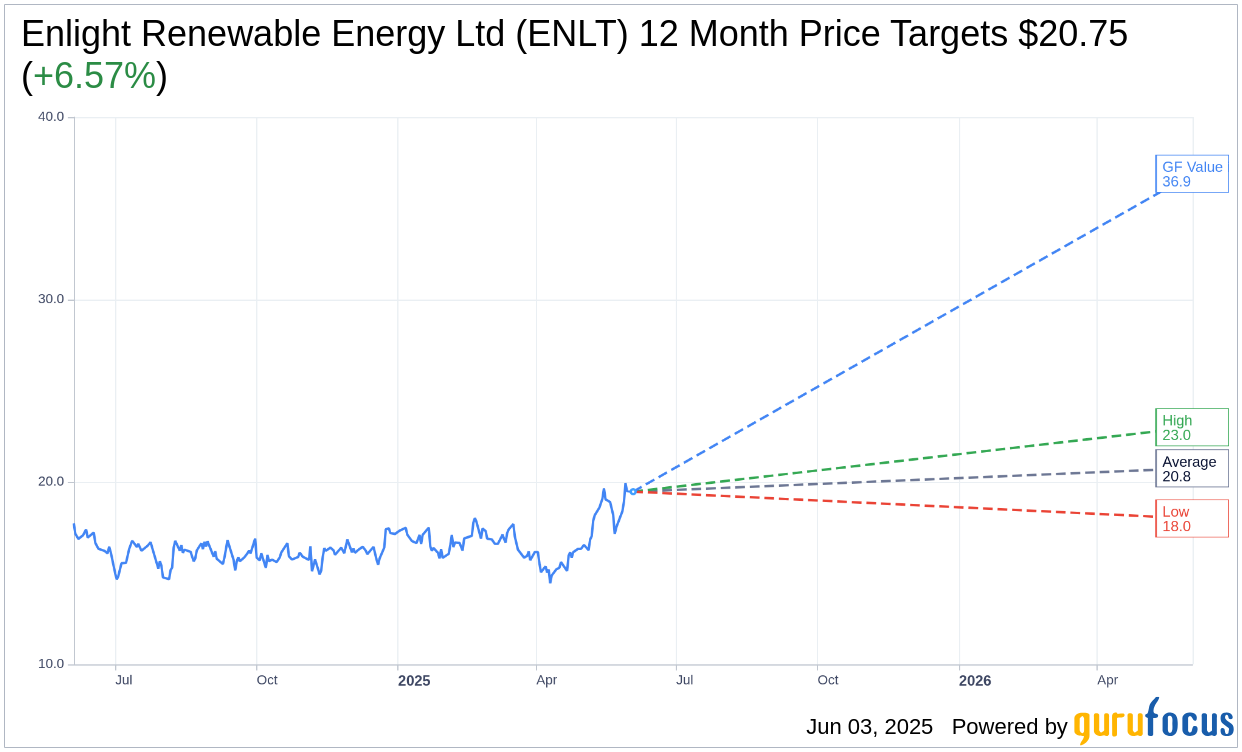

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Enlight Renewable Energy Ltd (ENLT, Financial) is $20.75 with a high estimate of $23.00 and a low estimate of $18.00. The average target implies an upside of 6.57% from the current price of $19.47. More detailed estimate data can be found on the Enlight Renewable Energy Ltd (ENLT) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Enlight Renewable Energy Ltd's (ENLT, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Enlight Renewable Energy Ltd (ENLT, Financial) in one year is $36.90, suggesting a upside of 89.52% from the current price of $19.47. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Enlight Renewable Energy Ltd (ENLT) Summary page.

ENLT Key Business Developments

Release Date: May 06, 2025

- Revenue: Increased by 39% year-over-year to $130 million.

- Adjusted EBITDA: Grew by 84% to $132 million.

- Net Income: Rose to $102 million, a 316% increase year-over-year.

- Sunlight Transaction: Added $42 million to adjusted EBITDA and $97 million to pretax profit.

- Electricity Sales Revenue: Increased by 21% to $110 million.

- Income from Tax Benefit: Recognized $20 million compared to $3 million in the previous year.

- New Projects Contribution: Added $30 million to revenues from electricity sales.

- Financing Raised: Total of $1.8 billion in financing secured for expansion plans.

- 2025 Guidance: Revenue and income expected between $490 million and $510 million; adjusted EBITDA between $360 million and $380 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Revenue and income grew by 39% year-over-year, reaching $130 million.

- Adjusted EBITDA increased by 84% to $132 million, supporting full-year guidance.

- Successful financial close for major projects, raising $1.5 billion in financing at favorable terms.

- Strong progress in US projects with 820 megawatts of generation capacity expected by end of 2026.

- Diversified supply chain strategy mitigates impact of US trade tariffs, ensuring project economics remain stable.

Negative Points

- Lower electricity volumes generated at European wind projects due to weaker wind conditions.

- Blade failure at Bjornbeget project in Sweden resulted in reduced generation volumes.

- Higher operating expenses of $70 million and net financial expenses of $10 million impacted net income.

- 20% of battery storage sourced from China, posing potential tariff risks despite mitigation strategies.

- Uncertainty in US trade policies and tariffs could impact future project costs and returns.