- Algonquin Power & Utilities shares soared 11.3% after revealing its 2025-2027 financial outlook, signaling strong future growth potential.

- The company's financial strategy includes a $2.5 billion investment in utility infrastructure, aiming for enhanced returns and efficiency.

- Analysts offer a "Hold" recommendation, with price targets indicating slight downside from the current stock price.

Algonquin Power & Utilities Corp (AQN, Financial) recently experienced a significant 11.3% uptick in its stock price, following the announcement of its ambitious financial projections for 2025-2027. The company anticipates a noteworthy boost in earnings, expecting adjusted earnings per share (EPS) to rise to a range of $0.42-$0.46 by 2027. As part of its strategic plan, Algonquin aims to invest $2.5 billion in utility projects which are expected to drive better equity returns and enhance operational efficiencies.

Wall Street Analysts' Insights

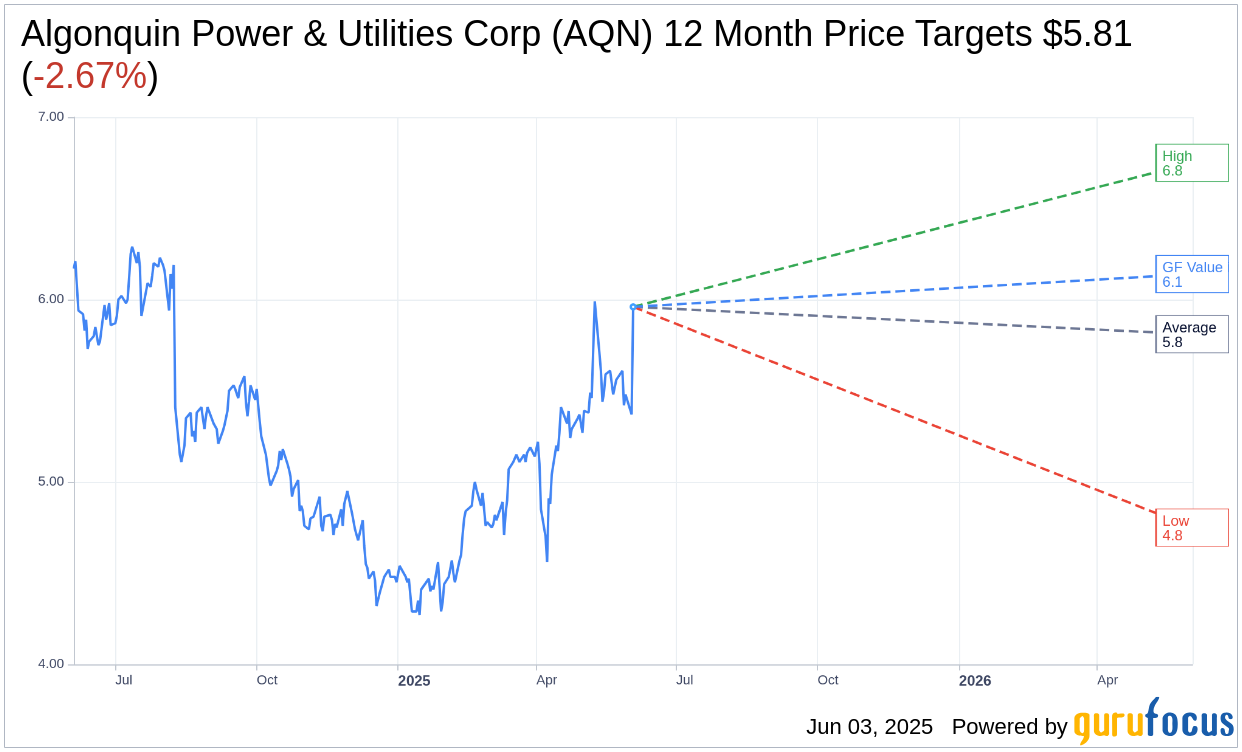

Wall Street's analysts have set a one-year average price target of $5.81 for Algonquin Power & Utilities Corp (AQN, Financial). This target spans from a high of $6.75 to a low of $4.75, implying a modest downside potential of 2.67% from the current trading price of $5.97. Investors seeking a deeper dive into these projections can explore the Algonquin Power & Utilities Corp (AQN) Forecast page for detailed data.

The consensus among 10 brokerage firms results in an average recommendation of 2.9 out of 5 for AQN, suggesting a "Hold" position. The evaluation is structured on a scale where 1 indicates a Strong Buy, and 5 signifies a Sell recommendation.

GuruFocus Valuation Metrics

According to GuruFocus, the estimated GF Value for Algonquin Power & Utilities Corp (AQN, Financial) for the upcoming year stands at $6.14, which suggests an upside potential of 2.93% from its current stock price of $5.965. The GF Value is a sophisticated measure that assesses the stock's fair value by considering historical trading multiples, past growth rates, and future performance projections. For further insights, visit the Algonquin Power & Utilities Corp (AQN) Summary page.