Key Insights:

- Kroger's shares dip amid renewed interest in tech stocks.

- Analysts forecast a moderate upside for Kroger based on current price targets.

- Despite market volatility, consumer staples may offer stability.

Kroger (KR, Financial) saw its shares decline by 2% as investors pivoted their focus to the tech sector. This shift was primarily driven by optimistic U.S. economic data and the potential for interest rate cuts. Amid these fluctuations, some analysts still view consumer staples, like Kroger, as a safe haven in times of trade uncertainties, providing a buffer against market turbulence.

Wall Street Analysts Forecast

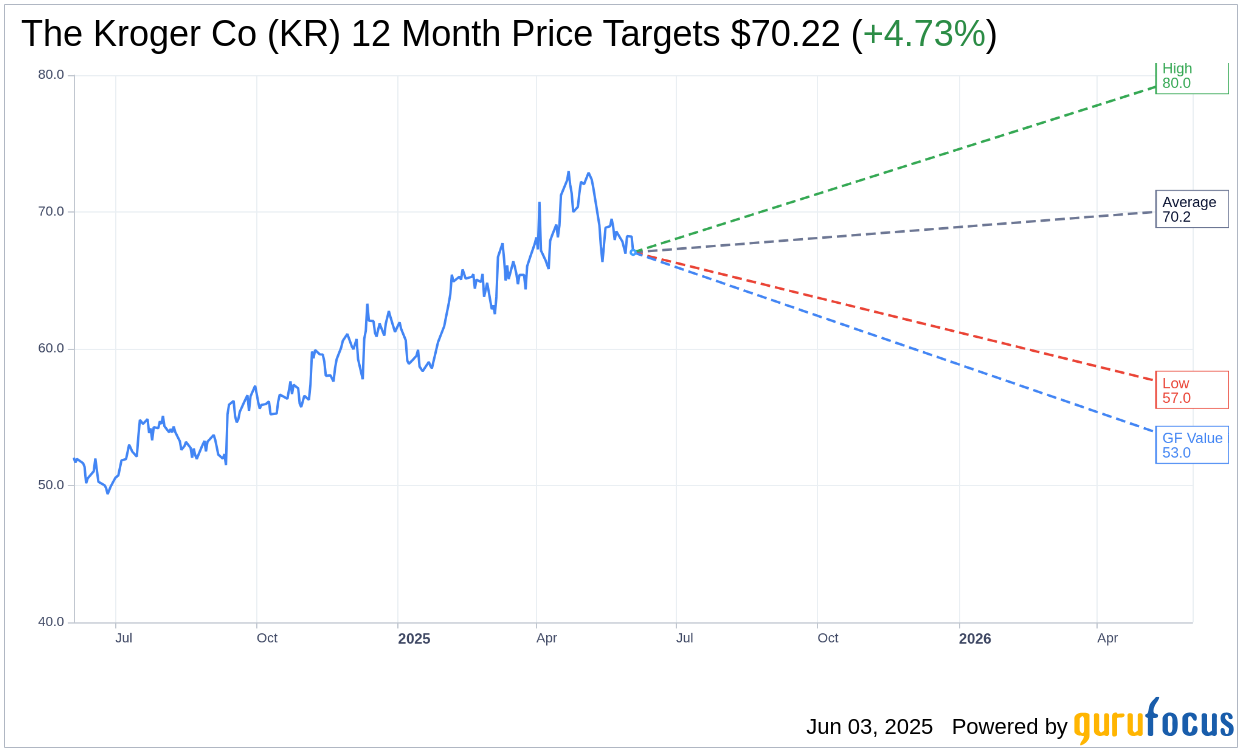

According to projections from 19 analysts, Kroger Co (KR, Financial) has an average price target of $70.22 over the next year. The predictions range from a high of $80.00 to a low of $57.00. This average target hints at a potential upside of 4.73% from the current trading price of $67.05. Investors can find more detailed forecasts on the The Kroger Co (KR) Forecast page.

The consensus from 25 brokerage firms positions Kroger Co's (KR, Financial) average brokerage recommendation at 2.3, which aligns with an "Outperform" rating. The scale used ranges from 1 to 5, with 1 indicating a Strong Buy and 5 indicating a Sell.

GuruFocus provides an estimated GF Value for Kroger Co (KR, Financial) at $52.98, suggesting a downside of 20.98% from its current price of $67.05. The GF Value represents GuruFocus' fair value estimate, derived from historical trading multiples, past business growth, and future business performance estimates. More comprehensive details are available on the The Kroger Co (KR) Summary page.