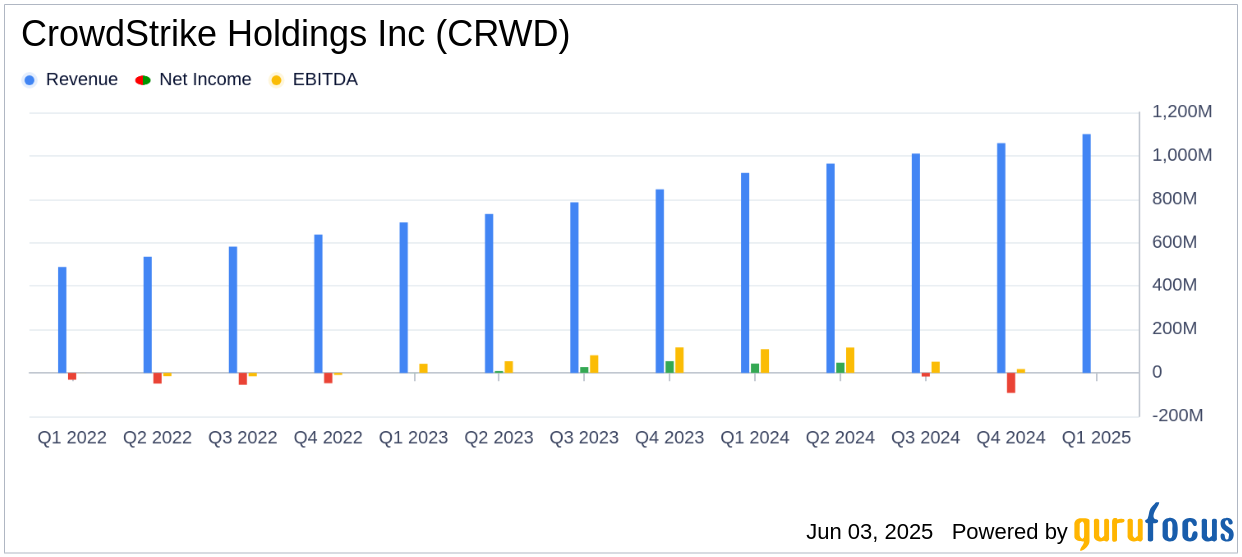

On June 3, 2025, CrowdStrike Holdings Inc (CRWD, Financial) released its 8-K filing for the first quarter of fiscal year 2026, ending April 30, 2025. CrowdStrike, a Texas-based cloud-based cybersecurity company, specializes in next-generation security solutions, including its flagship Falcon platform. The company reported a total revenue of $1.10 billion, aligning with analyst estimates, but posted a GAAP net loss per share of $0.44, missing the estimated earnings per share of -$0.33.

Performance and Challenges

CrowdStrike's revenue for the quarter increased by 20% year-over-year, reaching $1.10 billion, driven by strong subscription revenue growth. However, the company faced operational challenges, reporting a GAAP loss from operations of $124.7 million, a significant decline from the GAAP income of $6.9 million in the same quarter last year. This operational loss highlights the company's struggle to manage costs amidst rapid growth and increased competition in the cybersecurity sector.

Financial Achievements

Despite the operational challenges, CrowdStrike achieved several financial milestones. The company reported a record cash flow from operations of $384 million and robust free cash flow of $279 million. These achievements underscore CrowdStrike's ability to generate cash, which is crucial for sustaining growth and investing in innovation within the competitive software industry.

Key Financial Metrics

In terms of key financial metrics, CrowdStrike's Annual Recurring Revenue (ARR) grew by 22% year-over-year to $4.44 billion, with $193.8 million in net new ARR added during the quarter. The company's GAAP subscription gross margin was 77%, slightly down from 78% in the previous year, while the non-GAAP subscription gross margin was 80%, compared to 81% last year. These metrics are vital as they reflect the company's ability to retain and expand its customer base, a critical factor for long-term success in the cybersecurity industry.

Commentary and Strategic Initiatives

We started the fiscal year with record Q1 large deal and MSSP momentum alongside sustained 97% gross retention and consistently strong net retention as the market consolidates on Falcon as its cybersecurity platform of choice for the agentic AI era," said George Kurtz, Founder and CEO.

CrowdStrike's strategic initiatives include the announcement of a $1 billion share repurchase authorization, reflecting confidence in its future prospects. The company also highlighted its Falcon Flex deal momentum, which is expected to drive net new ARR re-acceleration and margin expansion in the second half of fiscal year 2026.

Income Statement Highlights

| Metric | Q1 FY2026 | Q1 FY2025 |

|---|---|---|

| Total Revenue | $1.10 billion | $921.0 million |

| GAAP Loss from Operations | -$124.7 million | $6.9 million (income) |

| GAAP Net Loss | -$110.2 million | $42.8 million (income) |

| GAAP Net Loss per Share | -$0.44 | $0.17 (income) |

Analysis and Outlook

CrowdStrike's performance in Q1 FY2026 reflects both the opportunities and challenges faced by the company. While revenue growth remains strong, the operational losses indicate the need for improved cost management and strategic investments to maintain competitive advantage. The company's focus on expanding its Falcon platform and leveraging AI innovations positions it well for future growth, but execution will be key to overcoming current challenges.

Overall, CrowdStrike's financial results highlight the dynamic nature of the cybersecurity industry, where rapid innovation and strategic agility are essential for success. Investors will be closely watching the company's ability to capitalize on its strong market position and drive sustainable profitability in the coming quarters.

Explore the complete 8-K earnings release (here) from CrowdStrike Holdings Inc for further details.