Bernstein has initiated coverage of Live Nation, trading under the ticker LYV, giving it an Outperform rating. As part of their analysis, they have set a price target of $185. This move indicates a positive outlook on the company's performance and potential growth in the market. Investors may want to consider this information as they evaluate their portfolio strategies involving Live Nation.

Wall Street Analysts Forecast

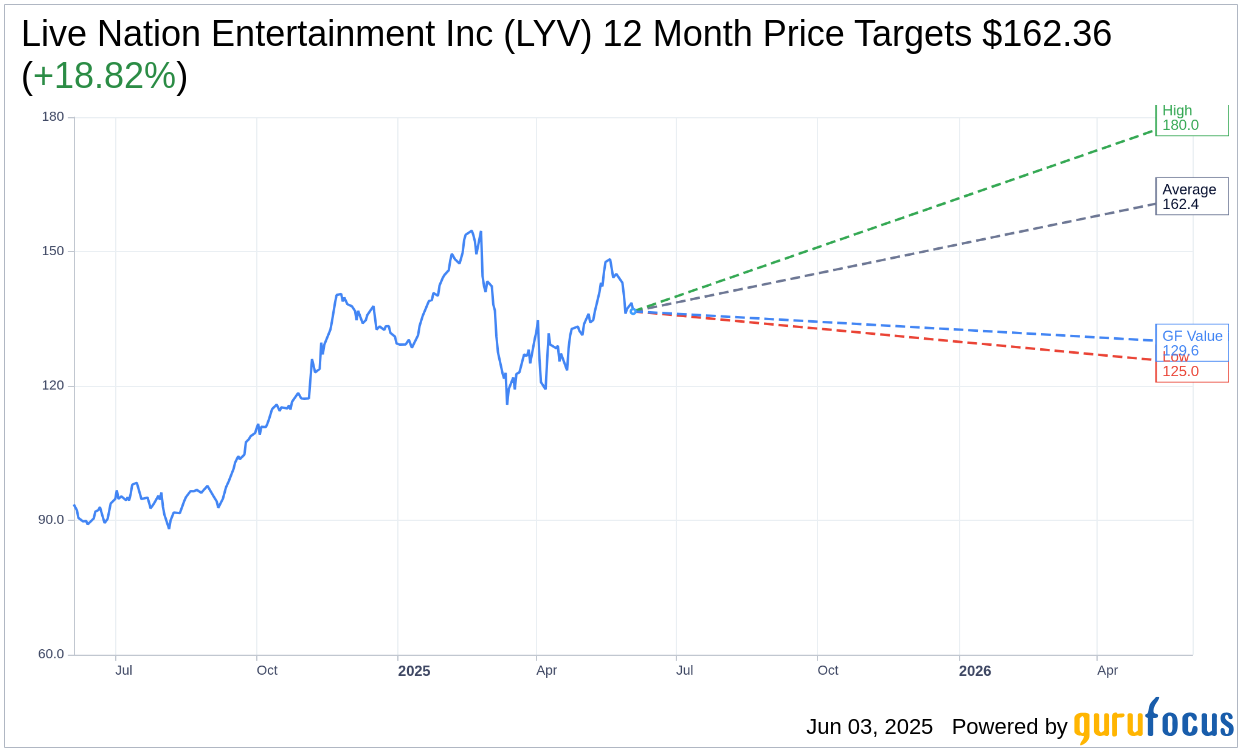

Based on the one-year price targets offered by 20 analysts, the average target price for Live Nation Entertainment Inc (LYV, Financial) is $162.36 with a high estimate of $180.00 and a low estimate of $125.00. The average target implies an upside of 18.82% from the current price of $136.64. More detailed estimate data can be found on the Live Nation Entertainment Inc (LYV) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Live Nation Entertainment Inc's (LYV, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Live Nation Entertainment Inc (LYV, Financial) in one year is $129.64, suggesting a downside of 5.12% from the current price of $136.64. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Live Nation Entertainment Inc (LYV) Summary page.

LYV Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Live Nation Entertainment Inc (LYV, Financial) reported a 12% year-on-year increase in Live Nation concerts through Ticketmaster.

- Deferred revenue for Ticketmaster increased by 13% for the quarter, indicating strong future revenue potential.

- The company is experiencing strong demand for concerts, with significant ticket sales for major artists like Chris Brown and Lady Gaga.

- Live Nation Entertainment Inc (LYV) has secured over 80% of its sponsorship business for the year, showing strong brand partnerships.

- The acquisition of Hayashi in Japan is a strategic move to expand in one of the largest music markets globally.

Negative Points

- Ticketmaster's revenue and AOI were down due to less activity from other promoters and non-concert categories.

- The company is facing foreign exchange headwinds, particularly in Mexico and Latin America, impacting Ticketmaster's short-term reported results.

- There is a later timing of on-sales, with more concert activity expected in the second half of the year, affecting revenue recognition.

- The regulatory environment remains challenging, with ongoing legal processes and potential impacts from the DOJ case.

- The secondary ticketing market is not seen as a growth driver, and the company aims to reduce its reliance on this segment.