Algorhythm's subsidiary, SMCB Solutions Private, has recently entered into four new pilot agreements along with expanding four existing contracts, involving eight large-scale customers across India. These developments will see SemiCab India, under the new and extended agreements, offering advanced enterprise shipping services utilizing its AI-driven, cloud-based Collaborative Transportation Platform.

The combination of acquiring new clients and expanding upon existing contracts significantly enhances SemiCab's digital freight orchestration capabilities, leveraging AI for optimized transport solutions. This strategic move underscores Algorhythm's commitment to expanding its market presence and technological offerings within the region.

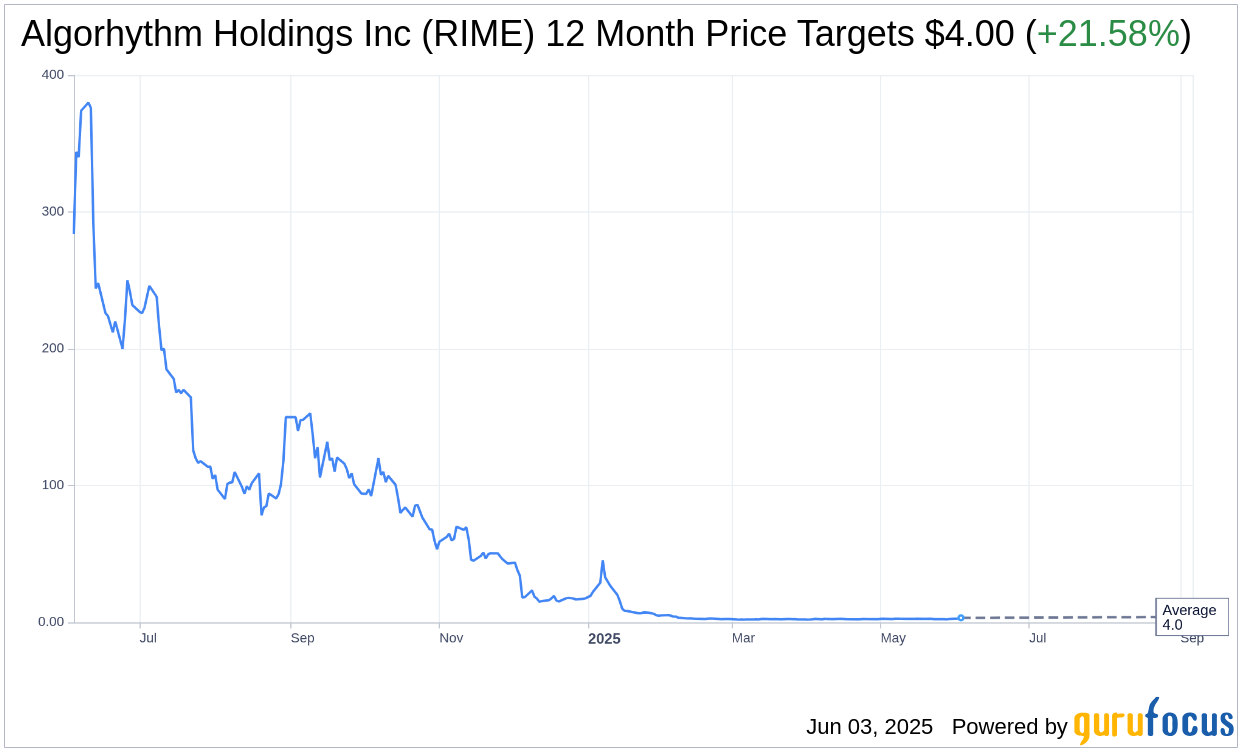

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Algorhythm Holdings Inc (RIME, Financial) is $4.00 with a high estimate of $4.00 and a low estimate of $4.00. The average target implies an upside of 21.58% from the current price of $3.29. More detailed estimate data can be found on the Algorhythm Holdings Inc (RIME) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Algorhythm Holdings Inc's (RIME, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Algorhythm Holdings Inc (RIME, Financial) in one year is $30.03, suggesting a upside of 812.77% from the current price of $3.29. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Algorhythm Holdings Inc (RIME) Summary page.