Key Highlights:

- Guidewire Software (GWRE, Financial) posted robust Q3 earnings, significantly beating Wall Street expectations.

- Projected fiscal year 2025 revenue is set between $1,178 million and $1,186 million.

- Stock experienced a 7.7% uptick post-earnings announcement.

Guidewire Software (GWRE) has reported an impressive performance for the third quarter, with non-GAAP earnings per share at $0.88, exceeding estimates by $0.41. The company achieved a revenue milestone of $293.51 million, marking a 22% year-over-year surge. As we look ahead, Guidewire anticipates an annual recurring revenue (ARR) reaching up to $1,022 million and total revenue for fiscal year 2025 ranging between $1,178 million and $1,186 million. Following these announcements, shares saw a significant 7.7% increase.

Wall Street Analysts Outlook

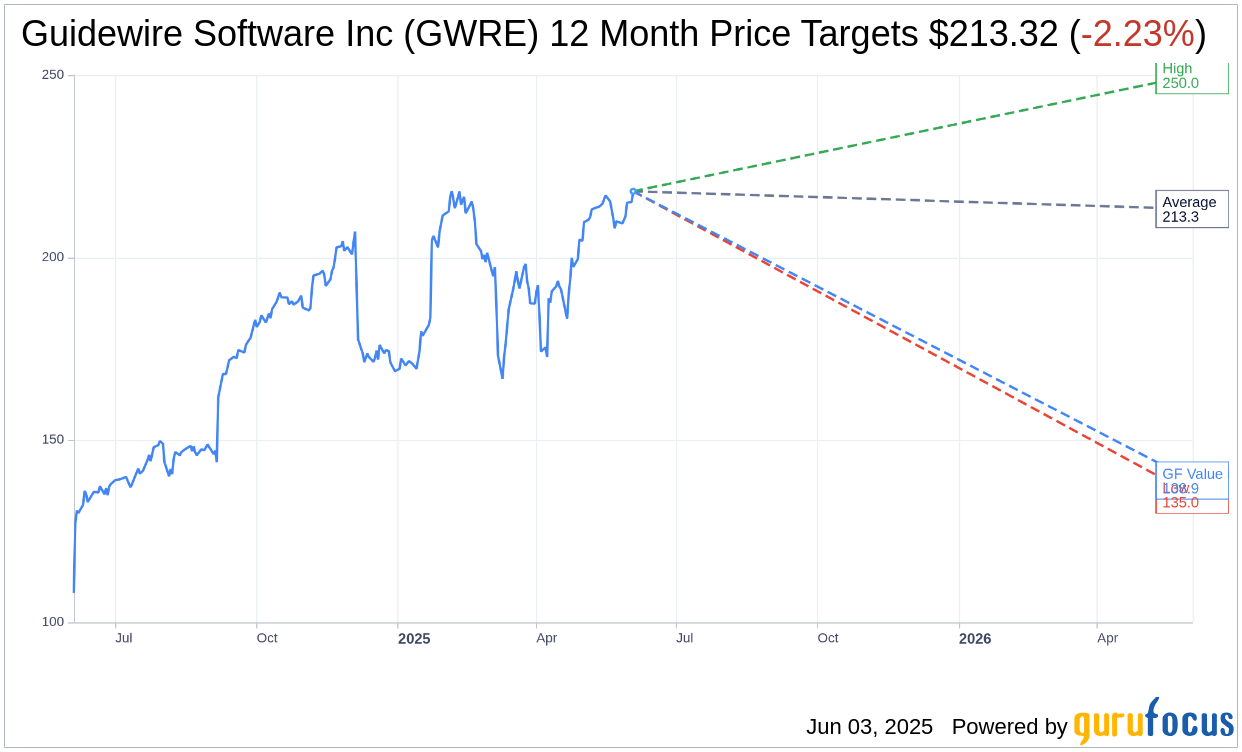

In terms of one-year price targets set by 12 analysts, Guidewire Software Inc (GWRE, Financial) has an average target price of $213.32, with an optimistic high of $250.00 and a more conservative low of $135.00. This average target indicates a potential downside of 2.23% from the current trading price of $218.18. Investors can find more comprehensive price target data on the Guidewire Software Inc (GWRE) Forecast page.

The consensus among 15 brokerage firms places Guidewire Software Inc's (GWRE, Financial) rating at 2.1, categorizing it as "Outperform." The recommendation scale ranges from 1, indicating a Strong Buy, to 5, denoting a Sell.

Moreover, according to GuruFocus estimates, the projected GF Value for Guidewire Software Inc (GWRE, Financial) in one year's time is $138.88. This suggests a potential downside of 36.35% from the current market price of $218.18. The GF Value is a proprietary GuruFocus metric that reflects the fair price at which the stock should trade, based on historical trading multiples, past business growth, and future business performance estimates. For further insight, more detailed data is available on the Guidewire Software Inc (GWRE) Summary page.