Palo Alto Networks (PANW, Financial) recently reported in a regulatory filing that its Chief Technology Officer, Nir Zuk, sold 100,000 shares of the company's common stock. The transaction, dated June 2nd, amounted to a total of $19.3 million.

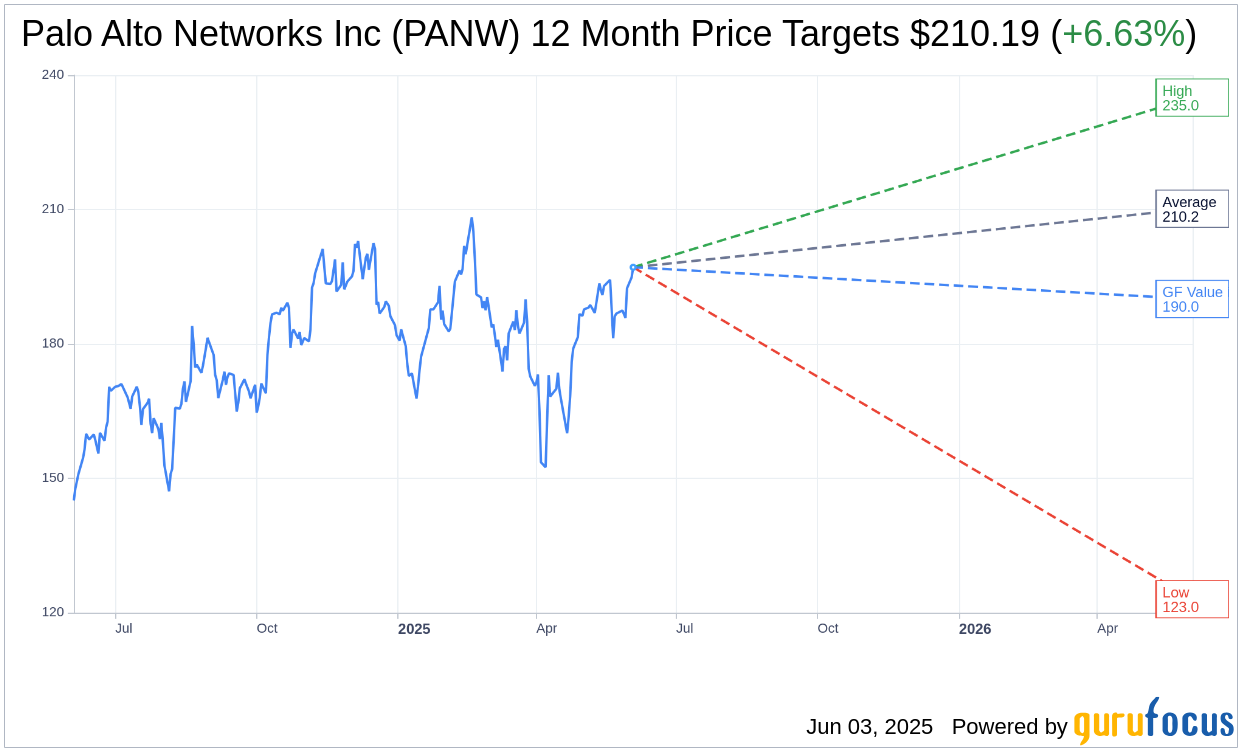

Wall Street Analysts Forecast

Based on the one-year price targets offered by 48 analysts, the average target price for Palo Alto Networks Inc (PANW, Financial) is $210.19 with a high estimate of $235.00 and a low estimate of $123.00. The average target implies an upside of 6.63% from the current price of $197.12. More detailed estimate data can be found on the Palo Alto Networks Inc (PANW) Forecast page.

Based on the consensus recommendation from 55 brokerage firms, Palo Alto Networks Inc's (PANW, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Palo Alto Networks Inc (PANW, Financial) in one year is $190.02, suggesting a downside of 3.6% from the current price of $197.12. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Palo Alto Networks Inc (PANW) Summary page.

PANW Key Business Developments

Release Date: May 20, 2025

- Total Revenue: $2.29 billion, up 15% year-over-year.

- Product Revenue Growth: 16% year-over-year.

- Services Revenue Growth: 15% year-over-year.

- Subscription Revenue Growth: 18% year-over-year.

- Support Revenue Growth: 10% year-over-year.

- Next-Generation Security ARR: $5.09 billion, up 34% year-over-year.

- Free Cash Flow: $578 million in Q3.

- Gross Margin: 76% total; Product gross margin at 78.4%.

- Operating Margin: Year-over-year improvement with 340 basis points leverage.

- Non-GAAP EPS: $0.80 per share.

- GAAP EPS: $0.37 per share.

- Remaining Performance Obligation (RPO): $13.5 billion, up 19% year-over-year.

- Geographic Revenue Growth: Americas 12%, EMEA 20%, JPAC 23%.

- AI ARR: Approximately $400 million, up over 2.5 times year-over-year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Palo Alto Networks Inc (PANW, Financial) achieved a significant milestone by surpassing $5 billion in next-generation security ARR, marking a 34% year-over-year increase.

- The company reported strong growth in its AI-powered XSIAM product, which saw ARR grow over 200% year-over-year, indicating robust demand and market leadership.

- Palo Alto Networks Inc (PANW) demonstrated strong financial performance with total revenue of $2.29 billion, growing 15% year-over-year, and a healthy free cash flow generation of $578 million.

- The company's platformization strategy is gaining traction, with 1,250 platformization deals among its top 5,000 customers, reflecting a 70% growth in customers adopting multiple platforms.

- Palo Alto Networks Inc (PANW) continues to lead in the SASE market, with ARR growing 36% year-over-year, significantly outpacing the overall market growth and expanding its customer base to approximately 6,000.

Negative Points

- Despite strong growth, the platformization deals account for a small percentage of the total customer base, indicating potential challenges in scaling this strategy across all customers.

- The geopolitical tensions and tariff discussions in April created uncertainty, potentially impacting customer decision-making and sales execution.

- The transition from hardware to software firewalls, while beneficial in the long term, may present short-term challenges in managing product revenue growth and customer adoption.

- The rapid evolution of AI technologies poses a challenge in keeping pace with security needs, requiring continuous innovation and adaptation from Palo Alto Networks Inc (PANW).

- The company's reliance on cloud service providers for AI implementations could expose it to risks related to cloud security and integration complexities.