Market Performance Overview

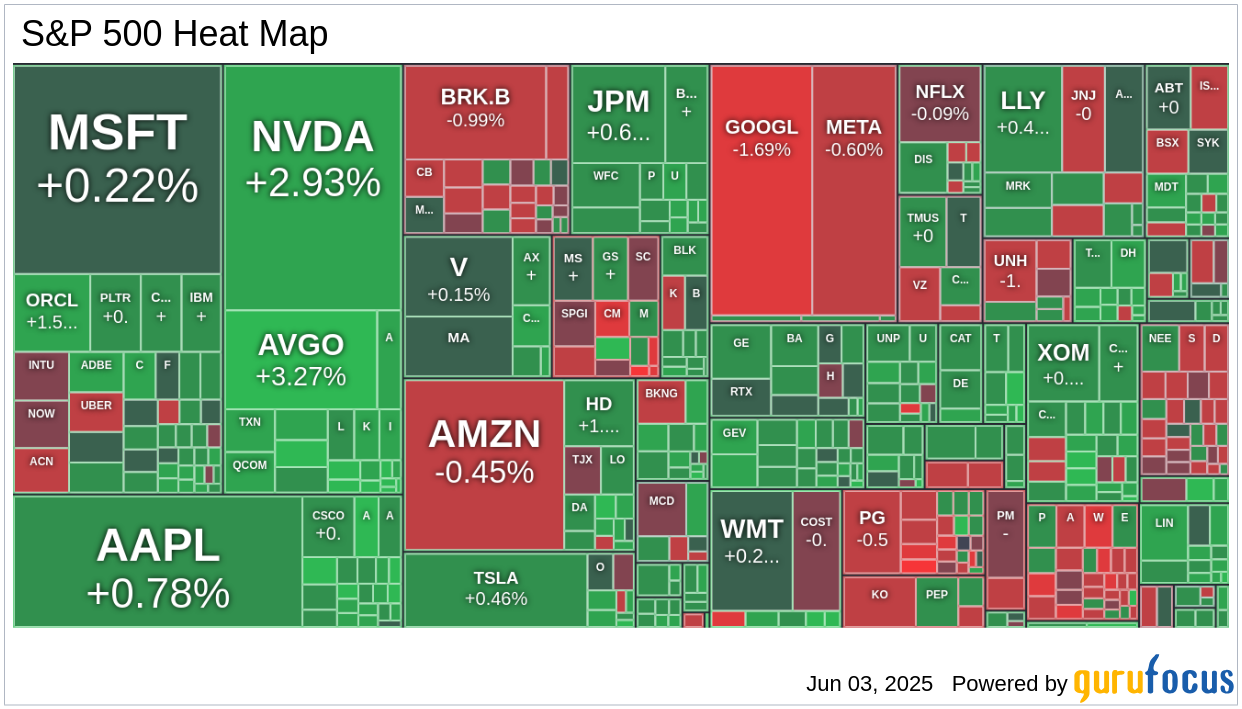

- The stock market gained momentum today, maintaining its upward trend despite Elon Musk's criticism of a budget bill, which he claims will significantly increase the deficit.

- Small-cap, mega-cap, and semiconductor stocks drove the gains, supported by growth optimism and momentum buyers.

- Initial sluggish trading gave way to gains around 10:00 a.m. ET following the April JOLTS - Job Openings Report showing increased job openings.

- The report was taken positively for the labor market despite the OECD's reduced 2025 GDP growth forecasts for global, U.S., and China's sluggish PMI.

Sector Performances

- The information technology sector was the top performer (+1.5%), led by NVIDIA (NVDA) and semiconductor stocks.

- Energy (+1.1%), materials (+1.0%), and industrials (+0.8%) sectors followed, reflecting a pro-cyclical market stance.

- The Russell 2000 rose by 1.6%, driven by its banking and energy stocks.

- Advancers outnumbered decliners by more than 2-to-1 on NYSE and Nasdaq, though trading volumes remained below average.

Treasury and Indices

- Treasury yields saw minor intraday movements, with the 10-year note holding at 4.46% and the 30-year bond at 4.98%, down two basis points.

- Year-to-date, S&P 500 is up 1.5%, Nasdaq +0.5%, DJIA -0.05%, S&P 400 -2.8%, and Russell 2000 -5.7%.

Economic and Global Insights

- U.S. factory orders dropped 3.7% in April, with business spending indicating weakness for the month.

- The April JOLTS report showed 7.391 million job openings, up from March's revised 7.200 million.

- Global indices: DAX +0.6%, FTSE +0.2%, CAC +0.3%, Nikkei -0.1%, Hang Seng +1.5%, Shanghai +0.4%.

- Commodities: Crude Oil +0.84 to $63.41, Nat Gas +0.02 to $3.72, Gold -19.70 to $3377.60, Silver -0.05 to $34.63, Copper -0.03 to $4.83.

NVDA

Stock News

● BASF (OTCQX:BASFY) has initiated the sale of its coatings business, valued at approximately $6.8 billion. The sale process, managed by Bank of America and J.P. Morgan, has attracted interest from major private equity firms, including Carlyle Group (CG, Financial) and Blackstone (BX, Financial). The coatings division, which generated €4.3 billion in revenue in 2024, could become one of the largest European industrial buyouts this year.

● Taiwan Semiconductor Manufacturing Company (TSMC) (TSM, Financial) reported that demand for its AI chips continues to outpace supply, despite potential impacts from U.S. tariffs. TSMC's CEO, Dr. C.C. Wei, emphasized that AI demand remains robust, overshadowing any tariff-related concerns. The company expects its AI-related revenue to double in 2025, maintaining a positive outlook despite geopolitical challenges.

● Elon Musk's xAI Corp. is seeking $5 billion in debt financing to support its AI infrastructure expansion. Morgan Stanley (MS, Financial) is handling the debt issuance, which includes a mix of floating-rate and fixed-rate loans. This move is part of Musk's broader strategy to focus on his business ventures, following a period of political involvement that coincided with a 20% drop in Tesla (TSLA, Financial) shares.

● Constellation Energy (CEG, Financial) surged 13.9% pre-market after announcing a 20-year agreement to supply nuclear power to Meta Platforms (META, Financial). The deal supports the continued operation of Constellation's Clinton nuclear facility in Illinois, expanding its clean energy output by 30 MW. This agreement marks a significant step in meeting the rising power demands driven by artificial intelligence.

● Viper Energy (VNOM, Financial) announced a $4.1 billion all-stock acquisition of Sitio Royalties (STR, Financial), enhancing its production profile and free cash flow growth. The deal, which includes a 10% dividend increase, is expected to be accretive to cash available for distribution immediately after closing. Diamondback Energy (FANG, Financial) will hold a 41% stake in the new entity.

● Credo Technology Group (CRDO, Financial) projects over 85% revenue growth for fiscal 2026, driven by new hyperscaler ramps. The company reported a 180% year-over-year revenue increase in Q4 2025, with significant wins in the DSP market. Credo's expansion into hyperscaler partnerships is expected to sustain its growth trajectory.

● Toyota Motor (TM, Financial) announced a $26 billion take-private offer for Toyota Industries, marking a strategic shift for Japan's largest corporation. The deal involves a tender offer by Toyota Fudosan and includes plans for share repurchases. This move is part of Toyota's broader strategy to consolidate its group companies.

● Microsoft (MSFT, Financial) laid off over 300 employees, following a recent announcement of a 6,000-headcount reduction. The layoffs are part of Microsoft's ongoing organizational changes to adapt to a dynamic market environment. The tech sector has seen significant workforce reductions in 2025, with Microsoft and Intel (INTC, Financial) leading the trend.

● Coinbase (COIN, Financial) is dealing with a data breach linked to an outsourcing firm in India, potentially costing up to $400 million. The breach involved unauthorized access to customer data, leading to the termination of over 200 employees at TaskUs (TASK, Financial). Coinbase has been addressing the security lapse, which affected nearly 70,000 users.

● Pinterest (PINS, Financial) shares rose nearly 5% after J.P. Morgan upgraded its rating to "overweight." The upgrade reflects Pinterest's progress in user growth, monetization, and ad spending capture. J.P. Morgan raised the price target to $40, citing favorable risk/reward dynamics.

● Ferguson Enterprises (FERG, Financial) reported Q3 earnings with a Non-GAAP EPS of $2.50, beating estimates by $0.48. Revenue reached $7.62 billion, exceeding expectations by $190 million. The company updated its 2025 guidance, projecting low to mid-single-digit net sales growth.

● Dollar General (DG, Financial) posted Q1 GAAP EPS of $1.78, surpassing estimates by $0.29, with revenue of $10.44 billion. The retailer's performance was driven by new store openings and same-store sales growth. Dollar General revised its fiscal 2025 guidance, anticipating higher net sales and EPS growth.

● Paramount Global (PARA, Financial) nominated three new directors amid its pending $8.4 billion merger with Skydance Media. The nominations aim to strengthen board governance as the merger faces regulatory reviews and legal challenges. Paramount is also dealing with a lawsuit involving CBS News and former President Donald Trump.

● Sandvik (SDVKY, Financial) completed the acquisition of Verisurf Software, a U.S.-based 3D metrology software provider. The acquisition is expected to have a limited impact on Sandvik's EBITA margin and earnings per share, as it integrates Verisurf into its Machining and Intelligent Manufacturing division.

● Accenture (ACN, Financial) agreed to acquire SIPAL's Integrated Product Support business in Italy, enhancing its engineering services for aerospace and defense clients. The acquisition will add approximately 250 engineering professionals to Accenture's Industry X division, supporting its digital engineering and manufacturing capabilities.

● Hims & Hers Health (HIMS, Financial) announced the acquisition of European digital health platform ZAVA, expanding its presence in the U.K., Germany, France, and Ireland. The acquisition, funded entirely in cash, is expected to be accretive by 2026 and supports Hims & Hers' global expansion strategy.

● FactSet (FDS, Financial) appointed Sanoke Viswanathan as CEO, effective September 2025. Viswanathan, a JPMorgan Chase veteran, will succeed Phil Snow, who will retire but remain as a senior advisor until the end of the year. The leadership transition aims to continue FactSet's growth trajectory.

● Network Media Group (TSXV:NTE:CA) announced the resignation of CFO Darren Battersby, who served since 2014. The company is actively seeking a replacement to fill the CFO position, as it navigates its financial and strategic objectives.

● Semilux International (SELX, Financial) received a Nasdaq non-compliance notice for failing to file its annual report on time. The company has 60 days to submit a compliance plan to Nasdaq, addressing the deficiency and ensuring adherence to listing requirements.

● Bruker Corporation (BRKR, Financial) acquired biocrates life sciences, an Austrian company specializing in metabolomics solutions. The acquisition enhances Bruker's multiomics capabilities, supporting its expansion into instruments, reagents, software, and research services.

GuruFocus Stock Analysis

- Nvidia (NVDA) Extends $1 Trillion Rally as AI Optimism Grows by Faizan Farooque

- UnitedHealth (UNH) Faces Sell Call Amid Margin Squeeze, Regulatory Risks by Faizan Farooque

- Broadcom (AVGO) Gets Citi Price Target Boost Ahead of Q2 Earnings by Faizan Farooque

- Broadcom (AVGO) Nears Record High as AI Optimism Builds Ahead of Earnings by Faizan Farooque

- Semiconductor Revenues to Top $700 Billion Next Year by Moz Farooque