Key Takeaways:

- CrowdStrike bolsters its financial position with significant ARR growth and a robust free cash flow performance.

- Analyst sentiment remains positive with an "Outperform" rating; however, the current price exceeds both average and GF Value estimates.

- A $1 billion share repurchase authorizes potential value return to shareholders.

CrowdStrike (CRWD, Financial) kicked off Q1 2026 with impressive results that underscore its strong market position and future potential. The company reported a substantial increase in net new Annual Recurring Revenue (ARR), adding $194 million to surpass $4.4 billion in total ARR. In addition, CrowdStrike demonstrated its strong cash-generating capabilities with $279 million in free cash flow, representing 25% of its revenue. To further enhance shareholder value, the company has approved a share repurchase program worth $1 billion.

Analyst Price Targets and Recommendations

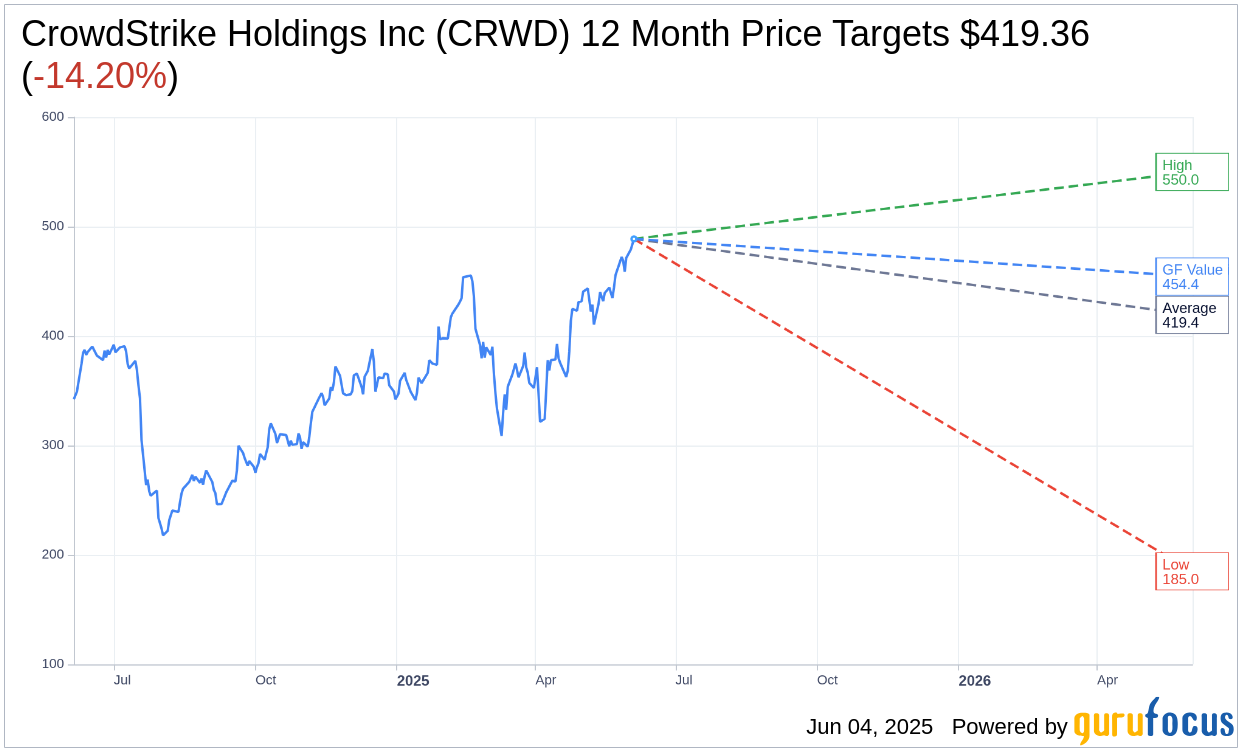

Wall Street analysts have set a one-year average price target for CrowdStrike Holdings Inc (CRWD, Financial) at $419.36. This target, based on assessments from 45 analysts, ranges significantly with a high projection of $550.00 and a low estimate of $185.00. It's important to note that the average target suggests a potential downside of 14.20% from the current trading price of $488.76.

The consensus among 53 brokerage firms places CrowdStrike Holdings Inc on an "Outperform" status, with a current average brokerage recommendation score of 2.1. This recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), indicating a predominantly positive outlook from the analyst community.

For more detailed forecast data, visit the CrowdStrike Holdings Inc (CRWD, Financial) Forecast page.

GF Value and Investment Outlook

According to GuruFocus estimates, CrowdStrike Holdings Inc's estimated GF Value in the next year is $454.39, implying a potential downside of 7.03% from the current market price of $488.76. The GF Value represents GuruFocus's valuation of what the stock's fair trading value should be, derived from historical trading multiples, past business growth, and future performance forecasts.

To explore more detailed valuation metrics and data on CrowdStrike, visit the CrowdStrike Holdings Inc (CRWD, Financial) Summary page.