- Guidewire Software (GWRE, Financial) is setting new benchmarks with its strategic cloud-focused initiatives, eyeing $1 billion ARR by year-end.

- Analysts predict a mixed outlook on GWRE stock with price targets suggesting a potential downside based on current prices.

- GuruFocus metrics indicate a considerable divergence between current trading prices and estimated fair value.

Guidewire Software (GWRE) marked a milestone in its Q3 performance by clinching 17 cloud deals, featuring significant contracts with prominent Tier 1 insurers. The company proudly reported $960 million in annual recurring revenue (ARR) and has set its sights on surpassing the $1 billion ARR threshold by the end of the fiscal year. Key elements of this growth strategy include the expansion of its cloud services footprint in Canada and the Asia-Pacific (APAC) regions, alongside the integration of its newly acquired entity, Quantee.

Wall Street Analysts' Projections

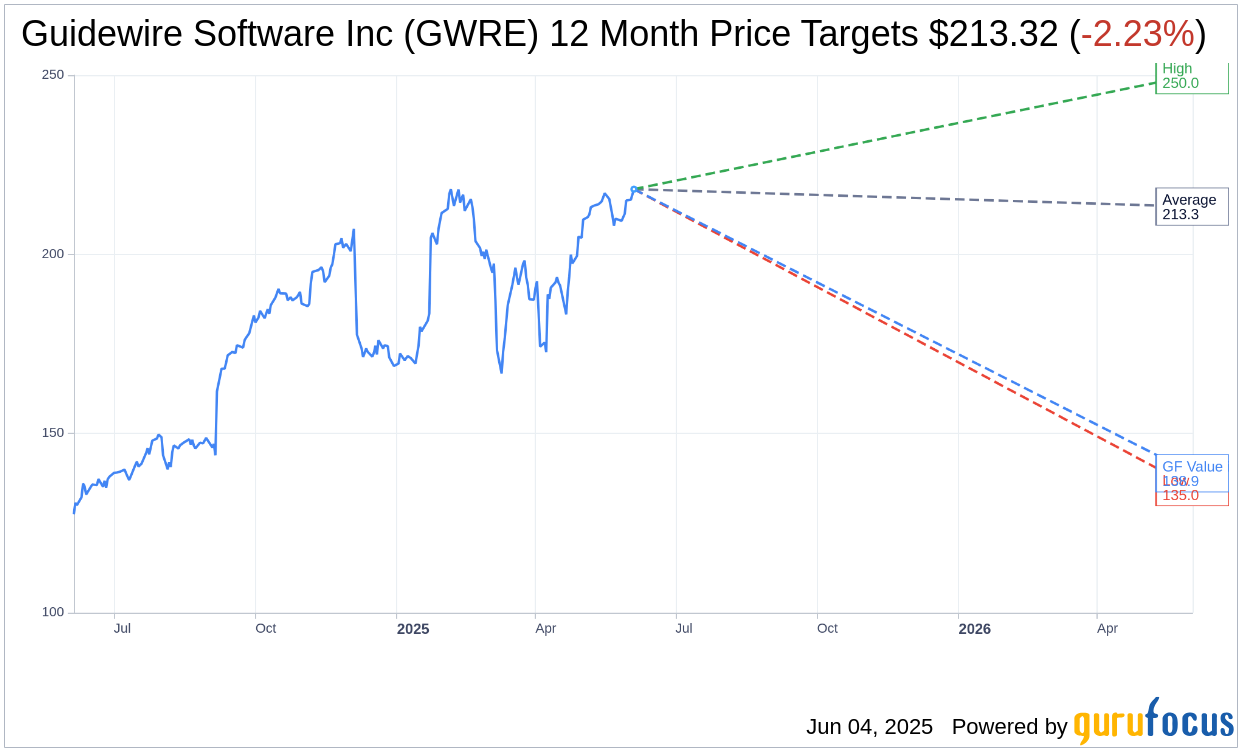

For Guidewire Software Inc (GWRE, Financial), one-year price targets provided by 12 analysts anticipate an average target price of $213.32, with a high estimate reaching $250.00 and a low forecast of $135.00. These projections reflect a potential downside of 2.23% from the current price of $218.18. For more comprehensive estimate data, visit the Guidewire Software Inc (GWRE) Forecast page.

The consensus from 15 brokerage firms assigns Guidewire Software Inc (GWRE, Financial) an average brokerage recommendation of 2.1, demonstrating an "Outperform" status. This rating is part of a spectrum where 1 indicates a Strong Buy and 5 denotes a Sell.

GuruFocus Valuation Metrics

Utilizing GuruFocus' proprietary valuation model, the projected GF Value for Guidewire Software Inc (GWRE, Financial) over the next year stands at $138.88. This suggests a significant downside of 36.35% when compared to the current trading price of $218.18. The GF Value is derived from historical trading multiples, past growth trajectories, and future performance estimates. Detailed data and analysis are accessible on the Guidewire Software Inc (GWRE) Summary page.