UBS has commenced coverage of Graphic Packaging (GPK, Financial) with a neutral rating and set a price target of $24. The investment firm notes that following a prolonged period of capital expenditures, Graphic Packaging is now shifting its focus towards share buybacks. Despite this strategic shift, UBS highlights that the company is currently dealing with reduced demand from its Consumer Packaged Goods and Quick Service Restaurant clientele. These conflicting factors are expected to balance out, potentially offering a 10% upside from present valuations.

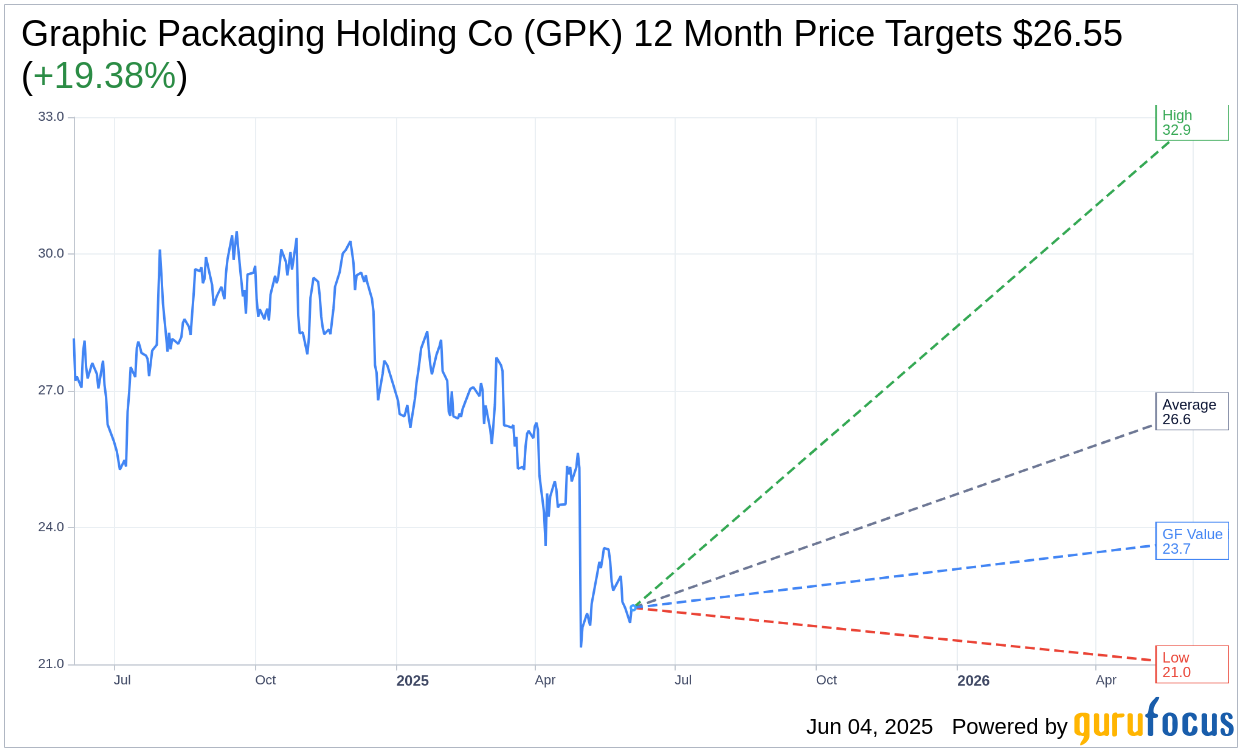

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Graphic Packaging Holding Co (GPK, Financial) is $26.55 with a high estimate of $32.90 and a low estimate of $21.00. The average target implies an upside of 19.38% from the current price of $22.24. More detailed estimate data can be found on the Graphic Packaging Holding Co (GPK) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Graphic Packaging Holding Co's (GPK, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Graphic Packaging Holding Co (GPK, Financial) in one year is $23.71, suggesting a upside of 6.61% from the current price of $22.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Graphic Packaging Holding Co (GPK) Summary page.

GPK Key Business Developments

Release Date: May 01, 2025

- Revenue: $2.1 billion for the first quarter of 2025.

- Adjusted EBITDA: $365 million.

- Margins: 17.2%.

- Adjusted EPS: $0.51.

- Volume in the Americas: Down approximately 1%.

- International Volume Growth: Up approximately 3%.

- Innovation Sales Growth: $44 million for the quarter.

- Net Leverage: 3.5 times at the end of the quarter.

- Capital Spending: Expected to be in the $700 million range for 2025.

- Share Repurchase Authorization: New $1.5 billion authorization approved.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Graphic Packaging Holding Co (GPK, Financial) reported first quarter sales of $2.1 billion, with adjusted EBITDA of $365 million and margins of 17.2%.

- The Waco recycled paperboard investment is on track for a fourth-quarter startup, with hiring and training effectively complete.

- A new $1.5 billion share repurchase authorization was approved, reflecting confidence in the company's future cash flow generation.

- Innovation sales growth was $44 million for the quarter, driven by new contributions in strength packaging, coffee, snacks, and cleaning products.

- The company expects to generate substantial excess cash over the next several years, with a focus on returning capital to stockholders and debt holders.

Negative Points

- First quarter results were significantly below expectations due to weaker volumes in the Americas and broad-based input cost inflation.

- Volumes across consumer staples remained uneven and below expectations, with a 1% decline in the Americas.

- Input cost inflation was significant, with increases in energy, chemicals, logistics, and transportation.

- The company lowered and widened its volume guidance range, now expecting a 4% volume decline at the low end.

- Consumer confidence has declined significantly in the US and other markets, impacting volumes and promotional activity effectiveness.