BTIG has adjusted its price target for FTAI Infrastructure (FIP, Financial), raising it from $9 to $10, while maintaining a Buy rating on the company's shares. This adjustment comes amid expectations of an improved EBITDA run rate for FIP. The company's recent full acquisition of the remaining 50% interest in Long Ridge is projected to boost their EBITDA by approximately $60 million this year. Furthermore, starting June 1st, FTAI is anticipated to gain an additional $30 million annually from capacity reserve payments from PJM. These developments reflect a positive outlook for the company's financial performance.

Wall Street Analysts Forecast

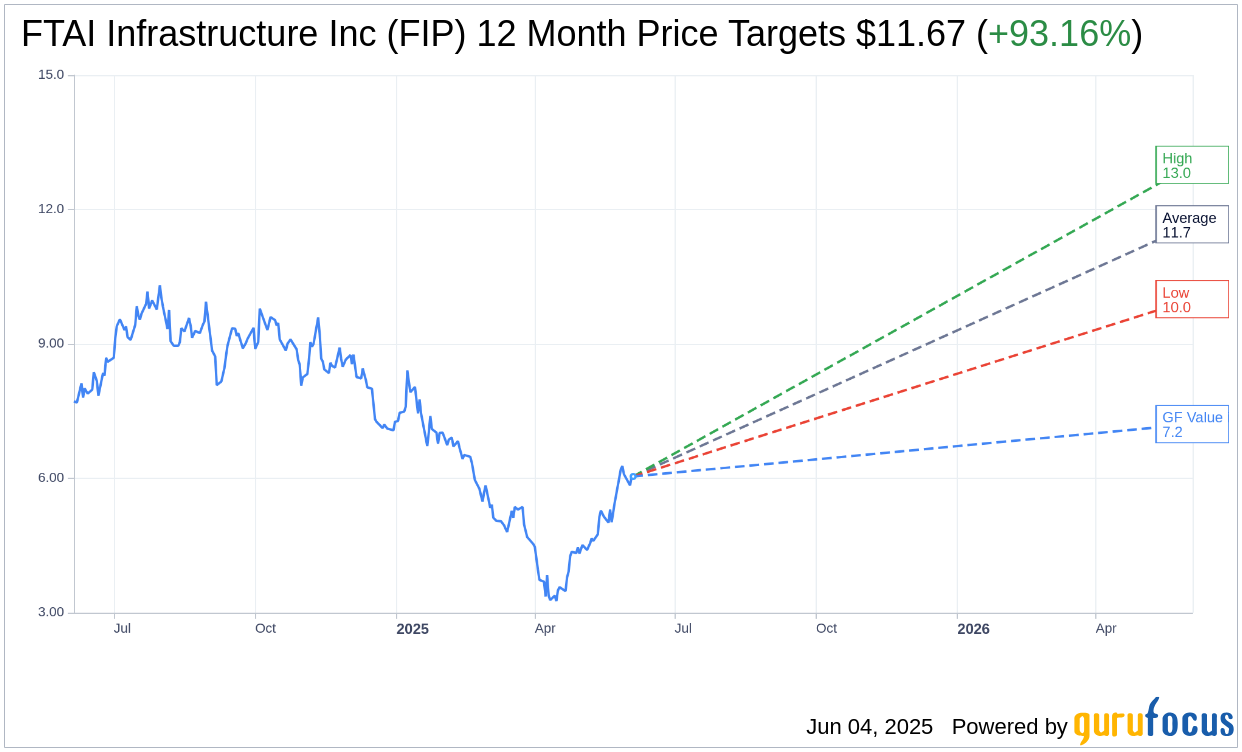

Based on the one-year price targets offered by 3 analysts, the average target price for FTAI Infrastructure Inc (FIP, Financial) is $11.67 with a high estimate of $13.00 and a low estimate of $10.00. The average target implies an upside of 93.16% from the current price of $6.04. More detailed estimate data can be found on the FTAI Infrastructure Inc (FIP) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, FTAI Infrastructure Inc's (FIP, Financial) average brokerage recommendation is currently 1.3, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FTAI Infrastructure Inc (FIP, Financial) in one year is $7.21, suggesting a upside of 19.37% from the current price of $6.04. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FTAI Infrastructure Inc (FIP) Summary page.