Algorhythm (RIME, Financial) has announced a significant expansion of its Master Services Agreement with SMCB Solutions Private, a subsidiary that will now offer enhanced managed transportation services. The agreement pertains to the Indian branch of the world's third-largest consumer packaged goods manufacturer, boasting over $84 billion in annual sales.

The initial phase of this expanded agreement sees SemiCab India, under SMCB Solutions, providing services across more than 40 key transit routes throughout India, marking a substantial 200% increase in serviced lanes. Following this phase, the CPG company plans to further deepen its collaboration with SemiCab by incorporating a broader geographic reach and additional transportation routes.

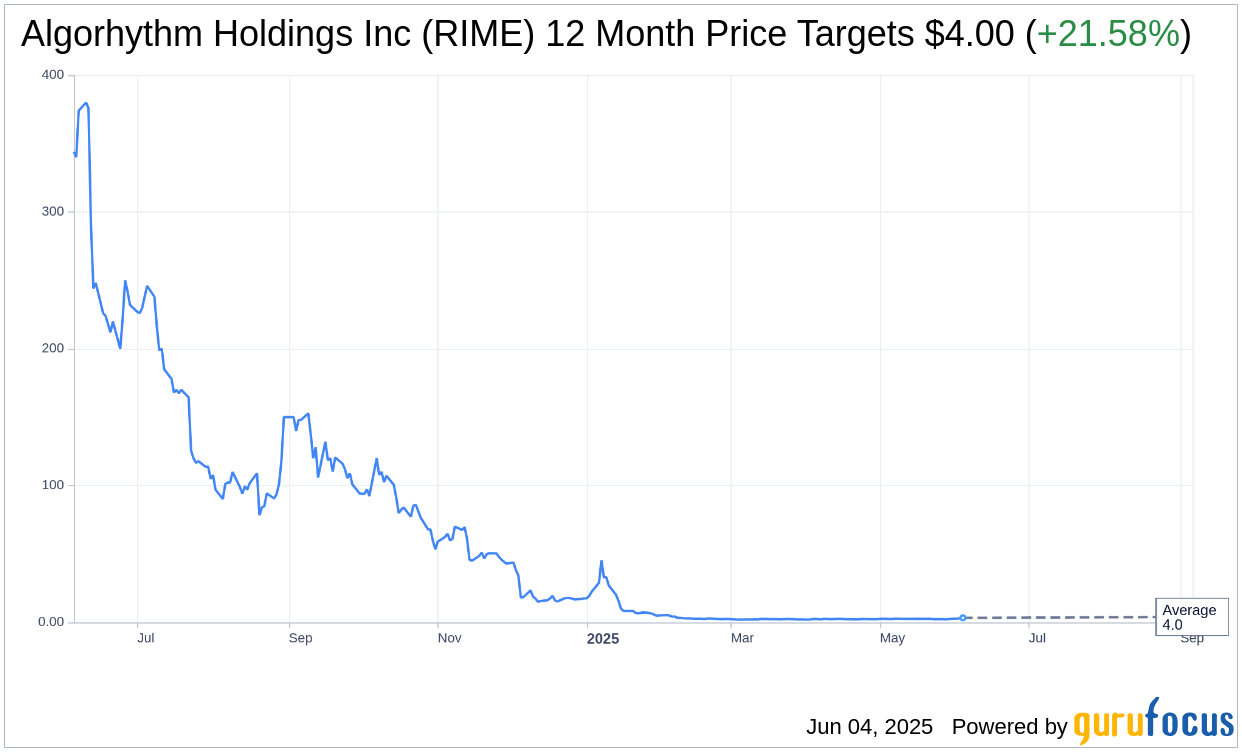

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Algorhythm Holdings Inc (RIME, Financial) is $4.00 with a high estimate of $4.00 and a low estimate of $4.00. The average target implies an upside of 21.58% from the current price of $3.29. More detailed estimate data can be found on the Algorhythm Holdings Inc (RIME) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Algorhythm Holdings Inc's (RIME, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Algorhythm Holdings Inc (RIME, Financial) in one year is $30.03, suggesting a upside of 812.77% from the current price of $3.29. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Algorhythm Holdings Inc (RIME) Summary page.