- STMicroelectronics is navigating an upcycle that could boost future financial performance according to CEO Jean-Marc Chery.

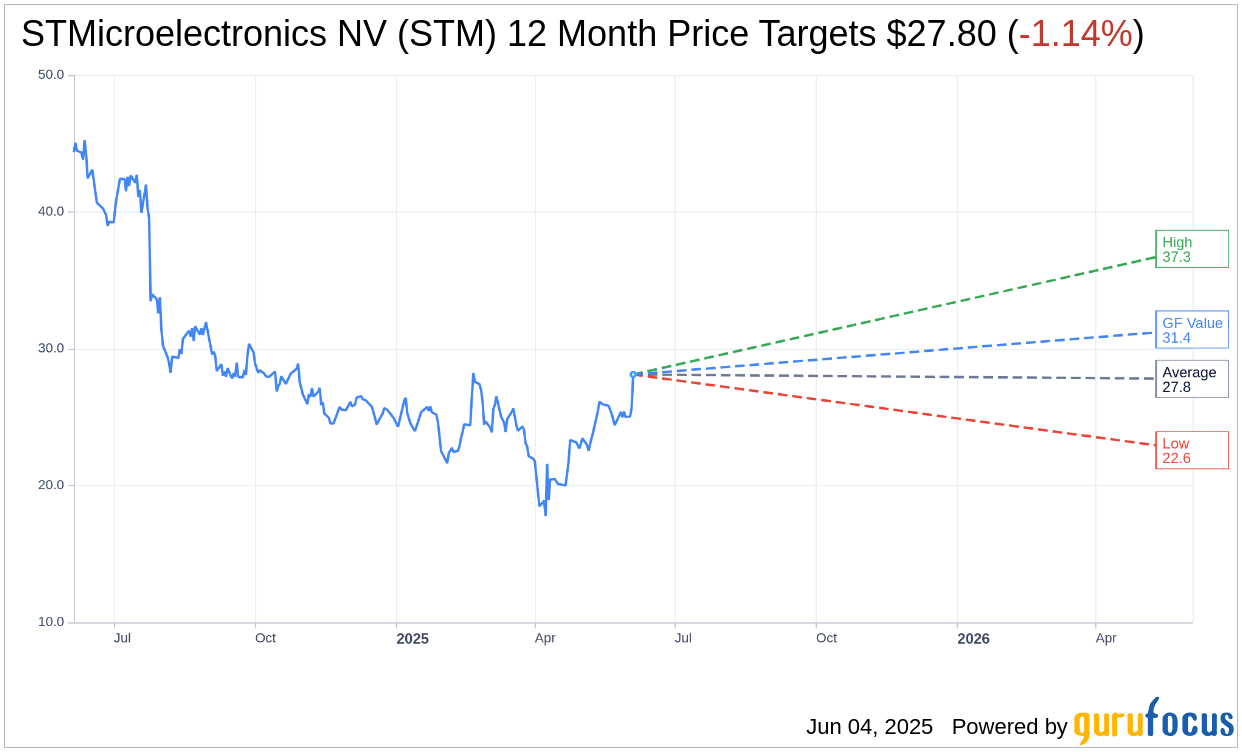

- Analysts suggest a modest downside to the current stock price with a target price of $27.80.

- GF Value indicates a potential 11.7% upside, reflecting the stock's undervaluation.

STMicroelectronics (NYSE: STM) CEO Jean-Marc Chery has signaled a promising uptrend for the company, forecasting that this cycle will enhance their performance in the upcoming quarters. As the company strives to reach at least the midpoint of its second-quarter revenue target, it remains cautious of the risks posed by ongoing global trade tensions.

Analyst Price Targets and Recommendations

In assessing STMicroelectronics NV (NYSE: STM), 12 analysts have provided a one-year average price target of $27.80, with individual projections ranging from a high of $37.30 to a low of $22.58. This average target suggests a slight downside of 1.14% from its current trading price of $28.12. For a deeper dive into these projections, investors can explore the STMicroelectronics NV (STM, Financial) Forecast page.

When evaluating broker recommendations, 13 brokerage firms have given STMicroelectronics NV an average rating of 2.7, positioning the stock as a "Hold." This rating scale runs from 1, which indicates a "Strong Buy," to 5, symbolizing a "Sell."

GF Value Estimation

The GF Value for STMicroelectronics NV (NYSE: STM) is projected at $31.41 over the next year. This suggests a potential upside of 11.7% from its current price point of $28.12. The GF Value reflects GuruFocus' assessment of the stock's fair trading value, derived from its historical trading multiples, past growth metrics, and future performance estimates. For more comprehensive data, visit the STMicroelectronics NV (STM, Financial) Summary page.