- Microsoft appoints LinkedIn CEO Ryan Roslansky to lead its Office division, focusing on AI integration.

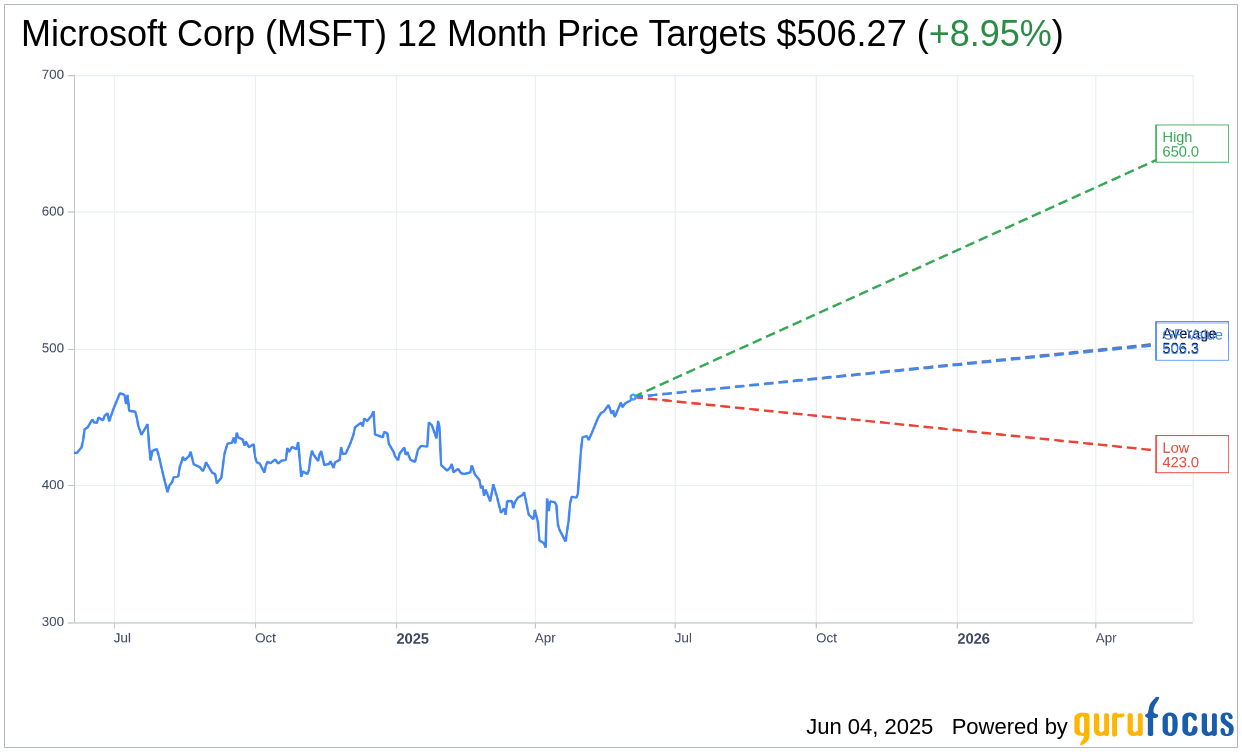

- Analysts project a potential 8.95% upside for Microsoft's stock, with a target price averaging $506.27.

- Microsoft's productivity segment revenue grows by 10%, highlighting robust business performance.

Microsoft (MSFT, Financial) is making strategic shifts by appointing LinkedIn's CEO, Ryan Roslansky, to lead its Office division. This move underscores Microsoft's ambition to bolster AI integration across its flagship productivity software such as Outlook and Word. Impressively, the company's productivity segment revenue has reached $29.9 billion, reflecting a significant 10% increase year-over-year.

Wall Street Analysts Forecast

Microsoft Corp (MSFT, Financial) remains in the spotlight of analysts' forecasts. According to 49 financial analysts, the average one-year price target is set at $506.27. This prediction includes a high estimate of $650.00 and a low estimate of $423.00, suggesting an average potential upside of 8.95% from the current price of $464.67. For more in-depth projections, investors can visit the Microsoft Corp (MSFT) Forecast page.

Brokerage Recommendations

An analysis of the consensus from 62 brokerage firms places Microsoft Corp's (MSFT, Financial) average recommendation at 1.8, signaling an "Outperform" verdict. This rating relies on a scale where 1 represents a Strong Buy, and 5 signifies a Sell.

GuruFocus Valuation

In terms of valuation, Microsoft Corp's (MSFT, Financial) estimated GF Value in one year stands at $505.29. This valuation implies a projected upside of 8.74% from its current price of $464.665. The GF Value metric reflects GuruFocus' assessment of the stock's fair trading value. This calculation is based on historical trading multiples, prior business growth, and anticipated future performance. Investors seeking comprehensive data can explore the Microsoft Corp (MSFT) Summary page.