Bill Peterson, a Clean Tech and Metals & Mining Equity Analyst, will engage in a conference call with the management team of CENX on June 4, starting at 12 pm. This session is sponsored by JPMorgan.

Wall Street Analysts Forecast

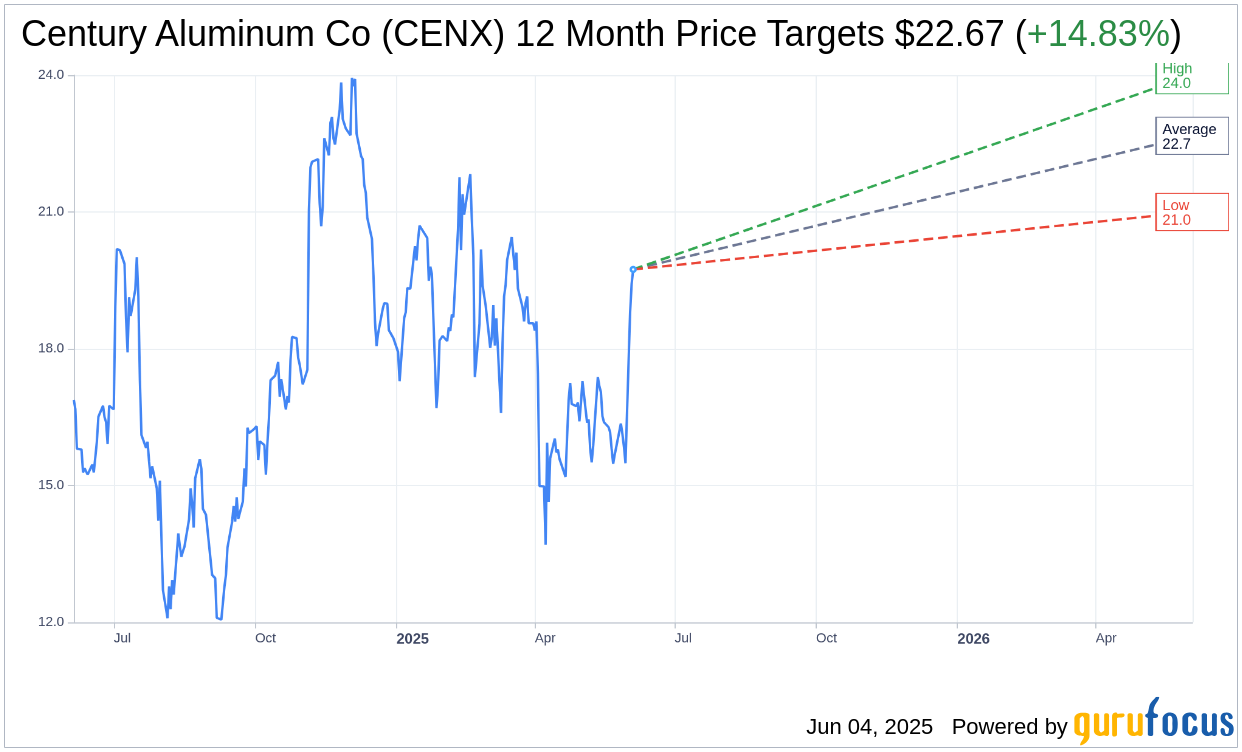

Based on the one-year price targets offered by 3 analysts, the average target price for Century Aluminum Co (CENX, Financial) is $22.67 with a high estimate of $24.00 and a low estimate of $21.00. The average target implies an upside of 14.83% from the current price of $19.74. More detailed estimate data can be found on the Century Aluminum Co (CENX) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Century Aluminum Co's (CENX, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Century Aluminum Co (CENX, Financial) in one year is $9.84, suggesting a downside of 50.15% from the current price of $19.74. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Century Aluminum Co (CENX) Summary page.

CENX Key Business Developments

Release Date: May 07, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Century Aluminum Co (CENX, Financial) reported $78 million in adjusted EBITDA for Q1 2025, reflecting strong operational performance.

- The company successfully reduced net debt by $55 million and increased liquidity by $94 million during the quarter.

- CENX's safety performance improved across all locations, highlighting the company's commitment to a high-performance safety culture.

- The company reached an extension agreement with a major power provider in Iceland, ensuring stable power supply until 2032.

- CENX is on track to complete a major capital improvement program at Jamalco by year-end, which is expected to enhance power generation and reduce costs starting in Q1 2026.

Negative Points

- Higher energy prices due to cold winter temperatures impacted Q1 results, although prices have normalized in Q2.

- Operational instability at Mount Holly led to increased operating costs and slightly lower production, which remains a focus for improvement.

- The European market showed demand weakness, affecting billet orders from the Grundetangi smelter.

- Coke, pitch, and caustic soda prices rose in Q1, contributing to increased raw material costs.

- A one-time increase in maintenance expenses at Seabree is expected to impact Q2 financials by approximately $10 million.