TD Securities has increased its price target for Algonquin Power (AQN, Financial) from $6 to $6.50 while maintaining a Hold rating on the company's shares. According to an analyst note, the company's ambitious growth targets have garnered a positive reaction from investors. The success in achieving these goals is anticipated to hinge on Algonquin's efforts to reduce costs effectively and close the significant gap between its earned and allowed return on equity.

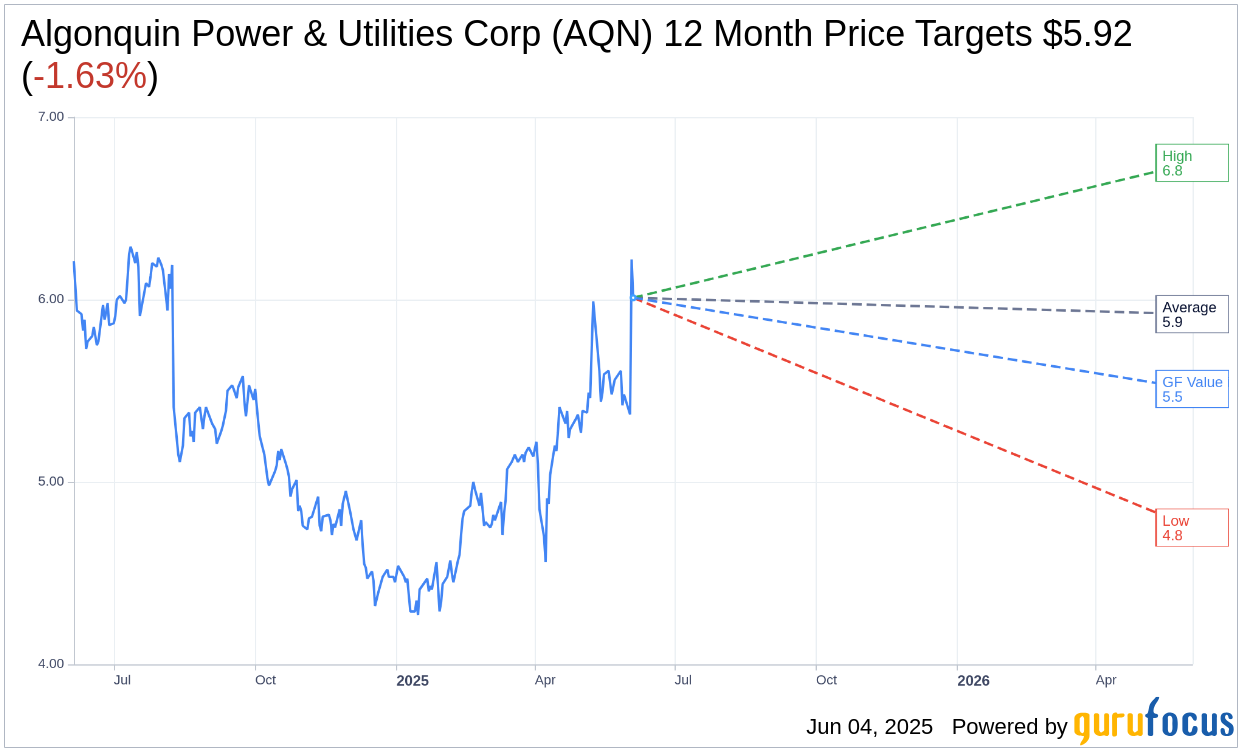

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Algonquin Power & Utilities Corp (AQN, Financial) is $5.92 with a high estimate of $6.75 and a low estimate of $4.75. The average target implies an downside of 1.63% from the current price of $6.02. More detailed estimate data can be found on the Algonquin Power & Utilities Corp (AQN) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Algonquin Power & Utilities Corp's (AQN, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Algonquin Power & Utilities Corp (AQN, Financial) in one year is $5.51, suggesting a downside of 8.4% from the current price of $6.015. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Algonquin Power & Utilities Corp (AQN) Summary page.

AQN Key Business Developments

Release Date: May 09, 2025

- Adjusted Net Earnings: $111.6 million, up 39% from $80.1 million in 2024.

- Regulated Services Group Net Earnings Increase: $40.8 million, driven by new rates and lower interest expenses.

- Depreciation Expense: Relatively flat year-over-year, with $8.2 million in non-recurring favorable pickups.

- Hydro Group Net Earnings Increase: $13.4 million due to a one-time tax recovery.

- Adjusted Net Earnings Per Share (EPS): $0.14, flat compared to Q1 2024 including renewables, but up from $0.11 excluding renewables.

- Credit Metrics: FFO to debt at 12.5% and debt to EBITDA at 5.6 times, both comfortably within BBB thresholds.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Algonquin Power & Utilities Corp (AQN, Financial) reported a 39% increase in first quarter adjusted net earnings from continuing operations, reaching $111.6 million.

- The company successfully implemented new rates, contributing $15.7 million to the Regulated Services Group's net earnings.

- Algonquin Power & Utilities Corp (AQN) benefited from lower interest expenses, saving $13.6 million due to debt repayment.

- The Southwest Power Pool approved a significant investment in transmission projects, with $750 million to $800 million dedicated to strengthening the Empire District Electric service area.

- The company plans to provide a forward-looking multi-year update on June 3, which will include projected adjusted net EPS ranges for 2025, 2026, and 2027.

Negative Points

- Algonquin Power & Utilities Corp (AQN) is dealing with multiple investigations related to billing issues in Missouri, Arkansas, and an audit in New Hampshire.

- The company experienced a decrease of $22.7 million in adjusted net earnings due to the removal of Atlantica dividends.

- There are ongoing challenges with customer service and billing issues, which are under investigation by the Missouri Commission.

- The company is facing dissynergies related to the sale of its renewable group, impacting operational costs.

- Algonquin Power & Utilities Corp (AQN) has yet to consistently evidence the practices that set premium utilities apart, indicating room for improvement in operational efficiency.