Key Takeaways:

- HealthEquity (HQY, Financial) experienced a significant stock price surge after exceeding Q1 projections.

- The company has raised its FY26 earnings forecast, boosting investor confidence.

- Analysts foresee a potential upside with an average price target of $115.15.

HealthEquity (HQY) recently witnessed a nearly 9% increase in its stock price following the announcement of impressive Q1 results that surpassed market expectations. The company has also revised its FY26 earnings outlook upward. HealthEquity projects FY26 revenue to range from $1.285 billion to $1.305 billion, with an anticipated non-GAAP EPS between $3.61 and $3.78, which has positively influenced investor sentiment.

Wall Street Analysts Forecast

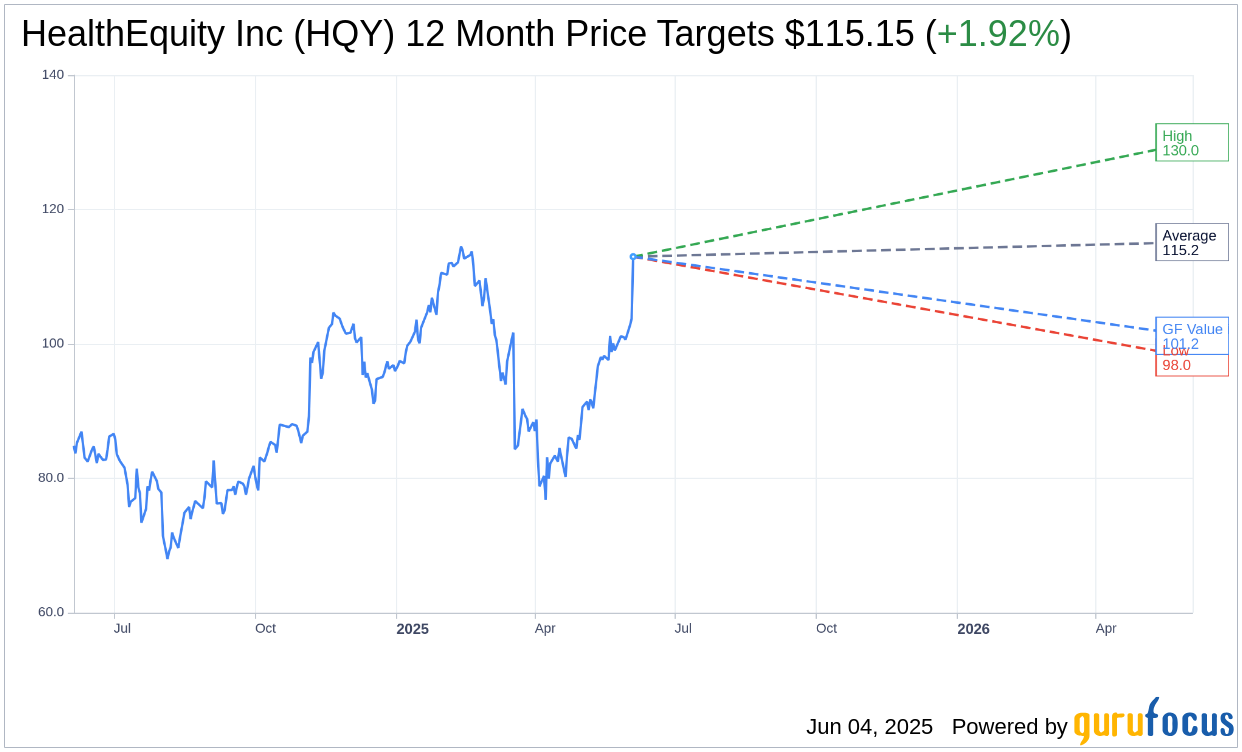

The average target price for HealthEquity Inc (HQY, Financial), based on projections from 13 analysts, stands at $115.15. This includes a high estimate of $130.00 and a low estimate of $98.00, pointing to a potential upside of 1.92% from the current price of $112.99. For more detailed estimates, visit the HealthEquity Inc (HQY) Forecast page.

According to the consensus recommendation from 14 brokerage firms, HealthEquity Inc (HQY, Financial) currently holds an "Outperform" status with an average brokerage recommendation score of 1.6. The rating scale ranges from 1, indicating Strong Buy, to 5, which represents Sell.

GuruFocus has calculated the estimated GF Value for HealthEquity Inc (HQY, Financial) as $101.21 for the coming year. This suggests a potential downside of 10.42% from the current price of $112.985. The GF Value is a measure of the fair stock price, reflecting historical trading multiples, past business growth, and future performance estimates. Additional detailed data is available on the HealthEquity Inc (HQY) Summary page.