Key Takeaways:

- Advanced Micro Devices (AMD, Financial) expands its AI capabilities with the acquisition of software firm Brium.

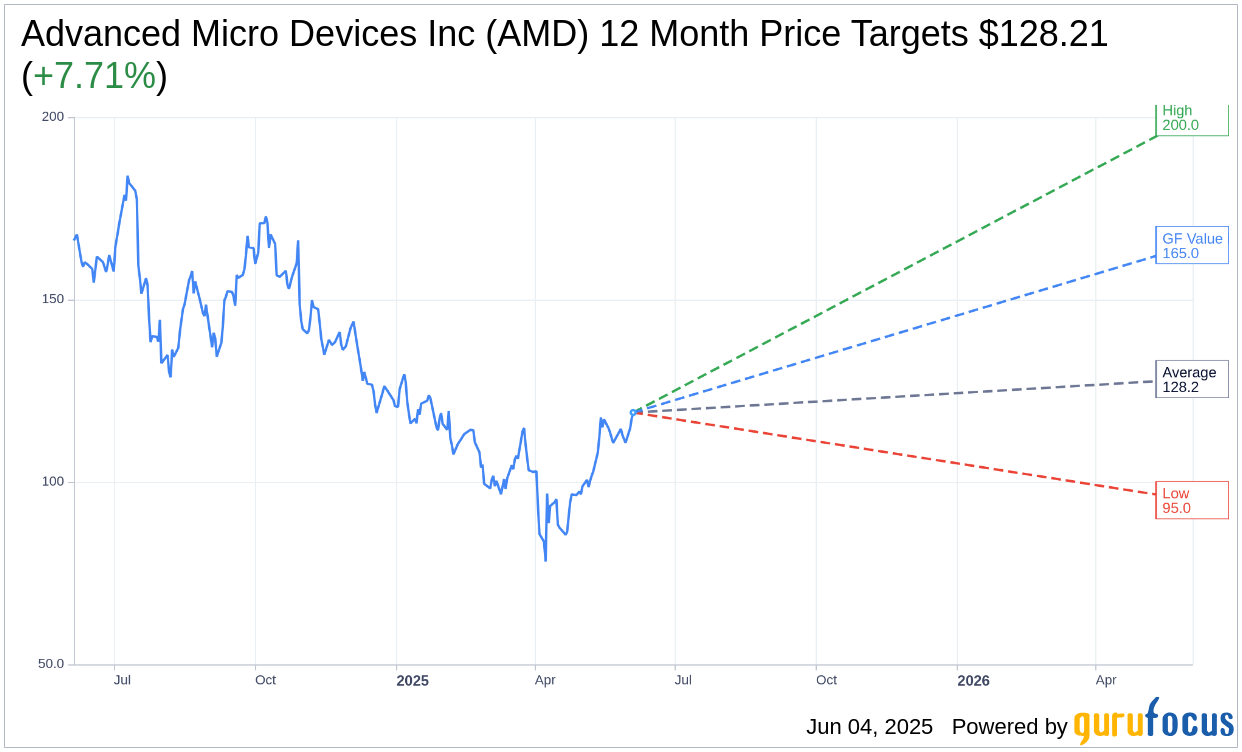

- Analysts project a 7.71% upside, with an average target price of $128.21 for AMD.

- GuruFocus estimates indicate a substantial 38.59% upside potential based on GF Value.

AMD Expands AI Capabilities with Strategic Acquisition

Advanced Micro Devices (AMD) has strategically advanced its artificial intelligence (AI) capabilities by acquiring the open-source software firm, Brium. This acquisition is a significant move in AMD's continuous series of investments aimed at enhancing software optimization capabilities on its hardware platforms. The announcement of this acquisition propelled AMD shares up by 1.4%, reflecting investor confidence in the company's strategic direction.

Wall Street Analysts' Forecast on AMD

According to a consensus from 41 analysts, the one-year price target for Advanced Micro Devices Inc (AMD, Financial) is set at an average of $128.21. This includes a high projection of $200.00 and a lower end of $95.00. Currently priced at $119.03, these targets indicate a potential upside of 7.71%. For a more comprehensive view of these estimates, explore our detailed data available on the Advanced Micro Devices Inc (AMD) Forecast page.

Brokerage Recommendations and GF Value Insights

Evaluating the recommendations from 52 brokerage firms, Advanced Micro Devices Inc (AMD, Financial) is presently rated with an average brokerage recommendation of 2.1, signifying an "Outperform" status. This rating scale spans from 1, indicating a Strong Buy, to 5, suggesting a Sell. This consensus underscores a positive outlook among analysts regarding AMD's market performance.

From a valuation perspective, according to GuruFocus estimates, the GF Value for AMD stands at $164.96 for the coming year. This suggests a promising upside potential of 38.59% from its current market price of $119.03. The GF Value is a proprietary metric designed to assess the fair value at which a stock should ideally trade. It leverages historical trading multiples, past growth performance, and projected future business growth. To delve deeper into these estimates, visit the Advanced Micro Devices Inc (AMD, Financial) Summary page.