Five Below (FIVE, Financial) reported first-quarter revenue of $970.53 million, surpassing the market expectation of $966.49 million. The company experienced a notable 7.1% rise in comparable sales during this period. This increase highlights the effectiveness of their strategy, which focuses on offering trending products at great value within an enjoyable store atmosphere. The broad strength across various merchandising areas and successful execution of a customer-focused approach contributed to the positive results. The performance was bolstered by strong sales from new store openings, reflecting significant advancements in the company’s merchandising, marketing, and operational efforts.

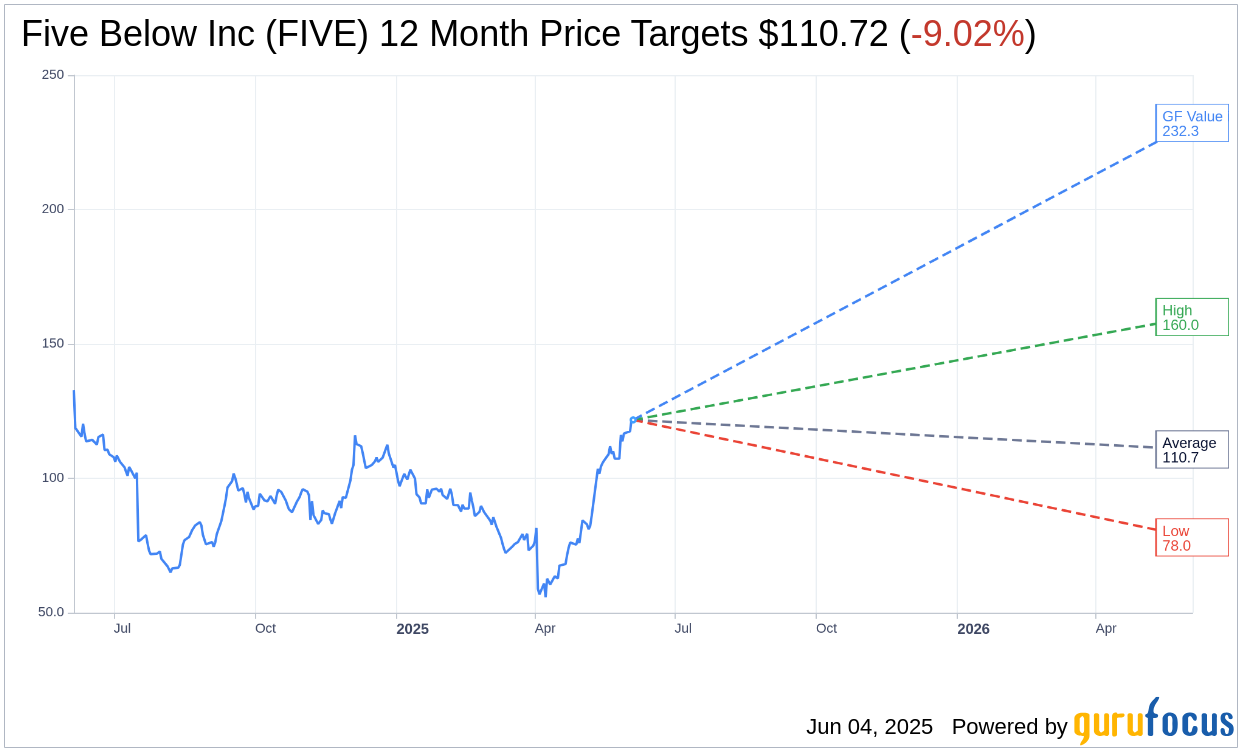

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Five Below Inc (FIVE, Financial) is $110.72 with a high estimate of $160.00 and a low estimate of $78.00. The average target implies an downside of 9.02% from the current price of $121.70. More detailed estimate data can be found on the Five Below Inc (FIVE) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Five Below Inc's (FIVE, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Five Below Inc (FIVE, Financial) in one year is $232.25, suggesting a upside of 90.84% from the current price of $121.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Five Below Inc (FIVE) Summary page.

FIVE Key Business Developments

Release Date: March 19, 2025

- Total Sales (Q4 2024): $1.39 billion, up 7.8% from $1.29 billion in Q4 2023.

- Comparable Sales (Q4 2024): Decreased 3.0%.

- Adjusted Gross Profit (Q4 2024): $563.2 million, up 6.2% from Q4 2023.

- Adjusted Gross Margin (Q4 2024): 40.5%, decreased by 60 basis points.

- Adjusted Operating Income (Q4 2024): $253.3 million.

- Adjusted Net Income (Q4 2024): $192.4 million.

- Adjusted EPS (Q4 2024): $3.48, compared to $3.50 in Q4 2023.

- Total Sales (Fiscal 2024): $3.88 billion, up 10.4% from $3.51 billion in 2023.

- Comparable Sales (Fiscal 2024): Decreased 2.7%.

- Adjusted Operating Margin (Fiscal 2024): 9.2%, down 150 basis points.

- Adjusted EPS (Fiscal 2024): $5.04, compared to $5.26 in 2023.

- Cash and Equivalents (End of Fiscal 2024): Approximately $529 million.

- Store Count (End of Fiscal 2024): 1,771 stores, an increase of 227 net new stores.

- Inventory (End of Fiscal 2024): $659.5 million, compared to $584.6 million in 2023.

- Capital Expenditures (Fiscal 2024): Approximately $324 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Five Below Inc (FIVE, Financial) reported a 7.8% increase in total sales for the fourth quarter of 2024, reaching $1.39 billion.

- The company opened a record 228 new stores in 2024, expanding its presence to 1,771 stores across 39 states.

- Five Below Inc (FIVE) successfully improved operational execution in the second half of the year, leading to better staffing, optimized labor, and higher customer engagement.

- The company is focusing on delivering trend-right products at great value, which resonates with customers seeking budget-friendly options.

- Five Below Inc (FIVE) ended the year with a strong cash position of approximately $529 million and no debt.

Negative Points

- Comparable sales decreased by 3.0% in the fourth quarter, driven by a decrease in comp transactions and average ticket.

- The company faced a 170 basis point decline in adjusted operating margin to 18.2% for the fourth quarter.

- Five Below Inc (FIVE) is dealing with the impact of tariffs, which are expected to result in a margin headwind despite mitigation efforts.

- Adjusted SG&A expenses increased by 110 basis points in the fourth quarter, driven by higher store wages and investment in store hours.

- The company acknowledged leaving sales on the table due to adjustments in orders and chasing product as sales improved in the third quarter.